Amid today’s volatile economic climate, SureYield introduces a groundbreaking DeFi solution that harnesses artificial intelligence to navigate and capitalize on market trends. This pioneering platform fuses AI with decentralized finance through its Reinforcement Learning (RL) model, offering a robust ecosystem designed to optimize investor returns. In this overview, we’ll examine SureYield’s strategic architecture, its protective Insurance Vault, and the advanced AI that underpins the system’s intelligence.

Introduction

The DeFi space has been a breeding ground for innovation, with projects constantly pushing the boundaries of what is possible in decentralized finance. However, among these innovators, SureYield stands out with its unique AI-managed liquidity solutions. SureYield has positioned itself as a beacon of advancement, marrying the reliability of blockchain technology with the sharp acumen of artificial intelligence. This has resulted in a platform that not only offers attractive yields for investors but also mitigates the inherent risks associated with DeFi investments.

Architecture

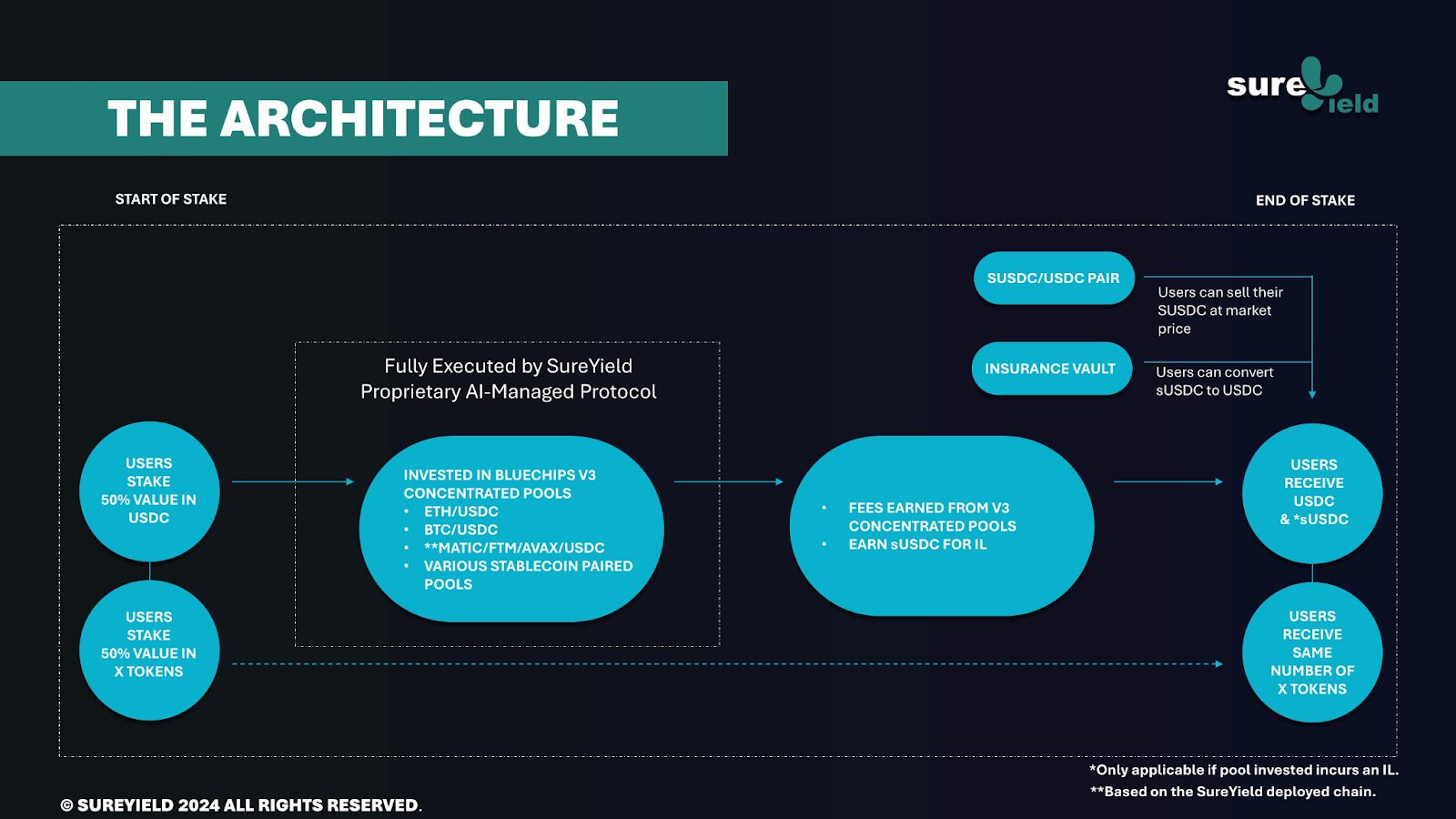

SureYield’s platform is structured to capitalize on the merging tides of AI and DeFi, constructing a sophisticated and multi-layered architecture that stands as a testament to modern financial engineering. Below, we dissect the intricacies of this architecture, revealing the mechanisms that drive its success.

Innovative Double Staking Mechanism

Balanced Asset Contribution:

- Investors contribute equal value portions of a stablecoin and a partner token, with USDC being the stablecoin of choice for its wide acceptance and stability.

- This 50-50 structure is designed to balance risk and return, offering a steady investment path in a typically volatile market.

Asset Allocation and Management:

- The USDC portion is dynamically channeled into concentrated liquidity positions within the reputable Uniswap V3 pools.

- The Partner token remains staked to access SureYield proprietary protocol and to provide secondary utility for partner token to yield additional returns.

- Liquidity is not static but managed actively, with the AI adjusting positions in Uniswap V3 pools to respond to market movements and liquidity demands.

Selection of Strategic V3 Pools:

- Targeting blue-chip pools with high-volume and potentially volatile pairs like ETH/USDC and BTC/USDC increases the potential for fee generation and security, a direct benefit for stakeholders.

Cyclical Staking Journey

Start of Stake:

Investors initiate their journey with a dual investment in USDC and a partner token, stepping into a realm of balanced DeFi engagement.

Active Management Phase:

- The USDC is set in motion by the AI, which meticulously orchestrates its placement into liquidity positions, harnessing the market’s vitality.

Accrual of Fees and Cover for Impermanent Loss:

- As the market ebbs and flows, the staked USDC accrues fees from trading activities, enhancing the investor’s yield.

- Concurrently, sUSDC tokens accumulate to offset any impermanent loss, ensuring the stake’s value remains intact.

End of Stake:

- The closure of the stake is as significant as its commencement, marked by the return of the initial partner tokens and the realized USDC gains.

- sUSDC tokens are provided as a hedge against impermanent loss, ready to be redeemed or traded, preserving the stake’s overall value.

Secure and Profitable Investor Experience

Security in Diversity:

By staking two asset types, investors enjoy a diversified portfolio within a single investment vehicle, reducing the risk associated with single-asset staking as only the USDC portion gets invested and the partner token remains staked

Profitability and Peace of Mind:

The architecture’s design ensures a hassle-free experience, promising profitability through AI management and security via sUSDC’s protection against impermanent loss.

Holistic Approach to Staking

User-Centric Design:

SureYield’s architecture is crafted with the user experience at its core, ensuring each phase of the stake is intuitive, transparent, and rewarding.

Fulfillment of the Staking Lifecycle:

From initiation to conclusion, the architecture ensures that every aspect of the staking journey adds value to the investor, culminating in a fulfilling and complete investment cycle.

Insurance Vault

A key feature of SureYield’s architecture is the Insurance Vault, an innovative mechanism that safeguards investors’ stakes against impermanent loss. Impermanent loss is a common concern in liquidity pools when the price of deposited assets changes compared to when they were deposited. SureYield’s Insurance Vault addresses this by setting aside 25% of all platform fees to fund compensation for affected investors. In the event of impermanent loss, there are two options that are available for investors.

Option 1: The platform issues sUSDC, which can be exchanged 1:1 for USDC from the Vault, thus preserving the value of the stake.

Option 2: Alternatively, investors have the option to trade sUSDC on an sUSDC/USDC pair, allowing investors who prefer immediate liquidity to sell their sUSDC at market price, albeit at a potential discount.

For SureYield, the Vault is more than a safety feature; it’s a statement of commitment to its investors, ensuring that their foray into DeFi is as secure as it is profitable.

| Feature | Description |

| Purpose | Protects against impermanent loss by compensating the stake’s value change. |

| Funding | Allocates 25% of platform fees to cover any impermanent losses. |

| Compensation Token | Issues sUSDC to represent covered losses, redeemable 1:1 for USDC from the Vault. |

| Risk Management | Proactively gathers resources to address impermanent loss before it impacts users. |

| Investor Flexibility | Provides options to redeem sUSDC or trade on the market for immediate liquidity. |

| Market Liquidity | sUSDC/USDC trading pair ensures liquidity for sUSDC, enhancing the platform’s robustness. |

| Investor Trust | By safeguarding against impermanent loss, it fosters confidence and long-term investment. |

| Platform Commitment | Demonstrates SureYield’s dedication to user success and platform reliability. |

AI

SureYield’s AI is not merely a component of their system; it is the core that drives their innovative approach in the DeFi space. This AI harnesses the advanced techniques of Reinforcement Learning (RL) to interact with the complex and dynamic markets of DeFi. We explore below the multifaceted layers of this AI and how it stands as a game-changer in liquidity management.

The Reinforcement Learning Paradigm

Dynamic Learning Mechanism:

Unlike static algorithms, SureYield’s AI evolves by continuously learning from the market environment, employing a sophisticated model that fine-tunes its strategies based on the outcomes of its actions.

Goal-Oriented Strategy:

The ultimate aim is clear — to maximize returns on liquidity positions. The AI’s role as an agent is to achieve this through a calculated series of actions, akin to a chess player thinking several moves ahead.

Real-Time Market Adaptation

Continuous Market Interaction:

SureYield’s AI engages with the market in a relentless loop of analysis, action, and adaptation, ensuring strategies are always aligned with the current market state.

Responsive to Market Conditions:

By assessing trading volumes, pair volatility, and liquidity depth, the AI navigates through market turbulence, extracting value even amidst fluctuations.

Optimization of Staking Positions

Strategic Asset Deployment:

The AI ensures that USDC allocations are not static. They are proactive, seeking the most advantageous positions within Uniswap V3 pools to accrue fees.

Hundreds of Daily Adjustments:

Flexibility is key in DeFi. SureYield’s AI performs potentially hundreds of liquidity position adjustments daily, responsive to market conditions to capture optimal yields.

Maximization of Investor Yields

Advanced Predictive Abilities:

Utilizing machine learning, the AI anticipates market trends, guiding liquidity strategies to capitalize on potential movements before they occur.

Risk Minimization:

An integral part of yield maximization is risk mitigation. The AI’s ability to foresee and adapt to market risks is crucial in protecting investor returns.

Technological Edge in DeFi

Unprecedented Dynamic Management:

The application of reinforcement learning in managing liquidity is groundbreaking, offering a level of dynamism that is transforming the expectations and capabilities within the DeFi sector.

Continual Evolution:

SureYield’s AI is not static; it embodies perpetual growth. As the market evolves, so does the AI, ensuring that the strategies employed are never outdated but always on the cutting edge.

Conclusion

SureYield’s AI-managed liquidity solutions represent a groundbreaking development in the DeFi space, where the potential for high yields is often counterbalanced by significant risks. Through its Double Staking architecture, protective Insurance Vault, and state-of-the-art AI, SureYield is not just participating in the DeFi space; it’s redefining it. It’s setting new benchmarks for what can be achieved when artificial intelligence is applied with precision to the decentralized economy, paving the way for a future where investors can approach DeFi with confidence, backed by the power of AI-driven strategies.

Official Links

Website: https://sureyield.com/

Gitbook: https://gitbook.sureyield.com/

Medium: https://sureyield.medium.com/

Twitter (X): https://twitter.com/SureYieldcom

Discord: https://discord.gg/SureYield

Disclaimer

Opinions stated on CoinWire.com do not constitute investment advice. Before making any high-risk investments in cryptocurrency, or digital assets, investors should conduct extensive research. Please be aware that any transfers and transactions are entirely at your own risk, and any losses you may experience are entirely your own. CoinWire.com does not encourage the purchase or sale of any cryptocurrencies or digital assets, and it is not an investment advisor. Please be aware that CoinWire.com engages in affiliate marketing.