Finding the best alternative to an exchange like Coinbase is a real struggle. There are so many options to consider, and they all seem to offer similar services. So, to help you cut to the chase, we handpicked the best Coinbase alternatives, summarized their key features, and gave you a stark comparison all in one article.

The Top 7 Coinbase Alternatives & Competitors

To get the best alternative to Coinbase, crypto traders first need to understand what makes Coinbase such a worthy competitor. Market depth data ranks Coinbase exchange as the second largest crypto exchange by trading volume.

The exchange supports well over 1000 tokens and is compatible with multiple blockchains including Bitcoin, Ethereum, Avalanche, Polygon, C-Chain, and any other EVM-compatible chain. Besides that, Coinbase has a wide client base, with its services available in at least 100 countries.

Coinbase’s popularity also extends from the wide range of trading and earning options that it provides clients. From spot, margin, derivatives, and futures trading to staking, Coinbase has it all, but there is stiff competition. Here’s a breakdown of the seven best alternatives to Coinbase.

| Exchange | Top 3 Features | Deposit Methods | Trading Fee |

| Coinbase | Has over 1000 tokens Supports spot, margin, derivatives, futures trading, and staking Has advanced security features | ACH Cashouts to bank accounts Debit card, credit card, wire transfer, PayPal Google and Apple Pay. | Between 0.00% and 0.40% makers fee and 0.05% and 0.60% takers fee |

| Binance | Supports multiple trading options including spot, futures, and margin trading. Allows users to make extra cash by staking Ethereum Offers occasional trading fee discounts | Credit card Bank transfer PayPal AdvCash, Binance’s Convert & OTC Portal Local peer-to-peer (P2P) trading | 0.1% makers fee and 0.1% takers fee |

| Kraken | Supports over 185 coins Allows staking for more than 12 different coins including BTC, ETH, SOL, TRON, ADA and DOT Facilitates futures and margin trading | Credit and Debit cards Apple Pay Google Pay | 0.16% makers fee or 0.26% takers fee |

| KuCoin | Lists over 700 digital currencies Supports spot and margin trading Has multiple earning options including crypto lending and cloud mining | Credit and Debit cards | 0.1% makers fee and 0.1% takers fee |

| CEX.io | Supports at least 200 cryptocurrencies Allows users to stake multiple digital assets including DOT, ATOM, ADA, SOL, and TRON Offers crypto-backed loans | Credit debit cards Google and Apple Pay Domestic Wire Transfers Skrill, and ePay | Makers fee of 0.01% to 0.15% and a takers fee of 0.01% to 0.25% |

| Bitstamp | At least 70 cryptocurrencies are available on the platform Supports staking for Ether and Algorand Has a highly advanced interface for advanced investment options | Debit and credit card Bank transfer | Makers and takers fee of 0.01% to 0.06% |

| Crypto.com | Supports at least 250 coins Offers derivatives and margin trading Offers users crypto credit without repayment deadlines | Credit and debit cards Crypto.com pay | Makers and takers fees ranging from 0.05% to 0.06% |

| Gemini | Has about 100 listed crypto assets Supports staking for Polygon(MATIC) and ETH Has Gemini Prime which offers full-service crypto solutions for institutional clients | ACH Wire transfer Bank account transfers | Maker fees ranging 0.01% to 0.08% and a takers fee of 0.01% to 0.08% |

1. Is Binance Better than Coinbase?

Binance is the largest crypto exchange by trading volume globally, while Coinbase is second. This makes the exchange a worthy Coinbase alternative.

Besides being the largest, Binance is also known for its range of digital currencies and trading options.

Key Features

- It has over 600 crypto coins for trading

- Supports multiple trading options, including spot, futures, and margin trading.

- Allows users to make extra cash by staking Ethereum.

- Offers occasional trading fee discounts

- It has Binance Academy to help new traders understand markets and the interface better.

Trading Fees

Binance is considered a highly affordable crypto exchange. The platform’s transaction fees range from 0.10% makers fee and 0.01% takers fee. Compared to Coinbase, this is highly affordable.

Coinbase charges 0.00% and 0.40% makers fee depending on the users’ trading volume. The takers fees on the platform are 0.05% and 0.60%, and there’s an additional 1% transaction fee on all cryptocurrency transactions.

Winner: Binance

Trading Limits

Immediately after the verification process, Binance traders can deposit a maximum of $5000. Ten days after verification is complete, the limit rises to $30,000. In contrast, Coinbase has unlimited crypto deposit limits, but it limits deposits for fiat currencies based on the payment method selected.

For withdrawals, Coinbase users have a $50,000 limit per day, which also applies to Coinbase Pro. This means Coinbase has more wriggle room for withdrawing bigger sums.

Winner: Coinbase

Payment Channels

Binance supports multiple payment methods. These include credit card, bank transfer, e-wallet options like PayPal and AdvCash, Binance’s Convert & OTC Portal, and local peer-to-peer (P2P) trading.

On the other hand, Binance payment options are more flexible for the non-U.S. version of the exchange. This platform allows traders to deposit, withdraw, buy and sell crypto through payment methods like ACH, instant cash-outs to bank accounts, wire transfer, Google and Apple pay, and PayPal. However, for U.S.-based clients who use Binance, U.S. local payment channels like instant bank account cash-outs can’t allow them to purchase crypto or make deposits.

Winner: Binance

Security

When it comes to security features, Binance has insurance from the Federal Deposit Insurance Corporation (FDIC), insuring digital assets for Binance U.S. users. Binance also uses two-factor authentication (2FA), address whitelisting, and stores its reserves in cold storage to reduce the risk of online breaches.

Similarly, Coinbase has FDIC insurance and uses 2FA and cold storage. But Coinbase takes its security a notch higher with AES-256 encryptions for its digital wallets and biometric fingerprint logins that keep out any unwarranted third parties.

Winner: Coinbase

2. Is Kraken Better than Coinbase?

Kraken crypto exchange is another impressive Coinbase alternative. This platform may be smaller than Coinbase, but some features, like its top-notch customer service, help rank it among the better alternatives to Coinbase.

Key Features

- Supports over 185 coins

- Allows staking for more than 12 different coins, including Bitcoin(BTC), Ethereum(ETH), Solana(SOL), Tron(TRON), Cardano(ADA), and Polkadot(DOT).

- Facilitates futures and margin trading

- Has a live chat support team for any inquiries.

Trading Fees

Kraken trading fees cost 0.16% for makers and 0.26% for takers. This makes the platform far cheaper than Coinbase. Considering that it may impose an additional account transfer fee on some transactions, Kraken is more expensive than Coinbase.

Winner: Coinbase

Trading Limits

This cryptocurrency exchange has no limits for deposits, but it imposes withdrawal limits depending on your account’s level. After verification, starter accounts can withdraw a maximum of $5000, while intermediate and pro accounts can withdraw $500,000 and $10,000,000, respectively.

The fact that Kraken has no deposit limits gives it an advantage over Coinbase. Also, the tier system that allows Kraken users to extend their withdrawal limits is impressive. Although Coinbase Pro users can also increase their limits, the process is more complex on Coinbase.

Winner: Kraken

Payment Channels

For payment methods, Kraken supports payment cards, Apple Pay, or Google Pay. However, some of these may be unavailable in certain regions, so the exchange provides a list of acceptable payment methods per region.

It’s hard to find a clear-cut winner in this section because all platforms have region-based limitations. However, Coinbase’s limitations are only in one region, while Kraken’s are widespread.

Winner: Coinbase

Security

Kraken’s security features are industry standards. The platform has 2FA and uses withdrawal email confirmation to ensure users verify their transactions. Kraken also has cold storage and precise API key permission control for extra security. However, these still need to catch up with Coinabase’s superior AES-256 encryptions and FCID insurance.

3. Is KuCoin Better than Coinbase?

KuCoin is one of the best Coinbase alternatives. The exchange has a vast collection of crypto assets and is easily accessible on desktop, iOS, and Android apps that are highly user-friendly.

Key Features

- Lists over 700 digital currencies

- Supports spot and margin trading

- It has multiple earning options, including crypto lending and cloud mining

- It has trading bots to automate trading

- It has one of the lowest fees among all cryptocurrency exchanges

Trading Fees

KuCoin is a popular crypto exchange because of its low fees. Its users pay transaction fees ranging from 0.1% makers fee and 0.1% takers fee for every trade. This makes it a better Coinbase alternative than other crypto exchanges.

Winner: KuCoin

Trading Limits

1 BTC per day, or an estimated $17000, is the KuCoin limit for account holders who still need to complete the KYC process. Once you complete the verification process, KuCoin’s withdrawal limit skyrockets to 200 BTC over 24 hours. These limits are higher than what is available on Coinbase-verified accounts, making the platform a better Coinbase alternative with regard to withdrawal limits.

Winner: KuCoin

Payment Channels

KuCoin’s payment methods include credit and debit card transactions. However, users can also buy crypto on the platform using the fiat deposits in their crypto wallets. These payment methods are fewer than what Coinbase offers, putting the latter in the lead.

Winner: Coinbase

Security

KuCoin has dramatically improved its security features since it experienced a $280 million-worth hack in 2020. The exchange now applies multi-factor authentication and issues users different transaction passwords. Despite this, the breach hints that Coinbase has more security because it has never experienced a hack.

Winner: Coinbase

4. Is CEX.io Better than Coinbase?

CEX.io is one of the best crypto exchanges for advanced regular trading. Because of its complex trading features, this exchange is well-equipped to provide advanced traders with all the resources needed to create an impressive crypto portfolio.

Key Features

- Supports at least 200 cryptocurrencies.

- Allows users to stake multiple digital assets, including Polkadot(DOT), Cosmos(ATOM), Cardano(ADA), Solana(SOL), and Tron(TRON).

- Offers crypto-backed loans

- Offers margin and spot trading.

Trading Fees

CEX.io charges a makers fee of 0.01% to 0.15% and a takers fee of 0.01% to 0.25%. By comparison, the platform charges significantly lower fees than Coinbase.

Winner: CEX.io

Trading Limits

This exchange’s trading limits differ with the withdrawal method you choose. The range is, however, as low as $2600 on Mastercard credit cards to an unlimited amount on SWIFT bank transactions. These are daily limits.

For the payment options that cut across both exchanges, like Mastercard credit card purchases or deposits and debit card transactions, CEX.io offers higher transaction limits. In fact, there are no credit debit card deposit limits. However, the withdrawal limits for the same are low. This puts the two exchanges on the same level.

Winner: Tie

Payment Channels

CEX.io supports many payment gateways, including a credit debit card, Google and Apple Pay, Domestic Wire Transfers, and e-wallets like Skrill and ePay. These payment methods are more diverse on CEX.io than on Coinbase.

Winner: CEX.io

Security

For a Coinbase alternative, CEX.io doesn’t have well-known security features. Besides the usual two-factor authentication and cold storage, little is known about the platforms’ security standing. So, judging by what is known, Coinbase has more safety protocols for its clients’ crypto holdings.

Winner: Coinbase

5. Is Bitstamp Better than Coinbase?

Bitstamp is another Coinbase alternative known for supporting advanced traders to trade crypto. This cryptocurrency exchange has advanced trading options like fill-or-kill orders that optimize how traders sell or buy crypto.

Key Features

- At least 70 cryptocurrencies are available on the platform.

- Supports staking for Ether and Algorand

- Has a highly advanced interface for advanced investment options.

Trading Fees

The transaction fees on Bitstamp comprise a makers and takers fee of 0.01% to 0.06%. This is within the same cost range as Coinbase. Both platforms also have a tier system that ensures traders with a high trading volume spend less on transaction fees.

Winner: Bitstamp

Trading Limits

Bitstamp enforces a $2500 limit as the maximum amount spent on credit and debit card purchases for cryptocurrencies within 24 hours. This limit may differ based on the country of residence. Coinbase does not limit users on how much they can spend to trade crypto. The limits are only imposed on withdrawals.

Winner: Coinbase

Payment Channels

Bitstamp crypto exchange will accept crypto payments made using debit and credit card deposits or bank transfer. It also supports instant bank account deposits, which are not supported in the list of Coinbase payment methods for U.S. residents.

Winner: Bitstamp

Security

Bitstamp has robust measures to secure all cryptocurrency trading activities and assets. The cryptocurrency exchange uses 2FA and stores almost 90% of all their virtual currencies on cold storage wallets. Bitstamp also has FDIC insurance, follows a strict KYC verification, and uses AES-256 encryption for its crypto wallet.

Coinbase and Bitstamp have nearly similar security features. However, Bitstamp suffered a data breach in 2015, while Coinbase has never experienced such. Although the exchange has managed to prevent hacks from happening again, the incident places Bitstamp’s security a step behind Coinbase.

Winner: Coinbase

6. Is Crypto.com Better than Coinbase?

Crypto trading on Crypto.com isn’t as beginner-friendly as it is on other crypto exchanges, but it is every bit worth it. Traders with background knowledge on how to trade stocks tend to have an easier time navigating this Coinbase alternative. They can use features like double trades and the platform’s earn feature to reap maximum benefits.

Key Features

- It supports at least 250 coins.

- Offers derivatives and margin trading.

- Offers users crypto credit without repayment deadlines.

- Allows staking for BTC, ETH, and USDC.

Trading Fees

Crypto.com’s makers and takers fees range from 0.05% to 0.06%. This doesn’t have much of a difference from Coinbase’s transaction fees. However, occasionally, Crypto.com may offer discounts where traders pay zero fees as makers’ charges.

Winner: Crypto.com

Trading Limits

Crypto.com has withdrawal limits. These depend on the cryptocurrency to be withdrawn, making it difficult to compare the exchange with Coinbase, whose limits are subject to verification and payment gateways. For these two, it’s heavily dependent on what users prefer.

Winner: Tie

Payment Channels

The supported payment methods on Crypto.com include credit and debit cards or Crypto.com pay, an in-app crypto payment system on Crypto.com’s app. Generally, Crypto.com’s payment methods are more flexible than Coinbase. The in-app payment system, for instance, is not affected by region and is more straightforward to use than an alternative like a bank transfer.

Winner: Crypto.com

Security

The significant difference between Coinbase and Crypto.com on security is that the latter uses multi-factor authentication (MFA) to secure client accounts. MFA is a step higher than 2FA, putting Crypto.com in the lead.

Winner: Crypto.com

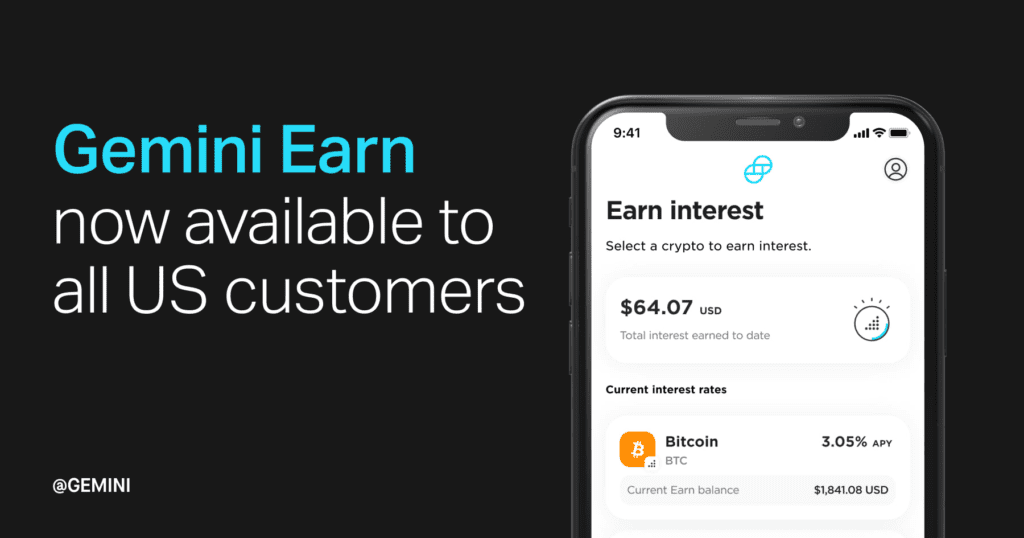

7. Is Gemini Better than Coinbase?

One of the best alternatives to Coinbase is the Gemini cryptocurrency exchange. This platform is the most popular crypto exchange among institutional clients, offering them high-performance tools for active trading.

Key Features

- Has about 100 listed crypto assets.

- Supports staking for Polygon(MATIC) and Ether.

- Has Gemini Prime, which offers full-service crypto solutions for institutional clients.

Trading Fee

Gemini charges maker fees ranging from 0.01% to 0.08% and a takers fee of 0.01% to 0.08%. For traders with lower trading volume, the exchange is more expensive than Coinbase.

Winner: Gemini

Trading limits

ACH transfers on Gemini have a $100000 daily limit. On the other hand, bank and wire transfer have no limits. Comparing this to Coinbase’s $50,000 daily limit, Gemini is a better alternative to Coinbase.

Winner: Gemini

Payment channels

Gemini payment methods include ACH, wire transfer, and bank account transfers. Clients can also make deposits using PayPal, but PayPal withdrawals are not supported. Also, Gemini bank transfer services are limited to U.S. clients,

Security

Gemini’s security suite comes complete with FDIC insurance for USD balances up to $250,000, 2FA, cold storage, and Universal 2nd Factor (U2F) hardware keys for a double layer of protection. Compared to Coinbase, both platforms are highly secure, with only significant differences that serve more of a distinguishing than ranking purpose.

Winner: Tie

FAQs

1. Is there a better alternative to Coinbase?

There are multiple crypto exchanges known to be better alternatives to Coinbase. The seven top-ranking crypto trading platforms better than Coinbase include Binance, Kraken, KuCoin, CEX.io, Bitstamp, Crypto.com, and Gemini.

2. What is safer than Coinbase?

Crypto.com is safer than Coinbase. The exchange offers all major security features on Coinbase, including FDIC insurance, bug bounties, and cold storage. However, the platform levels up with multi-factor authentication, while Coinbase only provides two-factor authentication.

3. What has cheaper transaction fees than Coinbase?

Binance, KuCoin, CEX.io, and Bitstamp have a lower transaction fee compared to Coinbase. The lowest fees belong to KuCoin, which charges a constant 0.01% maker and taker fee per transaction. However, despite its low transaction fees, KuCoin’s most significant demerit is that it is not licensed in the U.S.

4. What is the best alternative to Coinbase?

There isn’t an overall best alternative to Coinbase. However, there are multiple apps like Coinbase. Some of these Coinbase competitors have better stand-alone features than Coinbase, but overall, the best Coinbase alternative is the one that meets an individual’s or company’s crypto trading needs.

![Bitget Referral Code [currentyear]: Claim 1000 USDT Sign Up Bonus 29 Bitget Referral Code](https://coinwire.com/wp-content/uploads/2024/03/bitget-referral-code-1024x683.jpg)

![Bybit vs Kucoin [currentyear]: Exchange Leverage, Fees, Pros & Cons 30 Bybit Vs Kucoin](https://coinwire.com/wp-content/uploads/2024/01/bybit-vs-kucoin-1024x683.jpg)

![Best Kucoin Referral Code ([currentmonth] [currentyear]): $700 USDT Signup Bonus 31 Kucoin Referral Code](https://coinwire.com/wp-content/uploads/2024/02/kucoin-referral-code-1024x683.jpg)

![Bybit Review ([currentmonth] [currentyear]): Exchange Features, Fee, Pros & Cons 32 Bybit Featured Image](https://coinwire.com/wp-content/uploads/2022/06/Bybit-review-1024x683.png)

![OKX Referral Code [currentmonth] [currentyear]: 10K Mystery Box & BTC Bonus 33 Okx Referral Code](https://coinwire.com/wp-content/uploads/2023/08/okx-referral-code-claim-10k-mystery-box-and-btc-bonus-1024x683.jpg)