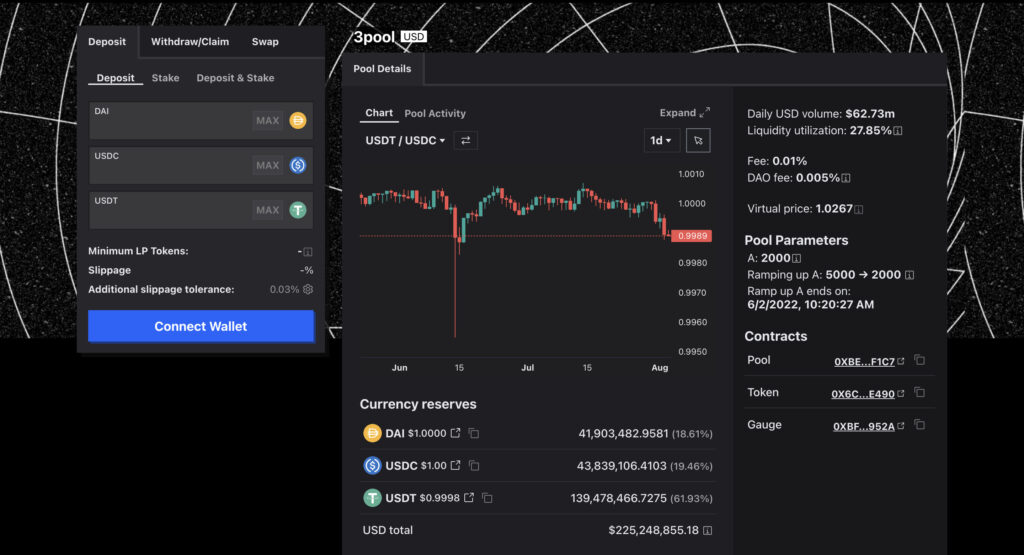

The cryptocurrency community witnessed an interesting development as traders dumped a substantial amount of USDT on Curve and UniSwap, causing the stablecoin to experience a slight depeg. On-chain data revealed that a significant number of users sold Tether’s USDT on the evening of August 3 within stablecoin pools on these platforms. The sudden surge in selling activities led to imbalances in the pools, with the data indicating a remarkable increase of over 60% in USDT within Curve’s 3pool. As a result, the price of USDT deviated slightly from its peg, reaching $0.9994 for a considerable period.

Tether’s USDT Faces Selling Pressure, While Competitor USDC Gains Attention

The situation garnered attention and raised eyebrows in the crypto space. Paolo Ardoino, the CTO of Tether, didn’t shy away from expressing his views. He suggested that USDT might be subject to manipulation, raising concerns about the involvement of Binance and its CEO, Changpeng Zhao (CZ).

In a sardonic tweet, Ardoino remarked that while USDT faced some pressure, its main competitor, USDC, stood to benefit from the situation by attracting more users. Additionally, a new contender, FDUSD, a stablecoin backed by Binance, emerged just two days ago and has already been garnering significant attention. However, Ardoino firmly stated that the situation is genuine and not manipulated.

Binance’s Involvement and the Rise of FDUSD

Binance, a leading cryptocurrency exchange in the space, listed First Digital USD (FDUSD) on its platform on July 26. The platform offered trading pairs FDUSD/BNB, FDUSD/USDT, and FDUSD/BUSD, with feeless maker trades for these pairs. However, shortly after the listing, a technical issue temporarily halted FDUSD trading. Despite the hiccup, Binance continued to make moves, recently listing Bitcoin and Ethereum pairs with FDUSD and introducing feeless trading for Bitcoin.

First Digital USD, the stablecoin in question, is issued on both the Ethereum and BNB Chain platforms by First Digital Labs, a Hong Kong-based company and part of the First Digital Group.

Conclusion

The recent events surrounding USDT on Curve and UniSwap have sparked discussions about the stability and competition within the stablecoin space. While Tether’s USDT experienced a temporary depeg, its main competitor, USDC, saw potential gains. Additionally, the emergence of FDUSD as a new competitor has added further intrigue to the situation. As the crypto landscape continues to evolve, it remains crucial for participants to monitor such developments and their potential impact on the broader market.

![Best Crypto Exchanges for Day Trading [currentyear] - Top 6 Platforms 9 Best Crypto Exchanges For Day Trading](https://coinwire.com/wp-content/uploads/2023/10/best-crypto-exchanges-for-day-trading-1024x683.jpg)

![MEXC Referral Code ([currentyear]): Steps to Earn $1000 Sign-Up Bonus 10 Best Mexc Global Referral Code (Mexc-Cwrefcode)](https://coinwire.com/wp-content/uploads/2023/09/best-mexc-global-referral-code-featured-image-1024x683.jpg)

![MEXC Review [currentyear]: How Safe & Legit is MEXC Global? 11 Mexc Review](https://coinwire.com/wp-content/uploads/2023/09/mexc-review-1024x683.png)

![13 Best No KYC Crypto Exchanges in [currentyear] (Buy Crypto No KYC) 12 Best No Kyc Crypto Exchanges](https://coinwire.com/wp-content/uploads/2022/11/best-no-kyc-crypto-exchanges-1024x683.png)