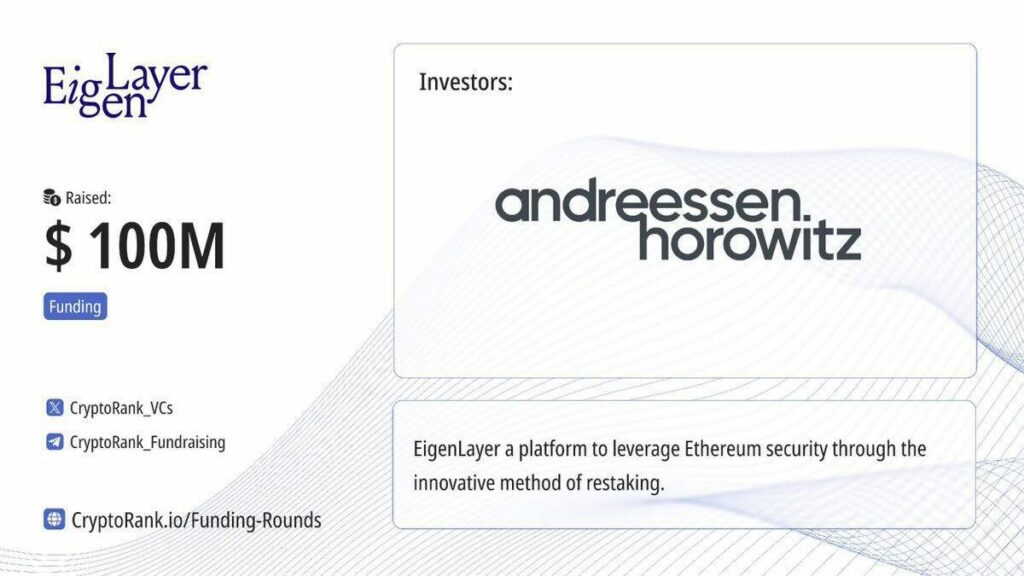

The venture capital firm Andreessen Horowitz (a16z) has announced a substantial $100 million funding round in EigenLayer, the largest restaking protocol on the Ethereum network by total value locked (TVL). This investment comes at a time when crypto-related venture capital funding has witnessed an uptick following the approval of spot Bitcoin exchange-traded funds (ETFs).

Venture Capital Influx in Crypto

Reportedly the sole investor in this funding round, a16z’s investment in EigenLayer follows the protocol’s earlier successful completion of a $50 million funding round in March, led by Blockchain Capital. According to a Bloomberg report on February 22, venture capital funding for crypto-related firms saw a notable 2.5% increase in the fourth quarter of 2023, reaching $1.9 billion. This marks the first rise in VC crypto investments since March 2022 and is attributed to the launch of the first spot Bitcoin ETFs in January.

Read more: Starknet Airdrop Attracts Airdrop Farmers Ahead of Token Launch

Unlocking New Possibilities with EigenLayer

Ali Yahya, general partner at Andreessen Horowitz, expressed optimism about the partnership with EigenLayer, highlighting its potential to usher in new applications. Yahya stated to Bloomberg, “It will enable all sorts of new kinds of applications to be built… People will stake capital in order to gain rewards from new services that get spun up on top of EigenLayer.” Founded in 2021, EigenLayer empowers validators and stakers to restake liquid staking derivative tokens, securing and validating other networks. The protocol’s TVL stands at an impressive $7.91 billion, making it the third-largest on Ethereum.

Read more: SEC Delays Decision on Fidelity’s Ethereum ETF Amidst Coinbase Legal Battle

Conclusion

EigenLayer’s recent surge in TVL, rising 4.30% in the last 24 hours and over 347% in the past month, underscores its growing prominence in the decentralized finance (DeFi) landscape. As the third-largest protocol on Ethereum, EigenLayer’s strategic partnership with a16z positions it for further innovation and development. The crypto community eagerly anticipates the potential applications and rewards that will emerge as a result of this substantial investment, solidifying EigenLayer’s role in shaping the future of decentralized finance.