Decentralized finance (DeFi) has grown rapidly in recent years, providing users with innovative financial services. Aave and Compound are two of the most popular DeFi platforms, offering lending, borrowing, and other financial services to users globally.

While both platforms offer similar services, there are some key differences between the two platforms that users should be aware of.

In this article, we’ll take a closer look at Aave vs Compound, comparing their features, interest rates, security, and user experience.

Key Takeaways:

- A decentralized lending platform is a peer-to-peer lending system that facilitates the lending and borrowing of digital assets using smart contracts.

- TVL is a key metric in DeFi that reflects a protocol’s success by showing how many assets are locked in it.

- Aave was the first to offer “flash loans” that enable uncollateralized borrowing, while Compound offers a conventional interest rate model on its lending platform.

Aave vs Compound: Which is Better?

| Features | Aave | Compound Finance |

|---|---|---|

| Total Value Locked | $5.28B | $1.89B |

| Total Users | 130K | 110K |

| Altcoins | 30 | 18 |

| LTV Ratio | 75% | 66.67% |

| Governance | AAVE Token holders | COMP Token holders |

| Flash loans | Yes | No |

| Chains supported | Ethereum, Polygon, Avalanche, Arbitrum, Optimism, Harmony, etc. | Ethereum and Polygon |

Aave vs Compound: History and Background

ETHLend was founded by Stani Kulechov. In 2017, it launched a peer-to-peer lending platform but eventually shifted towards a liquidity pool model. This led to a rebranding effort, and the platform was renamed Aave.

In 2020, Aave introduced the Aave Protocol, a non-custodial liquidity protocol built on an open-source framework.

Compound was launched in September 2018 by Robert Leshner and Geoff Hayes. initially, the protocol operated without requiring a token, and the Compound Labs team independently made updates and changes to the protocol.

To address this, the team introduced COMP, a token that allows for the protocol’s governance and introduces decentralization in the system.

What is Aave (AAVE)?

Aave is a decentralized lending and borrowing platform that allows users to lend, borrow, and earn interest on cryptocurrency assets. The platform is built on the Ethereum blockchain and is part of the wider DeFi ecosystem.

The platform is designed as a non-custodial, which gives you full control over your transactions from your personal crypto wallet. However, when you decide to deposit your tokens to Aave, they are deposited into a smart contract which can be used to liquidate your collateral tokens to repay your loan if necessary.

You may not have complete control over your deposited tokens. However, you can withdraw them anytime unless they’re not used as collateral.

Aave charges a variable borrowing rate, which fluctuates based on supply and demand. The borrowing rate is set by its automated market maker (AMM), which determines the rate based on the availability of funds in the lending pool.

Pros and Cons of Aave

Pros:

- Allows for borrowing and lending

- Offers flexible and fixed interest rates

- Utilizes flash loans for arbitrage

- Employs a decentralized governance system

Sign up for MEXC today with the promo code ‘mexc-aavevscomp‘ to receive up to $100 in welcome rewards, and enjoy a -10% trading fee. Start trading Aave now.

Cons:

- High gas fees on the Ethereum network

- Vulnerable to smart contract exploits/hacks

- Limited ability to dispute transaction errors

What is Compound Finance (COMP)?

Compound finance is another decentralized platform similar to Aave, built on the Ethereum blockchain. It allows users to lend and borrow various altcoins, including stablecoins, ETH, and popular ERC-20 tokens.

It was one of the first DeFi projects to introduce the concept of “liquidity mining”. The protocol has been audited multiple times by leading blockchain security firms, including Trail of Bits, OpenZeppelin, and Certora, to ensure the platform’s security and integrity.

Compound also has partnerships with several leading DeFi projects, including Coinbase, Chainlink, and Uniswap.

Pros and Cons of Compound Finance

Pros:

- Liquidity Mining Rewards

- User-friendly interface for non-technical traders

- No Minimum Deposit for lending and borrowing assets

- Withdraw funds at any time without penalties

Sign up for MEXC today with the promo code ‘mexc-aavevscomp‘ to receive up to $100 in welcome rewards, and enjoy a -10% trading fee. Start trading Comp now.

Cons:

- It can be expensive during periods of network congestion

- Only Supports the Ethereum network

- Not support all crypto assets

Aave vs Compound Finance: Lending and Borrowing Features Comparison

1. Interest Rates (APY)

Both Aave and Compound offer variable and most competitive interest rates based on the supply and demand for each asset.

AAVE is presently proposing a flexible annual percentage yield (APY) of up to 7%, which exceeds Compound’s offering of up to 6% APY.

When it comes to DAI, Aave offers a higher lending rate of 2.40% compared to Compound’s 1.56%. Moving on to USDC, Aave again offers a higher lending rate of 2.61%, compared to Compound’s 2.12%.

For borrowing DAI, Aave offers two options, a variable rate of 3.63% and a fixed rate of 11.82%. Compound, on the other hand, offers only a variable rate of 3.43%. Similar to DAI, Aave offers a higher variable rate for USDC also. (Note: Rates are subject to changes, for live data, visit DefiPrime.)

Winner: Aave currently offers higher variable rates compared to Compound for both DAI and USDC.

2. Borrow-to-Collateral Ratio

Aave and Compound use a collateralization model where borrowers must provide more collateral than the value of the assets they borrow.

Specifically, Aave’s borrow-to-collateral ratio is 75%, while Compound’s ratio is 66.67%.

For example, if a user wants to borrow $1,000 worth of Ethereum, they must provide $1,333 worth of collateral in another asset (such as Bitcoin) to secure the loan. This is known as over-collateralization and is designed to reduce the risk of default.

Winner: Aave offers more borrower-friendly collateral conditions than compound, allowing borrowers to access funds with less upfront capital.

3. Flash Loans

A standout feature of Aave’s platform is its innovative flash loan offering. With this feature, users can borrow funds without the need for collateral, but only for a short period of time.

This can be particularly advantageous for executing complex trades or seizing short-term arbitrage opportunities in the market. Notably, Compound finance does not currently provide a flash loans feature.

Winner: Aave

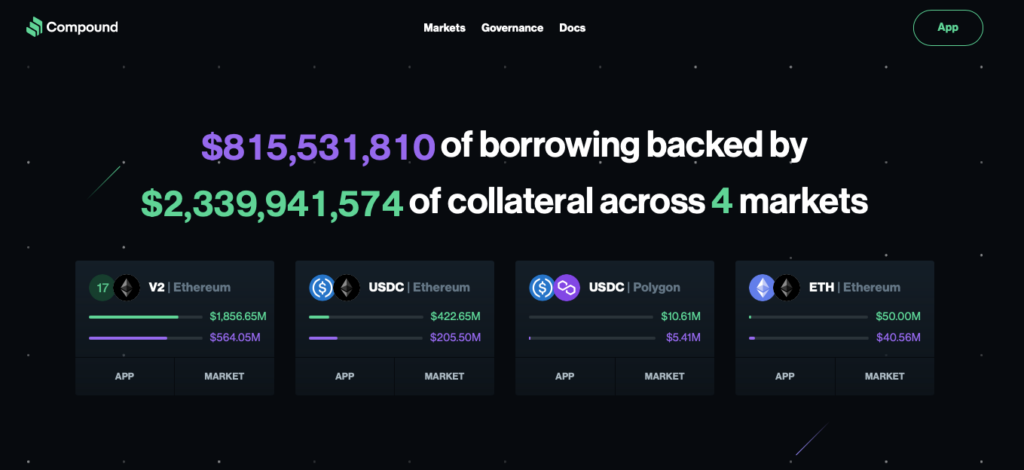

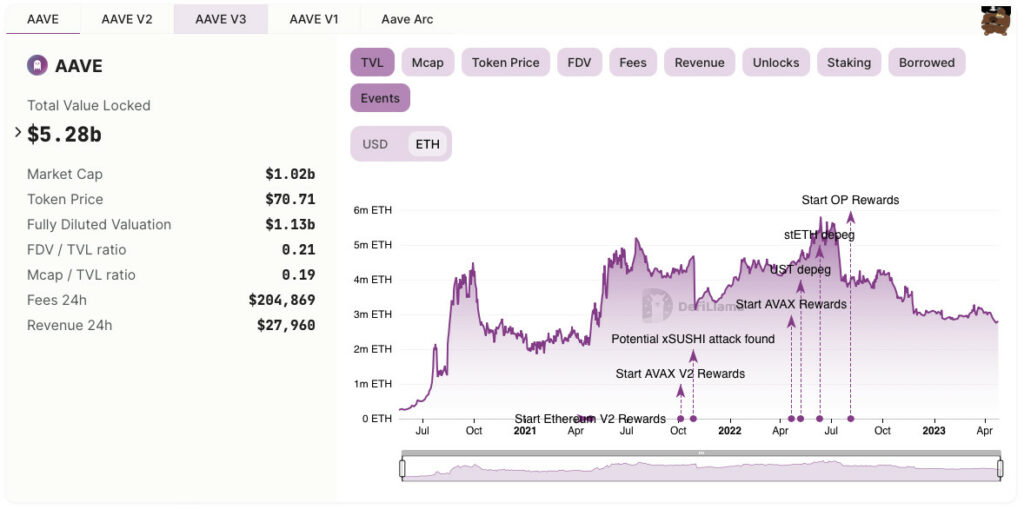

4. Total Value Locked in DeFi

Total Value Locked (TVL) is a metric used to measure the total value of assets locked in a decentralized finance (DeFi) protocol.

According to data from Defillama, Aave and Compound are two of the leading DeFi protocols in terms of Total Value Locked (TVL).

Aave’s TVL stands at $5.28 billion, significantly higher than Compound’s $1.89 billion. Aave also has a higher market capitalization of $1.02 billion compared to Compound’s $410 million value.

Aave’s fully diluted valuation is $1.13 billion, while its FDV/TVL ratio and Mcap/TVL ratio are 0.21 and 0.19, respectively.

Winner: Aave TVL is 3 times more than that Compound finance.

Sign up for MEXC today with the promo code ‘mexc-aavevscomp‘ to receive up to $100 in welcome rewards, and enjoy a -10% trading fee. Start trading Aave now.

Aave vs Compound: Supported Crypto Assets and Blockchains

AAVE stands out for its multi-chain support across different networks, including Ethereum, Arbitrum, Harmony, Fantom, Optimism, Avalanche, and Polygon. This broad coverage gives users access to a diverse range of crypto assets. It is also looking to support Solana in the future.

Aave also supports more than 30 crypto assets. In contrast, Compound is limited to the Ethereum mainnet and only supports around 18 cryptocurrencies.

Winner: Aave supports more Layer 1 and Layer 2 blockchains.

Aave vs Compound Finance: Platform Fees

Aave charges a gas fee on all transactions, which is based on network congestion. For every transaction made, Aave also imposes a flash loan fee of 0.09%. The fee can be paid in either AAVE token or the asset being borrowed

Compound does not impose any trading fees for purchasing or selling cryptocurrencies, and there is no occurrence of slippage either. The sole payment you need to make is for the gas utilized in transaction processing.

AAVE vs COMP: Market Cap and Tokenomics

- AAVE has a market cap of approximately $1.02 billion USD, making it the 49th largest cryptocurrency by market cap.

- COMP has a market cap of $410 million USD and it is currently at 116th rank.

- AAVE token has a fixed maximum supply of 16 million tokens, with approximately 14.3 million currently in circulation. Tokens are used for various purposes within the protocol, such as staking and earning interest on deposited assets, and participating in governance by proposing and voting on changes to the protocol.

- COMP token has a Total supply of 10 million tokens and a circulating supply of 7.4 million. It also has the same decentralized governance system.

What is the difference between Aave V3 and Compound V3?

The difference between both V3 versions lies in how they handle cross-asset liquidity and deployment.

Aave V3 introduces the concept of the “Portal”, which is essentially a bridge between different markets and chains, allowing liquidity to flow freely between them. This means that users can deposit assets into a liquidity pool on one chain, and then access those assets on another chain. This is made possible through the use of smart contracts, which allow for transfers of assets between different blockchains.

On the other hand, Compound V3 takes a different approach by deploying each instance of the protocol for a single asset. This means that each deployment is dedicated to a specific asset, such as ETH or DAI.

While this may seem to limit, it has the advantage of allowing for more precise risk management and control over the protocol. By focusing on a single asset, Compound V3 is better able to manage the risks associated with that asset, such as volatility and liquidity.

Aave V3 includes several updated features, such as the introduction of “credit delegation,” which allows users to delegate their credit lines to other users. It also includes an upgraded user interface and improved gas efficiency.

Sign up for MEXC today with the promo code ‘mexc-aavevscomp‘ to receive up to $100 in welcome rewards, and enjoy a -10% trading fee. Start trading Aave and Comp now.

What is DeFi lending & borrowing and how does it work?

Unlike traditional finance, DeFi lending and borrowing system is based on a trustless mechanism where borrowers and lenders do not need to trust each other.

Instead, they rely on smart contracts and protocols that are programmed to execute automatically based on predefined rules.

In this system, lenders provide liquidity to the market by depositing their crypto assets in a pool. Borrowers can then use these assets as collateral to borrow assets. The interest rates are determined by supply and demand and are not subject to the manipulation of centralized entities.

Liquidity providers earn a percentage of the transaction fees, which incentivizes them to keep their assets locked in the pool. This creates a virtuous cycle where more liquidity attracts more borrowers, which in turn generates more fees for the liquidity providers.

What is aTokens/cTokens on Aave and Compound Finance?

In Compound Finance, cTokens are minted when a user deposits funds into a liquidity pool. Each cToken is backed by an underlying asset, such as Ether (cETH) or Wrapped Bitcoin (cWBTC), and represents a user’s share of the underlying pool.

The cToken balance of a user increases over time as they earn interest on their deposited funds, and it can be used as collateral to borrow other cryptocurrencies.

Similarly, On Aave, aTokens are also minted when a user deposits funds, but they represent the amount of fund deposited instead of a user’s share of a pool.

Final Thoughts: Which Should You Choose?

Aave and Compound both offer unique features and benefits to users in the DeFi space. Aave’s credit delegation system allows for more flexibility in borrowing without requiring over-collateralization, while Compound’s model has proven to be effective in reducing risk and ensuring stability.

Aave may be a better choice for users looking for higher interest rates, more supported crypto assets, and flash loans without collateral.

As the DeFi space continues to evolve and grow, be sure to do your research and choose the platform that’s right for you.

Sign up for MEXC today with the promo code ‘mexc-aavevscomp‘ to receive up to $100 in welcome rewards, and enjoy a -10% trading fee. Start trading Aave and Comp now.

FAQs

Is Aave safer than Compound?

Both Aave and Compound have undergone multiple security audits and have strong track records of maintaining the security of their platforms.

Also, safety can be evaluated based on several factors, including security measures, smart contract audits, and overall historical track record in the DeFi space.

Which platform has lower fees, Aave or Compound?

Aave and Compound operate on the Ethereum blockchain and are subject to network congestion and high gas fees during times of high demand.

However, Aave has recently launched on the Polygon, Arbitrum, and Optimism network, which offers lower transaction fees and faster processing times. It also charges a 0.09% flash loan fee, which is a fee for using Aave’s instant loan feature.

Can I use Aave or Compound if I’m new to DeFi?

If you’re new to DeFi, using Aave or Compound can be a great way to enter the world of DeFi. Both decentralized lending platforms offer a user-friendly interface and offer a variety of financial features.

Start by understanding the risks involved and only invest small amounts of funds, to begin with. While these platforms offer the potential for high returns, they also come with risks of loss due to market volatility or other factors.

Is Lending on Aave and Compound risky?

All investments involve some level of risk, and lending on Aave and Compound is no exception. However, the risk associated with lending on these platforms may vary based on several factors, including the interest rate offered, the collateralization of the loan, and the volatility of the assets.

It’s important to note that lending on these protocols is not FDIC-insured, and there is no guarantee of a return on investment.

Related: DeFi Rates for Lending and Staking: 7 Safest Platforms

![Bybit Review [currentyear]: Exchange Features, Fee, Pros and Cons 31 Bybit Featured Image](https://coinwire.com/wp-content/uploads/2022/06/Bybit-review-1024x683.png)