The Ethereum network is experiencing a shakeup as concerns over diversity have led to a 5.2% drop in market share for Geth, a critical execution client. Community members fear that Geth’s concentrated use poses a significant risk to Ethereum’s decentralization, raising the specter of a potential “black swan event.” This drop in market share comes after worries were voiced regarding the vulnerability of the majority of Ethereum validators who have staked their Ether on the network.

Geth’s Dominance Raises Centralization Concerns

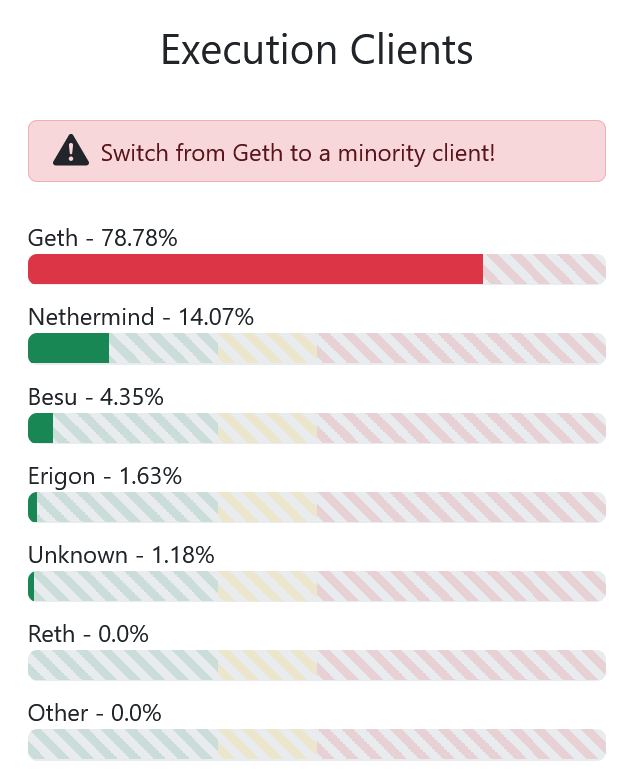

Geth, responsible for handling transactions and executing smart contracts on Ethereum, has become the execution client of choice for the majority of Ethereum validators. However, this preference has resulted in an alarming lack of diversity among execution clients, sparking concerns about centralization. On January 23, Geth’s market share fell from 84% to 78.8%, highlighting the need for a more balanced approach to prevent potential catastrophic scenarios.

Read more: SEC Delays Decision on Fidelity’s Ethereum ETF Amidst Coinbase Legal Battle

The Risk of Loss for Ethereum Validators

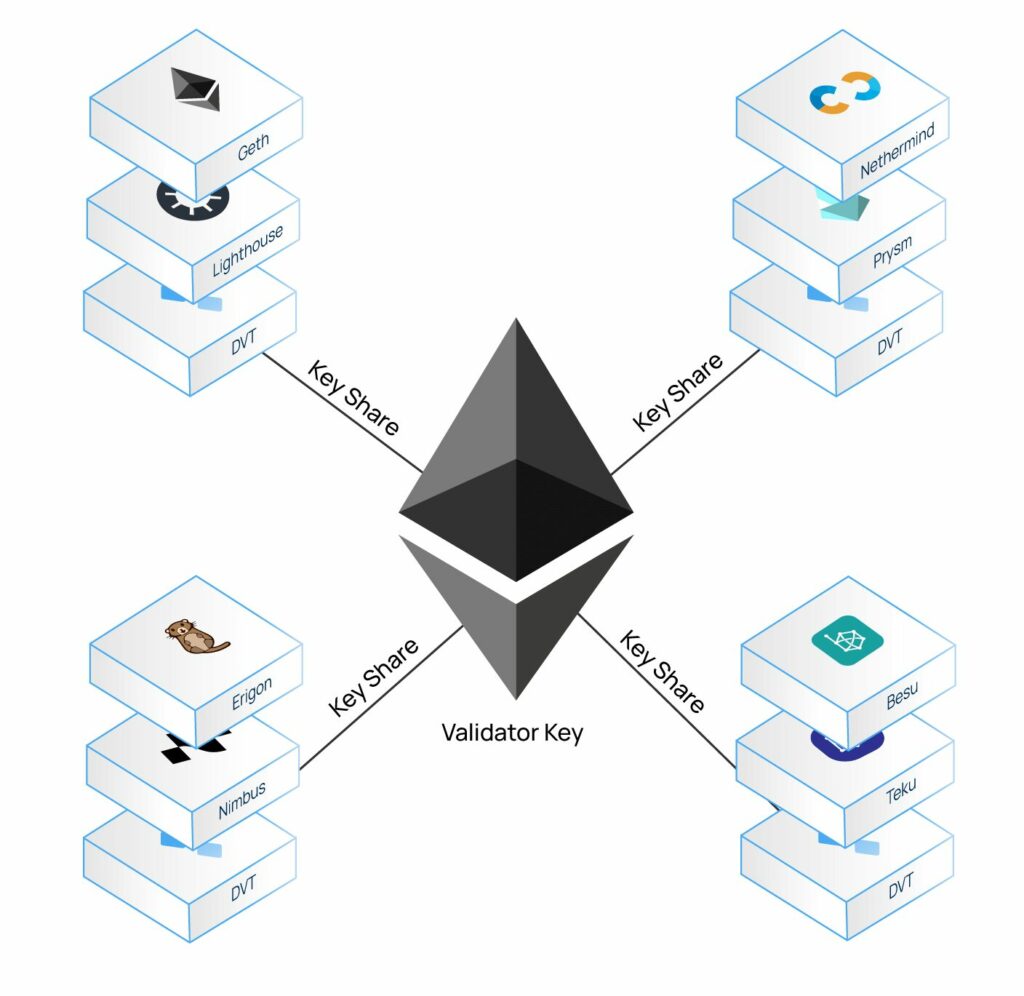

Lachlan Feeney, the founder and CEO of Ethereum infrastructure firm Labrys, warns that Ethereum validators face substantial risks by staking their Ether on a platform where Geth’s market share exceeds 66%. In the event of a critical bug, the chain could instantly stop finalizing, triggering an “inactivity leak.” Validators using Geth could potentially lose up to 90% of their staked Ether within approximately 40 days, posing a significant threat to their investments.

Read more: Best Place to Stake Ethereum (ETH) with Highest Rewards (2024)

Conclusion

Despite Geth’s historical dominance, Ethereum’s ecosystem is witnessing a shift as concerns over concentration and potential black swan events gain traction. Nethermind, the second-largest execution client, is gaining ground, highlighting the growing need for a more diversified approach. As major players like Coinbase announce plans to transition to a multi-client infrastructure, the Ethereum community is actively reevaluating its reliance on Geth to ensure the network’s robustness and long-term sustainability.

![Pionex Review ([currentyear]): Trading Bots, Fees, and Pros & Cons 8 Pionex Review Featured Image](https://coinwire.com/wp-content/uploads/2023/08/pionex-review-featured-image-1024x683.jpg)

![Best Crypto Exchanges in UAE and Dubai to Buy Bitcoin ([currentyear]) 9 Best Crypto Exchanges In Uae And Dubai Featured Image](https://coinwire.com/wp-content/uploads/2024/01/best-crypto-exchanges-in-uae-and-dubai-featured-image-1024x683.jpg)

![Cardano vs Solana ([currentyear]): Is Cardano or Solana better? 10 Cardano Vs Solana Featured Image](https://coinwire.com/wp-content/uploads/2023/06/cardano-vs-solana-featured-image-1024x683.jpg)

![Paybis Review ([currentmonth] [currentyear]): Is It Safe and Legit? 11 Paybis Review Featured Image](https://coinwire.com/wp-content/uploads/2024/05/paybis-review-featured-image-1024x683.jpg)

![How to Buy Crypto Under 18 in [currentyear] with Minors 12 How To Buy Crypto Under 18 Featured Image](https://coinwire.com/wp-content/uploads/2023/10/how-to-buy-crypto-under-18-featured-image-1024x683.jpg)