Binance US, the American counterpart of the global cryptocurrency exchange Binance, has announced the suspension of fiat deposits and withdrawals in response to pressure from an ongoing lawsuit filed by the U.S. Securities and Exchange Commission (SEC). The move is aimed at protecting customers and the platform, and it will take effect from June 13, 2023. However, trading, staking, and deposit/withdrawal activities involving stablecoins and cryptocurrencies will continue to function normally.

The SEC Lawsuit and Intimidation Tactics

Binance US revealed that it has been subject to aggressive and intimidating tactics employed by the SEC as part of its ideological campaign against the American digital asset industry. These tactics have also impacted the banks collaborating with Binance US, creating challenges in maintaining regular banking services.

Transition to a Crypto-Only Exchange

In light of the circumstances, Binance US has chosen to suspend USD deposits and notify customers that its banking partners are preparing to pause fiat (USD) withdrawal channels. The exchange encourages customers to take appropriate action with their USD holdings. While the transition to a crypto-only exchange is temporary, the platform emphasizes its commitment to maintaining 1:1 reserves for all customer assets. Any delays in processing withdrawals may be attributed to increased volumes and weekend bank closures. Meanwhile, trading, staking, and deposits/withdrawals involving cryptocurrencies will continue to operate without disruption.

Defending Against the SEC

Binance US remains open to finding a productive compromise that enables a thriving digital asset marketplace in America. The exchange vows to vigorously defend itself, its customers, and the industry against what it considers to be meritless attacks from the SEC.

OTC Trading Platform Suspension

In addition to the fiat deposit and withdrawal suspension, Binance US has indefinitely suspended its over-the-counter (OTC) trading platform. This decision follows the SEC’s lawsuit against Binance, the parent company, which has caused significant disruption in the crypto world. Retail customers will still have access to the public exchange for trading, as OTC trading involves direct matching with buyers and typically serves institutional clients.

Delisting of USDT Trading Pairs

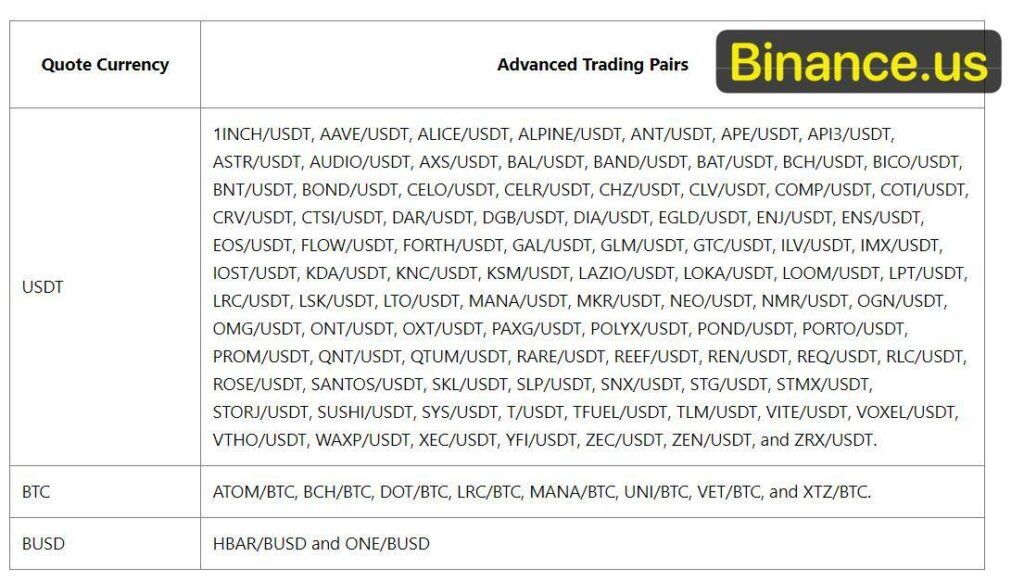

Initially, Binance US announced the delisting of several USDT trading pairs, including AAVE, MKR, MANA, and SUSHI. However, following community feedback, the exchange decided to retain all USDT Advanced Trading pairs. Consequently, cryptocurrencies and USDT pairs will continue to be available for trading.

Impact on Binance US and BNB

Binance US has reduced its trading pairs from 280+ to 226 due to recent delistings. Additionally, the exchange’s stablecoin BUSD is set to be phased out in the coming year following an SEC Wells notice. These developments have negatively affected BNB, the native token of Binance, resulting in an 8.5% decline over the past 24 hours and a 15% drop over the past week.

Please be aware that Binance and Binance US are distinct entities. If you have any inquiries regarding Binance, you can contact their Support team through on Twitter.

Conclusion

As the SEC lawsuit against Binance continues, Binance US has taken proactive measures to safeguard its customers and platform by suspending USD deposits and withdrawals. The exchange assures users that crypto-related activities will remain unaffected. While Binance US maintains its commitment to its customers and the industry, it remains committed to defending against what it deems to be unfounded attacks from the SEC.

Before that, the U.S. Securities and Exchange Commission (SEC) initiated a lawsuit against Binance and its CEO Changpeng Zhao (CZ) for alleged violations of securities regulations. This recent legal action by the SEC reflects their ongoing scrutiny and enforcement efforts concerning CZ and Binance’s activities in the securities market.