Identifying the best liquid staking crypto platform can increase your income from staked assets. But do you know what makes a liquid staking site worth your investment? This article breaks it down for you. Using market cap as the primary ranking factor, we will analyze the best liquid staking tokens and platforms, explaining their key characteristics, fee structure, and liquid staking rewards so that you can choose only the best.

Overview

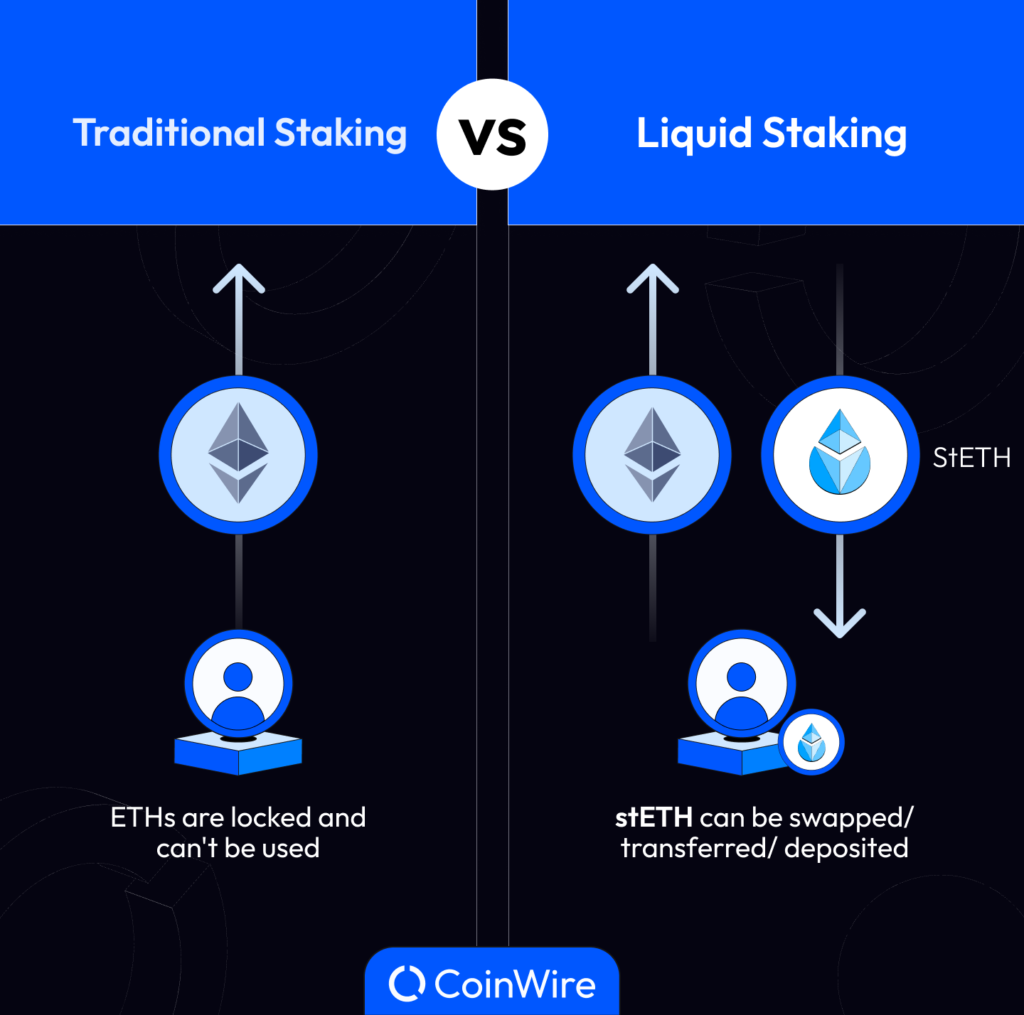

Liquid staking, also known as “soft staking,” is one of the most popular ways to generate passive income using crypto assets. This investment strategy allows users to stake their crypto coins without any lockup periods. It also provides an alternative to reinvesting staked coins in other decentralized finance (DeFi) systems.

This staking strategy happens through liquid staking crypto platforms. Typically, users stake leading cryptocurrency assets like Ethereum, Polkadot, and Solana on such sites, and then the platform generates a liquid staking coin. This liquid staking token is generated in a ratio of 1:1 to the staked cryptocurrency. Liquid staking token holders can trade these coins, use them as collateral for crypto loans, or place them in yield farming pools to earn extra income.

Soft staking has grown in popularity, leading to the rise of many liquid staking crypto platforms. We will rank the top five best soft-staking cryptocurrency platforms by market cap and discuss their characteristics, benefits, and financial returns.

Best Liquid Staking Derivative Tokens

| Liquid Staking Projects | Marketcap | TVL | LSD APY | LSD Minimum Staking Requirements |

|---|---|---|---|---|

| Lido | 74.80% | $8.91 billion | 10.40% | None |

| Coinbase Wrapped Staked ETH | 14.69% | $1.78 billion | 4.39% | None |

| Rocket Pool | 5.57% | $663.01 million | 4.31% | 0.01 ETH for tokenized staking 16 ETH for node validators |

| Frax Ether | 1.47% | $174.47 million | 6.61% | None |

| StakeWise | 1.12% | $133.71 million | 4.79% | None |

Liquid staking has become one of the most effective ways to increase liquidity while maintaining the capital efficiency of the assets involved. This has triggered the rise of many soft-staking platforms. If you need help deciding which platforms to settle for, here’s a summary of the top liquid staking protocols to consider.

Lido

- Market Cap: 74.80%

- Total Locked Volume: $8.91b

- Contracts: stETH

- Platform fees: 10% of total liquid staking rewards

- Platform minimum staking requirements: None

Lido has been the leading crypto staking platform by market cap and total locked volume since its launch in December 2020. With a market share of 74.74%, this liquid staking solution helps investors on the Ethereum Solana, Terra, Polkadot, Polygon, and Kusama blockchains to benefit from their staked assets.

The platform’s team noticed a gap in proof-of-stake (PoS) blockchains. These networks were more efficient at processing transactions than chains that used proof-of-work consensus mechanisms. However, they required users to lock up assets for some time, reducing liquidity.

On the other hand, Lido offered stakers a chance to earn from staking without compromising their liquidity. Typically, users stake their assets on the platform, and then Lido generates derivative tokens from the staked tokens. Stakers can then reinvest these tokens on other DeFi platforms.

Why Should You Consider Lido?

Liquid staking on Lido comes with multiple advantages. Here are some of the benefits of staking on the platform.

- LDO Rewards: LDO is LIdo’s native token. This ERC-20 standard coin serves as the platform’s governance and utility token. Lido users receive LDO rewards for making insurance purchases, participating in referral programs, or providing liquidity.

- Lucrative APY: Lido-staked assets generate an impressive annual percentage yield (APY). Averagely, staking coins on this platform generates 10.40% APY, paid out daily.

- Yield Farming Rewards: Lido-generated derivative assets like stETH and stMATIC earn yield farming rewards on platforms like SushiSwap, Bancor, Curve, and 1inch.

Coinbase

- Market Cap: 14.69%

- Total Locked Volume: $1.78b

- Contracts: CbETH

- Platform Fees: 25% commission on total liquid staking rewards

- Platform minimum staking requirements: None

Another leading liquid staking crypto solution is Coinbase. Coinbase is a centralized crypto exchange. However, in August 2022, the platform launched a liquid staking service to tap into opportunities in the PoS blockchain systems.

Because of its centralized governance, Coinbase has gained popularity among users who want to benefit from crypto without risking ungoverned investments. Although its liquid staking service is only available for the Ethereum network, Coinbase has captured a 14.68% market share in the liquid-staked cryptocurrency industry, placing it as the second-best liquid crypto-staking platform.

When investors stake ETH on Coinbase, this liquid staking service provider generates the Coinbase Wrapped Staked ETH (cbETH) token in a ratio of 1:1. cbETH holders have the alternative to transfer the token into their crypto wallets, trade, or use them to generate passive income on other DeFi platforms.

Why Should You Consider Coinbase?

Coinbase has many benefits as a liquid staking service provider. Let’s explore a few advantages of staking on the platform.

- Security: Coinbase is a centralized exchange. This means all assets on the site are thoroughly vetted and regulated. This centralized governance offers asset security and ensures users are safe from exposure to non-trustworthy assets.

- High APY: Liquid staking on Coinbase generates relatively high APY. Stakers can get up to 4.39% for their staked assets.

- Compatibility with crypto loan platforms: Coinbase has ensured that its cbETH token is compatible with some of the best crypto lending platforms in the market. This means holders can use the coin as collateral for crypto loans.

Rocket Pool

- Market Cap: 5.57%

- Total Locked Volume: $663.01m

- Contracts: rETH

- Platform Fees: 55 to 20% of total liquid staking rewards

- Platform minimum staking requirements: 0.01 ETH for tokenized staking & 16 ETH for node validators

Rocket Pool is a personal favorite for many liquid stakers. The platform launched in September 2021 and has so far managed to attract a 5.58% market share, with good reason. Rocket Pool only offers staking on the Ethereum blockchain. However, it lowers the staking requirements while offering better rewards and benefits.

Rocket Pool gives users two staking alternatives, unlike other liquid staking solutions, which offer only one way of staking digital assets. The first is ordinary staking. This alternative allows investors to stake a direct deposit of at least 0.01 ETH.

The other option is to run validator nodes. Typically, running nodes on Ethereum requires a minimum deposit of 32 ETH or other multiples of 32. But, Rocket Pool allows validators to deposit only 16 ETH and still run ETH nodes with all the benefits.

In both staking alternatives, Rocket Pool generates rETH from the staked ETH. rETH holders use this derivative asset to increase their staking income further.

Why Should You Consider Rocket Pool?

The key characteristic that makes Rocket Pool a popular liquid staking choice for many individuals is its flexibility. The site reduces the barrier of entry for staking on the Ethereum network while maintaining its benefits. Here are other reasons why you should consider Rocket Pool.

- Impressive Staking Rewards: Rocket Pool offers its users impressive staking rewards. Validators can earn as much as 7.4% APY while ordinary stakers can make at least 4.37% APY.

- ETH to rETH swapping: rETH holders can swap the token for ETH on crypto exchanges like Uniswap. The ETH from the swap can be re-staked or sold to earn more income.

Frax

- Market Cap: 1.47%

- Total Locked Volume: $174.47m

- Contract: FraxETH

- Platform Fees: Undefined

- Platform minimum staking requirements: None

Frax Finance is among the top five best liquid staking crypto service providers. Initially, the platform was known as the pioneer of fractional stablecoins. However, after launching its liquid staking service in October 2022, Frax developed a reputation for lucrative ETH liquid staking, translating into a 1.49% market share.

Liquid staking on Frax works differently than it does on other sites. First, the protocol requires users to stake their assets, which converts to FraxETH (frxETH). frxETH is an Ethereum-backed stablecoin.

On its own, frxETH does not generate staking rewards. It merely facilitates effective rebasing on Frax. To get stablecoin rewards for staked ETH, stakers need to place frxETH in the Staked Frax ETH (sfrxETH) vault. After staking FraxETH, the protocol generates sfrxETH coins, which holders can reinvest.

Why Should You Consider Frax?

The Frax protocol has multiple benefits. Let’s explore what you can get for your liquid staking efforts on the platform.

- Compounded interest: sfrETH offers an annual compounded yield of about 6.61%.

- Stablecoin Yield Farming: Frax partners with stablecoin yield farming protocols like Curve, These platforms have liquidity pools for coins like frxETH. In return, they offer yields that can be converted to sfrxETH and back to ETH, generating a higher income.

Stakewise

- Market Cap: 1.12%

- Total Locked Volume: $133.71m

- Contract: sETH2

- Platform Fees: 10% of total liquid staking rewards

- Platform minimum staking requirements: None

One of the best crypto liquid staking protocols is Stakewise. This platform is a reliable and secure platform for ETH staking. It utilizes the Ethereum Beacon Chain to ensure users can stake their ETH tokens. But, unlike traditional staking, Stakewise does not lock up the staked assets. Instead, it generates sETH2, a Liquid Staking Derivative (LSD), which holders can use on other ERC-20 compatible protocols or leading crypto wallets.

Why Should YOu Consider Stakewise?

With Stakewise, it is easy to explore DeFi markets profitably. The platform interprets with leading DeFi protocols like Uniswap, Gnosis Safe, and 1inch to provide additional investment opportunities for sETH2. Besides this, here are several other benefits of liquid staking on Stakewise.

- Maximum uptime and stability: Stakewise protocol provides highly efficient and secure on-chain software. This ensures node operators do not encounter challenges when validating transactions, minimizing the risk of penalties affecting their staking yield.

- Real-time monitoring: Stakers often lose their tokens when a protocol penalizes validators assigned the respective tokens. However, on Stakewise, investors receive real-time updates about a validator’s performance to avoid suffering penalties imposed on rogue validators.

- Lucrative APY: sETH2 yields 4.79% APY. This is the third-highest APY income after sfrxETH and stETH.

Advantages and Disadvantages of Liquid Staking Crypto Platforms

Liquid staking cryptos platforms can be beneficial. However, they occasionally have their shortcomings. Here are some of the most common pros and cons of liquid staking cryptocurrency protocols.

Pros

- No Lockup Periods: Protocols facilitating liquid staking allow users to submit their crypto tokens without locking them up. This makes it possible for investors to earn staking rewards while having the option to reinvest staked assets on different DeFi sites.

- Lowering the entry barrier for validators: Running validator nodes, especially on networks like Ethereum, can be costly. Interested parties have to part with at least 32 ETH to run a node. However, liquid staking platforms lower this by allowing validators to spend at least half of this and still get the full benefits of running Ethereum nodes.

- Diversifying DeFi: platforms supporting liquid staking help diversify income generation streams in DeFi. By allowing reinvestment of staked assets, these protocols facilitate the circulation of cryptocurrencies around multiple DeFi platforms, thereby diversifying the sector.

Cons

- Loss of assets: The greatest challenge with liquid staking crypto is the risk of losing assets through smart contract conflicts. When using LSDs on secondary platforms, the smart contracts may clash with those of the original platforms. This makes it difficult to recover the derivative assets; without them, retrieving staked assets is nearly impossible.

Liquid Staking Crypto Protocols Are The Next Big Thing

The move from classic to liquid staking is inevitable. The latter is impressively efficient and more rewarding. It offers the chance to diversify income from staked assets and provides increased liquidity in the DeFi sector. These benefits have enticed and continue to entice many investors to move towards such platforms, indicating that liquid staking is the future of crypto staking.

However, despite these benefits, this staking strategy may pose risks to staked assets. As such, exercise caution with the platforms you use, and ensure that the smart contracts involved do not clash.

FAQs

Which Liquid Staking Crypto Protocol is best?

The best liquid staking protocol is Lido. This platform offers liquid staking for multiple blockchains, including Polygon (MATIC), Solana (SOL), Polkadot (DOT), and Kusama (KSM). Aside from this, you can also use Coinbase, Rocket Pool, Frax, or Stakewise.

Is Liquid Staking risky?

Liquid staking is a secure strategy. The derivative assets generated are safe and well-regulated. Also, the platforms issuing these coins comply with multiple regulations and undergo thorough audits to guarantee their safety and performance.

Is Liquid Staking Worth It?

Liquid staking is impressively lucrative. Platforms like Lido offer interest rates that are as high as 11%. Across these platforms, stakers can earn between 4.4% to 11% APY.