Warren Buffett, the business entrepreneur, investor, and philanthropist, is apparently ‘in negotiations’ with senior White House officials about ‘investing in the banking sector’ following a string of significant failures. According to one analysis, approximately 200 institutions are supposedly facing the same types of dangers that the Silicon Valley Bank faced prior to its collapse.

According to reports, Warren Buffett is supposedly in talks with the Biden administration about future investment in US banks. The aforementioned business titan had a history of meddling during the banking crisis. Buffett is also accused of providing “advice” to White House officials.

Highlights of the Said Talk

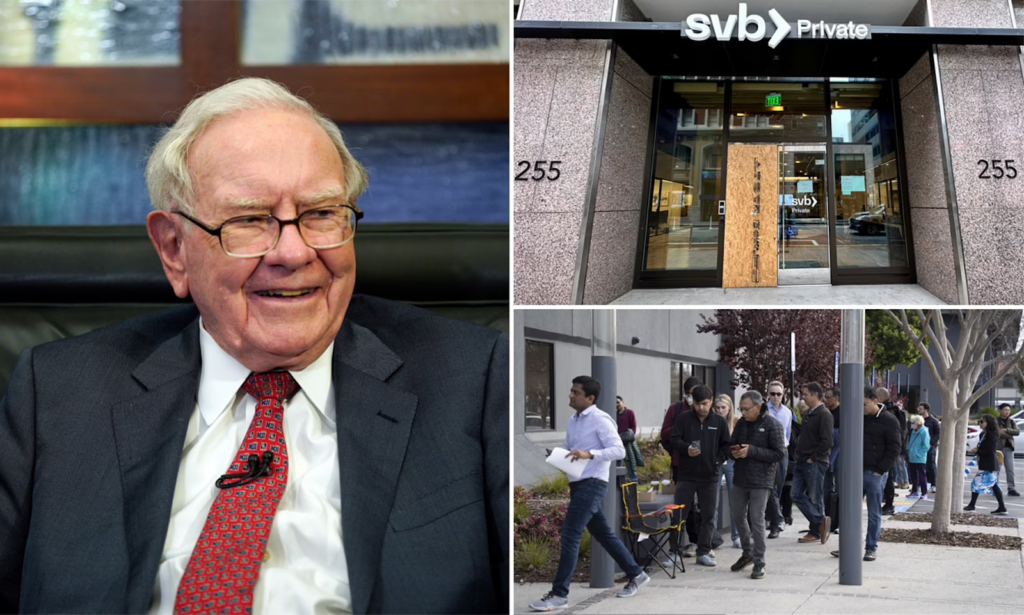

The aforementioned discussion is believed to have surfaced in response to claims that almost 200 banks have a propensity to fail, including Silicon Valley Bank and First Signature Bank if half of their depositors suddenly withdrew all of their money. Anonymous sources who spoke with a media outlet and claimed that calls between Buffett and President Biden’s administration were centered on the likelihood of his investing in the regional banking industry, verified the aforementioned talk.

Also, according to the aforementioned sources, Buffett plans to give his counsel to the officials on how to handle the present industrial storm because they are worried that the banking crisis would have a negative impact on the banking system. The White House and Berkshire Hathaway representatives have yet to respond to these allegations, despite their dominating the headlines.

Banking Crisis’s Root Cause

The recent failure of Silicon Valley Bank, known as the largest bank to fail since 2008, is said to be the cause of the fear that is currently engulfing the financial industry. Rising interest rates are thought to have started this crisis by prompting bank customers to abruptly withdraw their deposits in order to maintain their businesses.

CEO Greg Becker advised consumers to “stay cool” as a result of the aforementioned difficulties, which have resulted in a $1.8 billion financial black hole. Once customers started to feel the dread that the bank would fail, they made the decision to move quickly. Clients were seen lined up outside of their banks in order to withdraw money.

The Biden administration stepped in at this time and made a promise to fully repay uninsured deposits from failing banks in an effort to calm the situation. But, to prevent the taxpayers from bearing the cost, major American banks last week willingly contributed $30 billion to strengthen First Republic Bank.

![Tristan Tate Net Worth ([currentyear]): Biography, Businesses & Cars 12 Tristan Tate Net Worth Featured Image](https://coinwire.com/wp-content/uploads/2023/07/tristan-tate-net-worth-featured-image-1024x683.jpeg)

![11 Best Crypto Exchanges in Australia (Updated in [currentmonth] [currentyear]) 15 Best Crypto Exchanges In Australia Featured Image](https://coinwire.com/wp-content/uploads/2023/06/best-crypto-exchanges-in-australia-featured-image-1-1024x683.jpg)