Bitcoin has recently made headlines by surging to nearly $37,000 for the first time in 18 months, sparking excitement among investors. However, this rapid uptick has left traders feeling uneasy, with concerns arising about the sustainability of the price movement. Despite the cryptocurrency‘s push towards the $40,000 mark, market participants are questioning the legitimacy of this rally, citing declining trading volume as a cause for caution.

Suspicions Arise Amidst Declining Volume

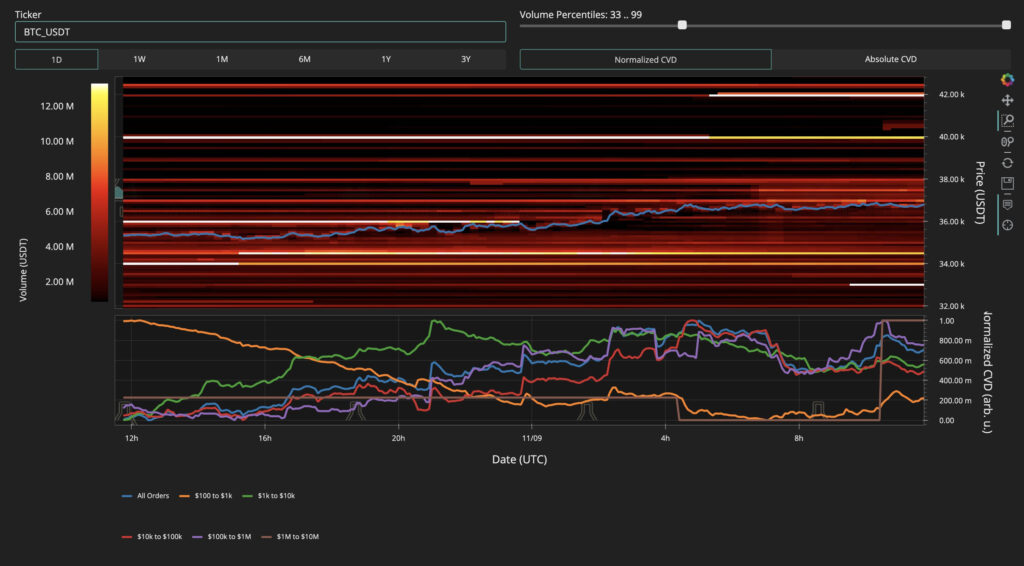

Traders are expressing skepticism as Bitcoin continues its upward trajectory, inching closer to the $40,000 milestone. While the price surge appears impressive, analysts are alarmed by the lack of substantial trading volume supporting the move. On-chain monitoring tools have highlighted the absence of strong volume at current levels, raising concerns about the authenticity of the rally. The apparent contradiction between price appreciation and declining volume has triggered warnings among market observers, prompting them to closely monitor the situation for any signs of a reversal.

Read more: Grayscale in Talks with SEC on Spot Bitcoin ETF Approval

Open Interest Hits Seven-Month High, Adding to the Mystery

Amidst the uncertainty surrounding Bitcoin’s price action, there has been a notable increase in open interest (OI) in the futures market. The total Bitcoin futures OI has exceeded $17 billion, marking the highest value since mid-April. Traditionally, rising OI has been associated with bullish momentum; however, traders are cautious this time, as the market seems to be reacting differently. The ongoing surge in OI, coupled with the skepticism among traders, has created a puzzling scenario, leaving experts and investors alike puzzled about the true nature of the current market dynamics.

Conclusion

Bitcoin’s recent surge to nearly $37,000 has left the crypto community both excited and wary. While the price rally has grabbed headlines, traders remain vigilant due to declining trading volume, raising doubts about the authenticity of the move. Additionally, the surge in open interest has added to the mystery, leaving experts closely monitoring the situation. As the market navigates these uncertain waters, investors are advised to exercise caution and stay vigilant, given the potential risks associated with the current market conditions.

Still without a trading account? Sign up today through our links below to enjoy exclusive trading fee discounts: Binance – MEXC

![Best Crypto Exchanges in Malaysia (Updated in [currentmonth] [currentyear]) 8 Best Crypto Exchanges In Malaysia Featured Image](https://coinwire.com/wp-content/uploads/2024/05/best-crypto-exchanges-in-malaysia-featured-image-1024x683.jpg)