In the lead-up to the highly anticipated Bitcoin halving event, U.S. exchange-traded funds (ETFs) for Bitcoin experienced a notable turnaround, breaking a week-long streak of outflows. This shift in investor sentiment signals renewed interest and confidence in Bitcoin as an asset class, particularly as the market anticipates potential value appreciation post-halving.

Inflow Reversal Before Bitcoin Halving

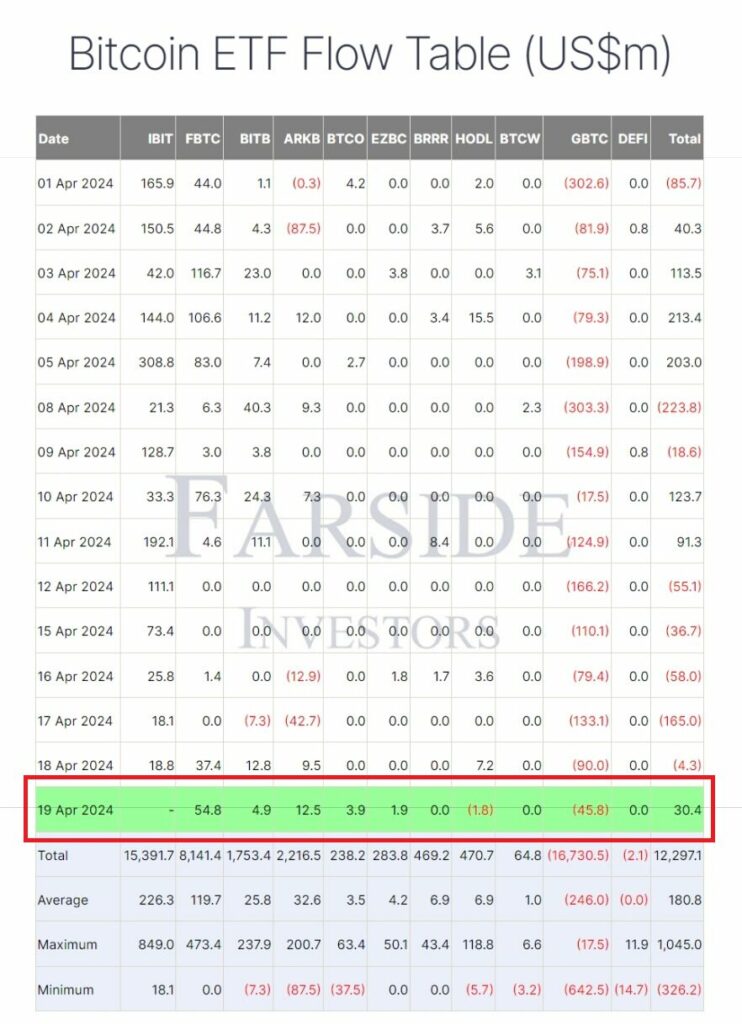

Following a recent trend of outflows, the U.S. Bitcoin ETF market saw a significant reversal on April 19, with five out of the 10 approved ETFs recording positive inflows. This influx of investments totaled $30.4 million, overshadowing the previous days’ drain primarily attributed to the Grayscale Bitcoin Trust ETF (GBTC).

During the outflow period from April 12 to 18, totaling $47.6 million, the market saw substantial contributions to the Fidelity Wise Origin Bitcoin Fund (FBTC), which brought in $54.8 million just before the halving. Notable inflows were also seen from Bitwise Bitcoin ETF (BITB), ARK 21Shares Bitcoin ETF (ARKB), Invesco Galaxy Bitcoin ETF (BTCO), and Franklin Bitcoin ETF (EZBC), indicating a broad-based resurgence in investor confidence.

Read more: Bitcoin Halving 2024: What’s Next for Bitcoin’s Price?

Implications of Bitcoin Halving on Market Dynamics

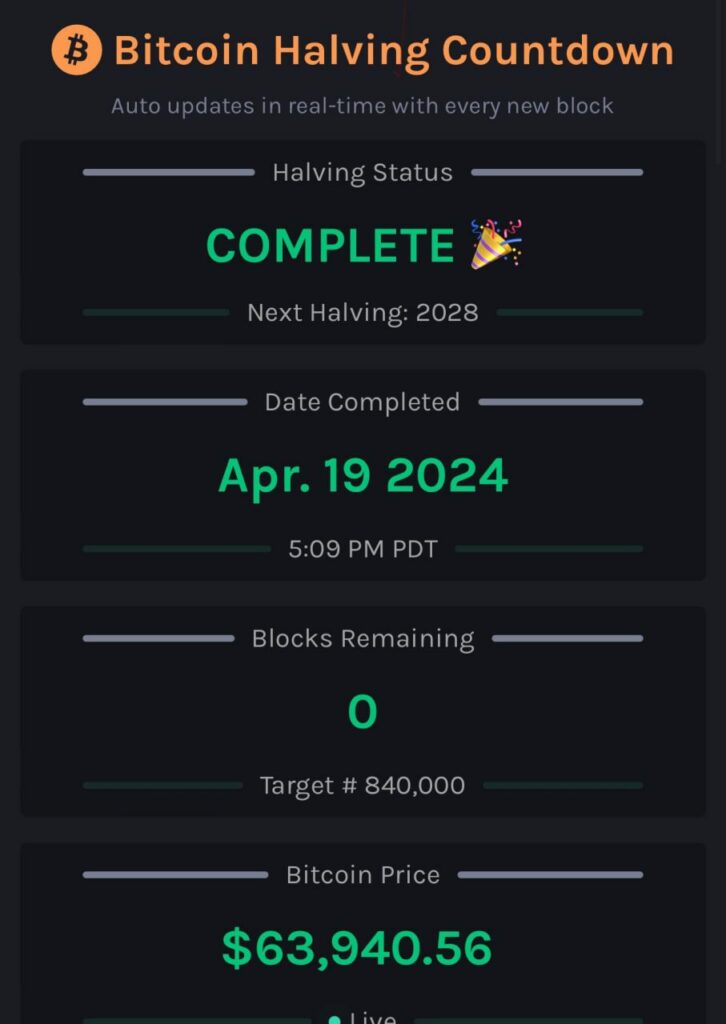

The Bitcoin halving event, occurring on April 20 at 12:09 am UTC with the block 840,000, sparked increased network activity and momentarily spiked transaction fees due to heightened demand. This milestone, which occurs roughly every four years, reduces the issuance rate of new Bitcoins, historically leading to an appreciation in its market value over time.

The previous Bitcoin halving in May 2020 saw the asset’s market value surge from approximately $8,500 to around $65,000 over the subsequent four years. This historical precedent likely contributed to the recent influx of investments in Bitcoin ETFs, as investors seek to capitalize on the potential value gains post-halving.

Read more: Buy Bitcoin with Apple Pay No Verification in 2024

Conclusion

The reversal of outflows and the surge in investments in Bitcoin ETFs ahead of the halving reflect growing confidence and strategic positioning among investors. As Bitcoin continues to demonstrate resilience and potential for appreciation, ETFs offer a regulated and accessible avenue for traditional investors to participate in the digital asset market. The ongoing evolution of ETF offerings and investor sentiment underscores the maturation and broader acceptance of Bitcoin as a viable investment asset.

![Pionex Review ([currentyear]): Trading Bots, Fees, and Pros & Cons 8 Pionex Review Featured Image](https://coinwire.com/wp-content/uploads/2023/08/pionex-review-featured-image-1024x683.jpg)

![Best Crypto Exchanges in UAE and Dubai to Buy Bitcoin ([currentyear]) 9 Best Crypto Exchanges In Uae And Dubai Featured Image](https://coinwire.com/wp-content/uploads/2024/01/best-crypto-exchanges-in-uae-and-dubai-featured-image-1024x683.jpg)

![Cardano vs Solana ([currentyear]): Is Cardano or Solana better? 10 Cardano Vs Solana Featured Image](https://coinwire.com/wp-content/uploads/2023/06/cardano-vs-solana-featured-image-1024x683.jpg)

![Paybis Review ([currentmonth] [currentyear]): Is It Safe and Legit? 11 Paybis Review Featured Image](https://coinwire.com/wp-content/uploads/2024/05/paybis-review-featured-image-1024x683.jpg)

![How to Buy Crypto Under 18 in [currentyear] with Minors 12 How To Buy Crypto Under 18 Featured Image](https://coinwire.com/wp-content/uploads/2023/10/how-to-buy-crypto-under-18-featured-image-1024x683.jpg)