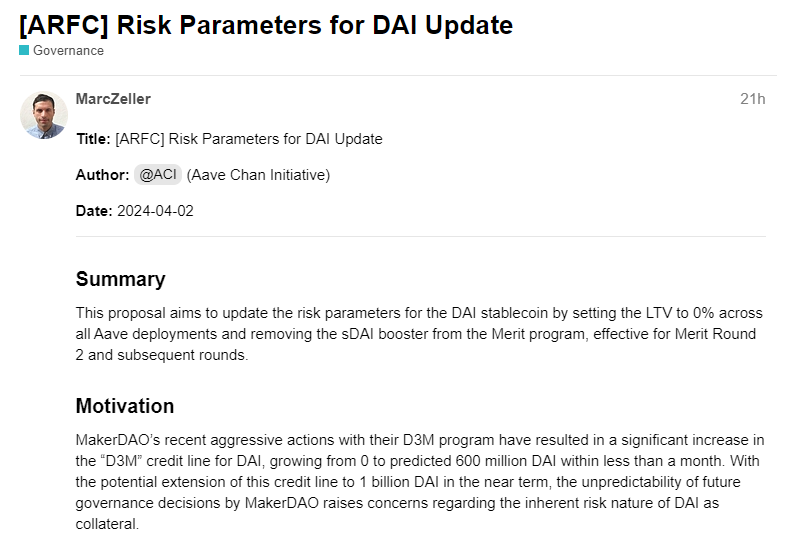

Aave, one of the prominent players in the DeFi space, has recently unveiled a strategic proposal aimed at addressing the risks associated with MakerDAO’s aggressive expansion of its stablecoin, DAI. With a focus on safeguarding users’ interests and minimizing disruptions, Aave’s proposal seeks to recalibrate risk parameters while providing alternative collateral options. Let’s delve into the details of this initiative and its implications for the DeFi ecosystem.

Mitigating Risks with Aave’s Proposal

Under the stewardship of the Aave Risk Framework Committee (ARFC), Aave has initiated a proposal targeting the adjustment of risk parameters concerning the DAI stablecoin. The proposal, advocated by the Aave Chan Initiative (ACI) team, advocates for reducing the loan-to-value ratio (LTV) of DAI to 0% across all Aave deployments. This strategic move aims to counteract the risks posed by MakerDAO’s rapid expansion of the DAI credit line, which has surged to an estimated 600 million DAI within a remarkably short span. By proactively addressing potential vulnerabilities, Aave endeavors to fortify the resilience of its ecosystem and uphold user confidence.

Read more: Exploring the Ethena Protocol: A Comprehensive Guide to Ethena Crypto

Transitioning Towards Sustainable Growth

Meanwhile, MakerDAO, the pioneering DeFi lending protocol, is gearing up for its transformative “Endgame” phase. Spearheaded by co-founder Rune Christensen, the Endgame initiative envisions steering the platform toward scalable resilience and sustainable user growth. Through a comprehensive five-phase plan, MakerDAO aims to elevate DAI’s market capitalization to unprecedented heights, rivaling established stablecoins like Tether’s USDT. The forthcoming phases include strategic rebranding efforts and token redenomination strategies aimed at fostering widespread adoption and ecosystem expansion.

Conclusion

As the DeFi landscape continues to evolve, strategic maneuvers and proactive initiatives are imperative to navigate the complexities and mitigate potential risks. Aave’s proposal to adjust risk parameters concerning the DAI stablecoin underscores its commitment to ensuring the stability and security of its ecosystem. Concurrently, MakerDAO’s ambitious Endgame transformation signals a pivotal phase in the evolution of decentralized finance, with a focus on scalability, resilience, and sustainable growth. By embracing innovation and collaboration, DeFi protocols can pave the way for a more robust and inclusive financial ecosystem.