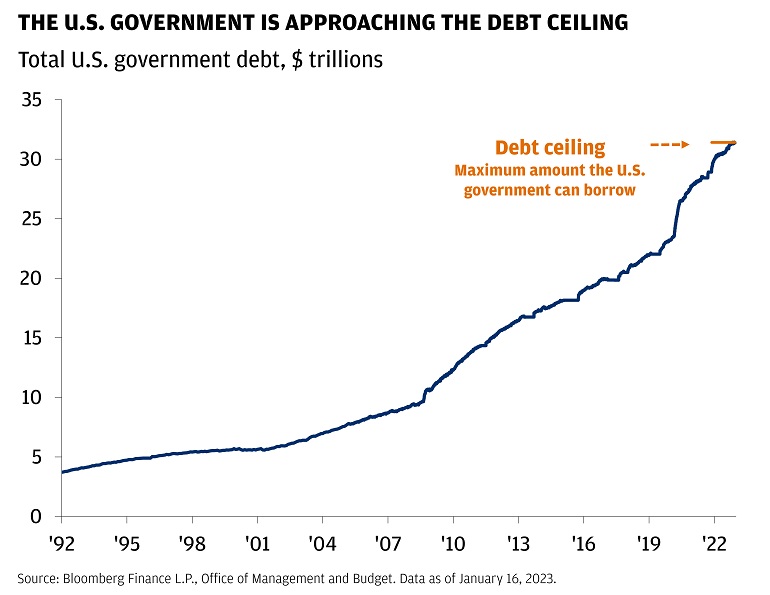

JPMorgan, one of the world’s largest financial institutions, has recently sounded the alarm on the US debt ceiling. The bank has warned that the concerns over the US debt limit could resurface in May. This is a serious matter that needs attention, as the US debt ceiling has a significant impact on the global economy.

Preparing for Potential Debt Ceiling Impacts on Financial Markets

With the looming threat of the US debt ceiling returning in May, it’s essential for investors and financial institutions to prepare for the potential impacts on financial markets. The uncertainty surrounding the debt ceiling can cause significant volatility in the markets, so understanding how to navigate this situation is crucial.

First and foremost, it’s important for investors to stay informed about the ongoing debt ceiling negotiations in Congress. Keeping a close eye on the news and developments regarding the debt ceiling will help investors make more informed decisions about their investments.

Another strategy for preparing for potential debt ceiling impacts is to diversify your investment portfolio. By spreading your assets across different types of investments, such as stocks, bonds, and cash, you can help protect yourself from the potential negative consequences of the debt ceiling crisis.

While the debt ceiling crisis may cause short-term market turbulence, it’s important to remember that financial markets have historically recovered from such events. By staying focused on your long-term investment goals and maintaining a well-diversified portfolio, you can help increase the likelihood of weathering any potential debt ceiling-related market volatility.

The Role of the Federal Reserve in Managing the Debt Ceiling

One of the primary ways the Federal Reserve can help manage the debt ceiling is through its open market operations. These operations involve the buying and selling of government securities, which can help influence interest rates and the overall supply of money in the economy. By adjusting its open market operations, the Federal Reserve can help stabilize financial markets and minimize the potential negative consequences of the debt ceiling.

Another tool the FED has at its disposal is its ability to act as a lender of last resort. This means that the central bank can provide emergency funding to financial institutions in need of liquidity, helping to prevent a potential financial crisis from spiraling out of control. In the event of a debt ceiling impasse, the FED could take steps to ensure that banks have access to the necessary funds to continue operating, helping to maintain stability in the financial system.

As JPMorgan’s warning suggests, the US debt ceiling concerns are likely to resurface in May, leading to potential impacts on financial markets and the global economy. It’s essential for investors and financial institutions to stay informed and prepared for this possibility, as well as to understand the role of the Federal Reserve in managing the situation.

![Tristan Tate Net Worth ([currentyear]): Biography, Businesses & Cars 11 Tristan Tate Net Worth Featured Image](https://coinwire.com/wp-content/uploads/2023/07/tristan-tate-net-worth-featured-image-1024x683.jpeg)

![11 Best Crypto Exchanges in Australia (Updated in [currentmonth] [currentyear]) 14 Best Crypto Exchanges In Australia Featured Image](https://coinwire.com/wp-content/uploads/2023/06/best-crypto-exchanges-in-australia-featured-image-1-1024x683.jpg)