The DeFi space has seen significant growth in the past few years, with the total value locked (TVL) in protocols reaching an all-time high of over $170 billion in November 2021.

DeFi rates for lending and staking have become increasingly popular among investors looking for ways to earn passive income investments. The platforms offer many benefits, including high-interest rates, low transaction fees, and no intermediaries.

Sometimes it can be challenging to understand the pros and cons of each platform. That’s why we have compiled a list of the top 7 safest platforms for DeFi rates for lending and staking.

We have taken into consideration several factors, including security measures, transparency, user reviews, and overall reputation in the DeFi space.

Disclaimer: The DeFi rates for lending and staking mentioned in this article are subject to change based on various factors, including but not limited to supply and demand in lending markets and network congestion in staking. The rates presented here are sourced from Defillama, and while we strive to ensure their accuracy, we cannot guarantee the reliability of the information provided. It is important to do your own research and exercise caution when participating in DeFi activities.

What is DeFi?

Decentralized Finance built on top of blockchain technology that operates without intermediaries.

In DeFi, people can lend, borrow, trade, and invest in various financial instruments without needing a central authority or middleman.

All transactions are recorded on a public ledger, and anyone can access the network as long as they have an internet connection and a wallet.

What are DeFi Lending and Staking?

DeFi Lending platforms work by matching lenders with borrowers. Lenders deposit their digital assets into a smart contract, and borrowers can then borrow those assets by depositing collateral.

The smart contract ensures that the collateral is sufficient and automatically executes the loan terms. Once the loan is repaid, the collateral is returned to the borrower, and the lender receives their principal plus interest.

DeFi Staking involves holding a certain amount of digital assets in a wallet and participating in the network’s consensus mechanism. The consensus mechanism varies depending on the blockchain network.

For example, Ethereum 2.0 is now PoS (Proof of Stake). When you stake ETH, you are ultimately participating in its network validation process. In return, you will receive rewards in the form of more ETH tokens.

Pros and Cons of DeFi Lending & Staking

| DeFi Lending | DeFi Staking | |

|---|---|---|

| Pros | – High potential returns – Decentralized and open access – Low fees compared to traditional finance | – Earn rewards while holdings – Support for various cryptocurrencies – Governance rights – Compounding returns over time |

| Cons | – Risk of smart contract exploits – Lack of regulation and insurance – Limited collateral options | – Inability to easily access funds in case of emergency – Double-spending attack – Stakers can be penalized (or “slashed”) for acting against the network |

Factors Affecting DeFi Rates

- Supply and demand: The interest rates for a specific cryptocurrency can be affected by its supply and demand. High demand means high-interest rates. Conversely, when the supply of a cryptocurrency is high, its interest rate is likely to decrease.

- Liquidity: The amount of liquidity in a DeFi platform is essential for its operation. When there is less liquidity in a platform, the interest rate offered on the assets will typically be lower. This also results in a decrease in demand.

- Volatility: The volatility of cryptocurrencies can also impact the DeFi rates offered by protocols. High volatility can result in collateral liquidation.

- Collateralization: In DeFi lending, borrowers must provide collateral to secure their loans. The type and amount of collateral provided can impact the interest rate.

- Risk assessment: The platforms must assess the risk associated with each borrower and lender. For example, borrowers with a poor credit history may be charged a higher interest rate to compensate for the higher risk.

- Platform fees: DeFi platforms charge fees for their services, which can impact the interest rates offered. If the platform charges high fees, borrowers and lenders may receive lower interest rates, as the fees eat into the profits generated by the transaction.

Some other factors are:

- Smart contract risk

- Governance decisions of the DeFi platform

- Regulatory changes and government policies

- Competition from other DeFi protocols

- Adoption and user base growth

Top Lending Platforms for Highest DeFi Rates

1. Aave (AAVE): Open-Source Liquidity Protocol

- Total Value Locked (TVL): $5.31b

- Interest Rate Range: up to 9.71% APY

Aave is a decentralized lending platform that was launched in 2017 under the name ETHLend. The platform was rebranded to Aave and has since become one of the most popular DeFi platforms in the industry.

It operates on the Ethereum blockchain and offers competitive defi rates for lenders and borrowers.

Aave has introduced a unique system of flash loans, which allows users to borrow cryptocurrency without collateral for a very short period of time. This has enabled traders to execute complex arbitrage strategies and has contributed to the growth of the DeFi industry as a whole.

Aave provides a unique DeFi yield and interest rate structure for each asset they support, which can also differ across various networks.

Although most lending DeFi rates tend to fluctuate between 1% to 5%, certain digital assets offer significantly higher DeFi yields. Currently, the Ethereum network’s BAL token boasts an impressive 9.71% APY.

2. JustLend DAO: Earn Interest on TRON Network

- Total Value Locked: $3.85b

- Interest Rate Range: Up to 20.65% APY

JustLend is a money market protocol that operates on the TRON blockchain. It allows users to borrow and lend TRON-based assets such as TRX, USDT, SUN, JST, and others. Users can earn interest by lending their assets, and borrowers can access liquidity by depositing collateral.

Based on supply and demand, you can calculate your Defi interest rates and earn incentives. The rates are updated in real-time based on market and network conditions.

3. MakerDAO: Borrow DAI Stablecoin

- Total Value Locked: $7.42b

- Interest Rates: 1% APY

Maker DAO lending works by allowing users to lock up their Ethereum as collateral and generate DAI stablecoin. Users can borrow up to 66% of the value of their collateral in DAI. The amount of DAI that can be generated depends on the collateralization ratio. It is the ratio of the value of the collateral to the amount of DAI generated.

For example, if a user locks up $1,000 worth of Ethereum and has a collateralization ratio of 150%, they can generate up to $666 worth of DAI.

The user can then use the DAI for various purposes, such as trading or making purchases, and they will need to pay back the DAI with interest in order to unlock their collateral.

4. Solend: Earn High APY on Solana Network

- Total Value Locked: $23.39m

- Interest Rate Range: Up to 9.82% APY

Solend works by allowing users to deposit their SOL tokens into a liquidity pool. The liquidity pool is used to fund loans, and users who lend their tokens to the pool earn interest on their deposits.

It allows you to borrow 84 crypto assets on 54+ liquidity pools. Being built on the Solana blockchain, a high-performance blockchain, it enables fast, low-cost transactions, making it suitable for decentralized lending and borrowing.

Top Staking Platforms for Highest DeFi Rates

1. LIDO Finance: High Liquid Staking Rates

- Total Value Locked: $11.9b

- Interest Rate Range: Up to 19.62% APY (on Kusama chain)

- Supported networks: Ethereum, Solana, Polygon, Polkadot, and Kusama

Lido Finance offers competitive DeFi rates for staking Ethereum. In Liquid staking, users can stake their ETH by sending it to a smart contract that is managed by a network of validators.

The staked ETH is represented by stETH, an ERC-20 token that is issued to users when they deposit their ETH. stETH is pegged to the value of ETH, meaning that 1 stETH always represents 1 ETH.

This allows users to trade their stETH on decentralized exchanges without having to worry about the value of their staked ETH changing.

Related: 5 Best Liquid Staking Derivatives Tokens

2. Rocket Pool: ETH 2.0 Staking Rewards

- Total Value Locked: $1.47b

- Interest Rate Range: Up to 4.85% APY (RETH)

Rocket Pool utilizes the Ethereum blockchain to offer an exclusive chance to users for staking their ETH2 and earning considerable rewards.

Being a member of Rocket Pool comes with a generous Annual Percentage Rate (APR) of up to 4.33% for staked ETH2, making it an attractive opportunity for crypto enthusiasts.

Rocket Pool sets itself apart from other platforms by employing a decentralized node operator network, which makes it easy for users to join the pool.

Additionally, users have the option to run their own nodes with just 16 ETH, allowing them to earn a commission by staking their ETH and receiving additional RPL rewards by providing RPL collateral. With this, users can earn an impressive APR of up to 6.36% for ETH and extra RPL rewards.

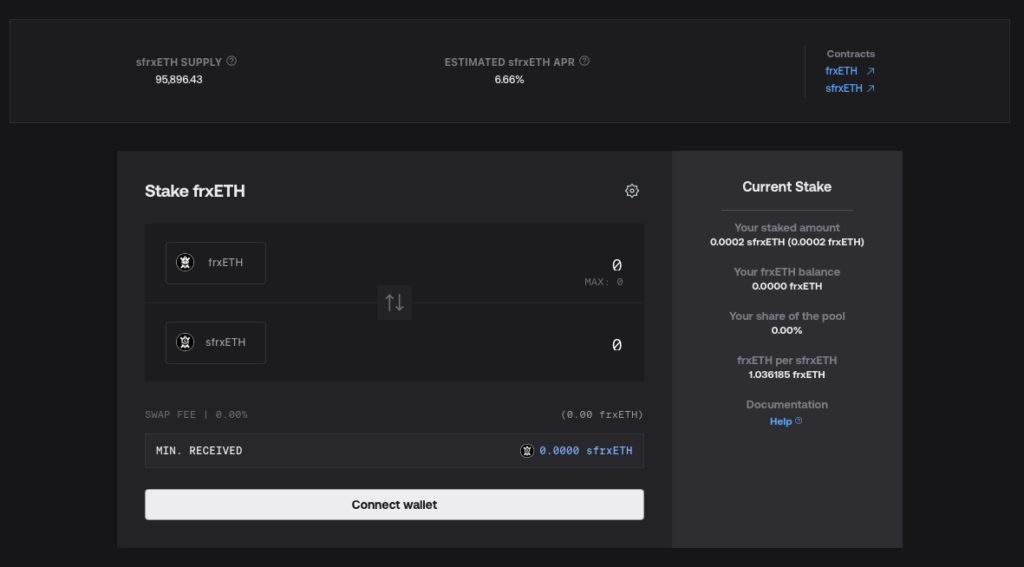

3. Frax Ether: High Yield on Ethereum

- Total Value Locked: $1.4b

- Interest Rate Range: Up to 6.66% APY

Frax Ether is a new way to earn interest on ETH that’s easy and secure. It uses the Frax Finance system to simplify staking and generate higher yields.

Normally, staking ETH is complicated and requires setting up a validator node. Plus, deposits must be in multiples of 32 ETH, which is tough for most people.

With Frax Ether, anyone can earn interest on any amount of ETH they have without needing a validator node. It’s simple and accessible for everyone.

Why DeFi Interest Rates Higher than Traditional Rates?

In traditional finance, intermediaries such as banks, credit unions, and other financial institutions act as a bridge between lenders and borrowers. These intermediaries charge a fee for their services, which include assessing credit risk, managing cash flow, and providing liquidity.

As a result, the interest rates offered by traditional financial institutions are generally lower than what you can find in DeFi.

Another reason why Decentralized finance interest rates are higher is supply and demand. In DeFi, interest rates are determined by the market, just like in traditional finance.

However, the difference is that the market is more transparent in DeFi. Anyone can see the current supply and demand for a particular asset, and this information influences interest rates.

If there is high demand for borrowing a particular asset, the interest rates will increase. This is because lenders can charge a premium to lend the asset to borrowers.

Crypto Lending vs Staking: DeFi Rates Compare

| Key Points | Lending | Staking |

|---|---|---|

| Rewards for supporting the network and validating transactions. Rates can range from 1% to over 100% per year | The practice of lending cryptocurrencies to borrowers in exchange for interest. | The act of holding cryptocurrencies in a wallet to support the network and validate transactions in exchange for rewards. |

| DeFi Rates | Interest paid by borrowers. Rates can range from 1% to over 22% per year | Rewards for supporting the network and validate transactions. Rates can range from 1% to over 100% per year |

| Risk | Borrowers may default on loans. | Market volatility can lead to potential losses. |

| Liquidity | Cryptocurrencies are locked up for the duration of the loan term. | Staked cryptocurrencies may have lock-up periods, but can generally be unstaked and sold relatively quickly. |

| Flexibility | Loans can typically be customized to specific terms and amounts. | Staking rewards are typically fixed and determined by the protocol. |

| Eligibility | Anyone can lend cryptocurrency, subject to availability and loan requirements. | Only users who hold a minimum amount of the cryptocurrency can stake and participate in the network consensus. |

| Popular Platforms | Nexo, Maker, Aave, Compound, etc. | Lido Finance, Rocket Pool, Frax Finance, etc. |

Which Crypto Can You Lend on DeFi Platforms?

The chance of a DeFi protocol letting you lend a token goes up as more people want to borrow it. But if you’ve kept a coin that nobody wants, hoping it’ll become famous, but it doesn’t, you might find it tough to lend it out.

Here are some examples of common tokens that are traded a lot and can be borrowed or lent:

- Ethereum (ETH)

- Wrapped Bitcoin (WBTC)

- Dai (DAI)

- USD Coin (USDC)

- Aave (AAVE)

- Compound (COMP)

- Uniswap (UNI)

- Chainlink (LINK)

- Synthetix (SNX)

- Tether (USDT)

- Bitcoin (BTC)

- Solana (SOL)

- Cardano (ADA)

- Ripple (XRP)

Final Thoughts

DeFi lending and staking platforms are becoming more popular in the world of cryptocurrency. These platforms allow users to earn passive income by lending or staking their cryptocurrencies.

There are many platforms for high DeFi rates to choose from, but it’s important to understand the risks involved. Some risks include vulnerabilities in smart contracts, market volatility, and liquidity risks.

Aave and Compound are popular lending platforms with attractive interest rates and a range of cryptocurrencies to choose from. MakerDAO is a decentralized platform that allows users to borrow Dai stablecoins by using their Ethereum tokens as collateral.

The seven platforms mentioned above are considered the safest and most reliable in the DeFi space.

FAQs

Which DeFi platforms offer the best interest rates?

There are several DeFi platforms that offer high-interest rates for lending and staking, but the rates can vary depending on the platform and the cryptocurrency being used.

Some of the popular DeFi platforms with high-interest rates include Aave, Frax Finance, and Lido Finance.

Is DeFi lending and staking profitable?

DeFi lending and staking can be profitable, but it also comes with risks. The profitability depends on the interest rates offered by the platform, the cryptocurrency used, and the market conditions.

Additionally, there is the risk of smart contract vulnerabilities, market volatility, and liquidity issues. It is important to do thorough research and assess the risks before investing in DeFi lending and staking.

What is DeFi yield farming?

Yield farming, also known as liquidity mining, is a way to earn rewards for providing liquidity to decentralized finance (DeFi) platforms.

In yield farming, users deposit their cryptocurrency assets into a DeFi platform such as a decentralized exchange or a lending platform. These assets are then used to facilitate transactions or provide loans to other users of the platform.

In return for providing liquidity, users receive rewards in the form of additional tokens or fees from transactions.

How risky is crypto lending?

Crypto lending can be risky due to the volatility of the cryptocurrency market and the potential for smart contract vulnerabilities. Additionally, some lending platforms may not have adequate security measures in place, which can lead to the loss of funds.

There are also several other risks associated with crypto lending, including market risk, credit risk, operational risk, and regulatory risk.

![11 Best DeFi Wallets in [currentmonth] [currentyear] (Tested) 23 Best Defi Wallet Featured Image](https://coinwire.com/wp-content/uploads/2022/11/best-defi-wallet-featured-1024x683.png)

![Best Crypto Staking Platforms for Highest APY in [currentyear] 25 Best Crypto Staking Platforms Featured Image](https://coinwire.com/wp-content/uploads/2024/04/best-crypto-staking-platforms-featured-image-1024x683.jpg)