In the dynamic world of decentralized finance (DeFi), Ethena Protocol stands out, offering a pioneering approach to digital currency. Led by Ethena Labs, this protocol is the force behind the USDe token, a synthetic dollar designed to revolutionize the DeFi space by providing a crypto-native, censorship-resistant stablecoin not dependent on traditional banking systems. It’s a premise that promises to unlock new potentials in yield, liquidity, and stability within the crypto ecosystem, making Ethena crypto a term worth watching.

As we delve into this comprehensive guide, we will explore the technology that powers Ethena, from its foundation on Ethereum to the innovative use of delta hedging to ensure peg stability of its synthetic dollar, USDe. You will uncover how Ethena crypto facilitates a globally accessible, yield-generating instrument known as ‘Internet Bond’, and how it compares to traditional stablecoins while paving the way for future developments within its ecosystem. This exploration is not just about understanding a digital asset but about recognizing how Ethena’s unique approach to synthetic, yield-generating assets can redefine your engagement with the DeFi and broader crypto landscape.

Ethena Protocol Explained

Ethena Protocol introduces a novel approach to the DeFi space, providing users with a unique blend of technologies and strategies aimed at maintaining stability and generating yield. Here’s a closer look at the core components and functionalities:

- Synthetic Dollar, USDe: Unlike traditional stablecoins, USDe is a synthetic dollar that employs a combination of delta-hedging and Ethereum (ETH) to maintain its peg to the USD. This innovative approach allows USDe to act as a censorship-resistant financial instrument within the Ethena ecosystem.

- Delta Hedging for Stability: Delta hedging, a strategy borrowed from traditional finance (TradFi), is at the heart of maintaining the USDe peg. By taking short positions in ETH or ETH-based derivatives, Ethena Protocol aims to offset potential losses due to ETH price volatility, ensuring the stability of USDe against the USD.

- Internet Bond: A unique financial instrument, the Internet Bond, is issued by Ethena Finance. It combines yields from derivatives markets and staked Ethereum, democratizing investment opportunities and redefining the concept of savings within the crypto space.

- Ethena Shards: As part of its Shard Campaign, Ethena encourages community involvement through the distribution of Ethena Shards. These shards, akin to points, are awarded to users for completing specific tasks within the ecosystem, fostering a sense of engagement and participation.

- ENA Token: The ENA token serves as the backbone of the protocol’s sustainable strategies, with its distribution encompassing core contributors, investors, the foundation, and ecosystem development initiatives. Token holders are eligible to claim their share of 750 million ENA tokens, representing 5% of the total supply, based on their accumulated shards. This approach incentivizes long-term participation and grants governance rights, staking opportunities, and rewards for active involvement in the Ethena ecosystem.

- Security Measures: Ethena Protocol prioritizes the safety and integrity of its platform by implementing robust security measures. These measures are designed to protect ENA token transactions, smart contracts, and user funds, ensuring a secure and trustworthy environment for participants.

- Scalability and Independence: Challenging traditional banking systems, Ethena offers a decentralized alternative that is scalable and secure. Its design aims to provide predictably higher returns than simple staked ETH, positioning itself as more independent from traditional finance (TradFi) compared to other stablecoins like Tether. This independence is further underscored by the doxxed and experienced team behind Ethena, highlighting the protocol’s commitment to transparency and reliability.

Ethena Protocol’s innovative approach, combining synthetic dollars with delta-hedging strategies and community-focused initiatives, marks a significant leap forward in the DeFi and crypto landscape. Its emphasis on security, scalability, and user engagement positions it as a promising player in the ongoing evolution of decentralized finance.

The Mechanism Behind Ethena

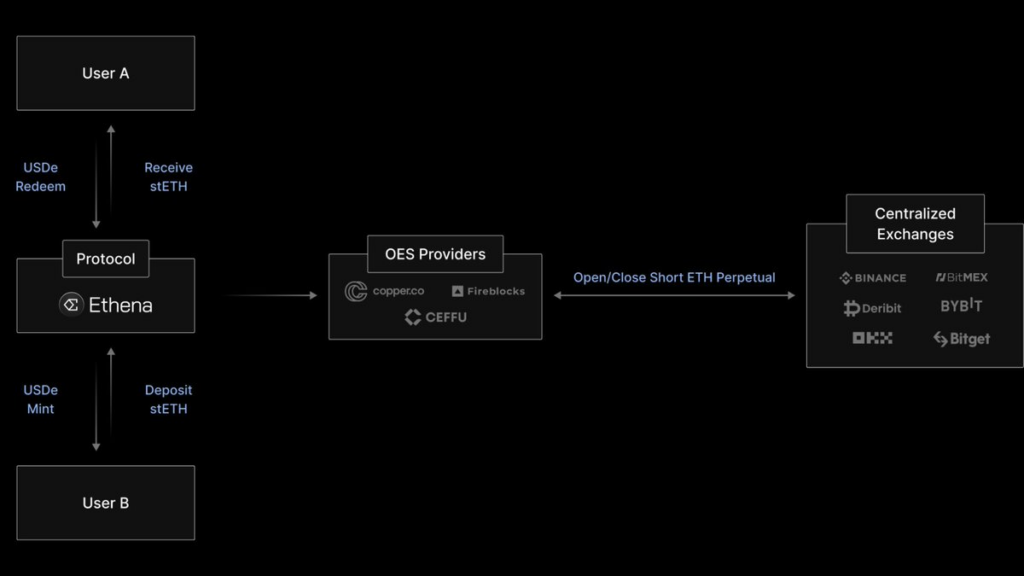

Diving into the technological backbone of the Ethena Protocol reveals a sophisticated blend of strategies and assets designed to maintain the USDe token’s stability and generate yields. Here’s a closer look at the core components:

- Backing Assets and Yield Generation:

- The USDe token is fully collateralized by ether (ETH) liquid staking tokens, providing a solid foundation for its value.

- Short ETH perpetual futures positions on derivatives exchanges are utilized to hedge against market volatility, ensuring the stability of the USDe’s dollar peg.

- This combination of backing assets not only supports the USDe’s value but also generates steady yields for investors, making it an attractive option for those looking to earn from their crypto holdings.

- Delta Hedging for Stability:

- Delta hedging plays a pivotal role in maintaining the USDe peg to the USD. This strategy involves taking short positions in ETH or ETH-based derivatives to offset potential ETH price declines, creating a delta-neutral position that stabilizes the USDe price.

- By employing this standard TradFi method, Ethena effectively mitigates the risk associated with ETH price fluctuations, ensuring the USDe remains a stable and reliable synthetic dollar.

- Innovative Financial Instruments:

- Ethena introduces the Internet Bond, a novel financial instrument that democratizes investment opportunities and redefines savings within the DeFi space.

- Combining yields from derivatives markets and staked Ethereum, the Internet Bond offers investors a unique way to participate in the crypto economy while earning returns.This approach not only broadens access to investment opportunities but also highlights Ethena’s commitment to innovation and user empowerment in the DeFi ecosystem.

Through these mechanisms, Ethena Protocol leverages Ethereum’s capabilities and the principles of decentralized finance to offer a scalable, stable, and censorship-resistant crypto-native solution for money. By backing the USDe token with liquid staked ETH and employing delta hedging strategies, Ethena ensures the stability of its synthetic dollar while generating attractive yields for investors, setting a new standard for stablecoins in the DeFi landscape.

Ethena’s Tokenomics

ENA Token Key Metrics

| Token Name | Ethena |

| Ticker | ENA |

| Blockchain | Ethereum |

| Token Type | Governance |

| Token Standard | ERC-20 |

| Total Supply | 15.000.000.000 ENA |

| Initial Supply | 1,425,000,000 ENA |

Ethena (ENA)’s Token Allocation

- Core Contributors: 30% of the tokens are allocated to the valued core contributors, including the Ethena Labs team and advisors who tirelessly contributed to the development of USDe.

- Ecosystem Development: 30% of tokens are dedicated to nurturing the ecosystem, with an initial 5% earmarked for an airdrop to Ethena users ahead of the Token launch. The remaining allocation will be overseen by DAO, earmarked for strategic programs and collaborations to propel the project’s growth

- Investors (25%): Allocated to investors supporting the development of the Ethena protocol, to launch the protocol and reserve funds to support the launch of Ethena.

- Foundation (15%): This allocation will be used for further initiatives to expand USDe’s reach.

Ethena (ENA) on Binance Launchpool Details

As of March 29, 2024, Binance Launchpool has officially announced the listing of the ENA token. Users can participate by staking BNB and FDUSD to earn ENA tokens, starting from March 30, 2024, at 00:00 (UTC) until April 1, 2024, at 00:00 (UTC).

The amount of ENA allocated to each pool is as follows:

- BNB pool: 240,000,000 ENA

- FDUSD pool: 60,000,000 ENA

ENA Farming Distribution:

| Dates | Total Daily Rewards (ENA) | BNB Pool Daily Rewards (ENA) | FDUSD Pool Daily Rewards (ENA) |

| 2024-03-30 to 2024-04-01 | 100,000,000 | 80,000,000 | 20,000,000 |

Starting from April 2, 2024, at 08:00 (UTC), users will have the opportunity to trade ENA on Binance across various pairs, including ENA/BTC, ENA/USDT, ENA/BNB, ENA/FDUSD, and ENA/TRY.

(Note: If you do not have a Binance account, you can register via CoinWire’code to gain -10% trading fee)

Join Binance Community Now for the Latest Updates

- https://www.binance.com/en/community

- https://bit.ly/BinanceVietnamTelegram (for Vietnamese community)

Team and Investors of Ethena

The Ethena development team comprises individuals with exceptional talent, expertise, and extensive experience in both traditional and crypto markets. Their professional background includes notable stints at renowned organizations like Goldman Sachs, Wintermute, Aave, Lido, Tradeparadigm, among others:

- Guy Young (Founder at Ethena Labs): With 6 years of experience investing for Cerberus Capital Management fund.

- Elliot Parker (Product Manager): Graduated with a Bachelor of Economics majoring in Accounting from The Australian National University. Experienced in the derivatives trading industry, worked as a director at Tradeparadigm and community manager at Deribit.

- Brian Grosso (Head of Full Stack Eng): With many years of experience working as a Software Engineer for many companies such as Capital One, BeamQL, Dottid.

- Amine Mounazil (Research Analyst): Master’s degree in Economics and experience in analyzing and researching products and markets at companies such as SUN ZU Lab, Kaiko, CoinShares France, CMA CGM, Synergie Media.

- Seraphim Czecker (Head of Growth): With experience in financial management, risk management and has worked for some big names in the industry such as Goldman Sachs, Euler Labs, Lido Finance.

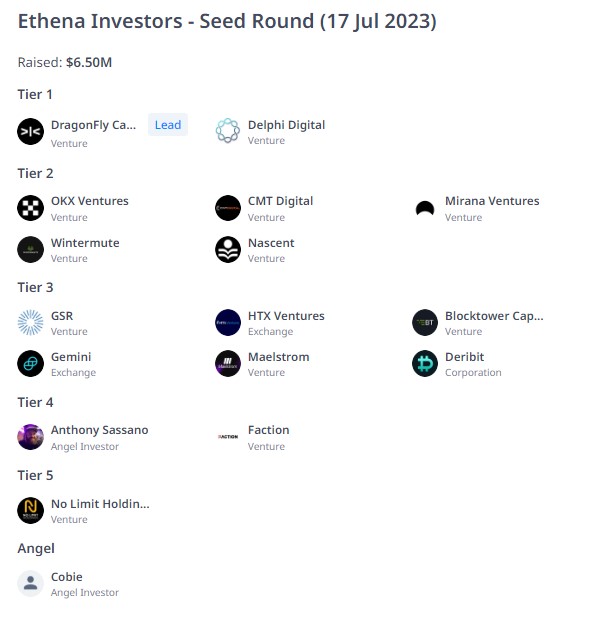

Ethena’s investor

As per the official announcement, the Ethena team has secured a remarkable $20.50 million across three funding rounds from prominent investment funds in the crypto market, including leaders such as DragonFly Capital, Binance Labs, Delphi Digital, and OKX Ventures

Comparing Ethena to Traditional Stablecoins

When comparing Ethena crypto to traditional stablecoins, several key distinctions emerge that highlight the innovative approach of Ethena Protocol. Let’s delve into these differences to understand why Ethena might be a game-changer in the world of stablecoins.

Centralization vs. Decentralization

- Traditional Stablecoins: Centralized control, such as USDC and USDT, often lacks transparency regarding offchain reserves, raising concerns about their actual backing.

- Ethena Crypto (USDe): Operates on a decentralized framework, aiming for high capital efficiency and stability without central control, making it a noteworthy contender in the stablecoin arena.

Yield Opportunities

- Traditional Stablecoins: Many, like Tether, do not provide yield opportunities for holders, limiting their utility beyond a medium of exchange.

- Ethena Crypto (USDe): Designed as a decentralized, yield-generating asset, offering users the potential for returns on their holdings, thereby enhancing its attractiveness as an investment.

Inflation Resistance and Interest Rate Dependence

- Traditional Stablecoins: Some DeFi stablecoins lack inherent resistance to inflation, and others, dependent on treasury bills, are vulnerable to fluctuating interest rates, impacting their stability and attractiveness.

- Ethena Crypto (USDe): By leveraging innovative strategies like delta hedging, Ethena aims to offer a stablecoin that is less susceptible to inflation and interest rate changes, providing a more reliable store of value.

Peg Stability and Scalability

- Issues with Peg Stability: Traditional stablecoins, including MKR’s MK USD and Terra’s UST, have faced challenges maintaining their peg, undermining trust and utility.

- Scalability Concerns: Overcollateralized options like SSD and LUSD struggle with scalability, limiting their growth potential.

- Ethena Crypto (USDe): With its focus on stability and capital efficiency, Ethena addresses these common pitfalls, aiming for a scalable and stable stablecoin solution.

Risk and Yield Distribution

- Traditional Stablecoins: Tend to externalize all the risk onto users while internalizing all the yield, creating a one-sided benefit structure.

- Ethena Crypto (USDe): Seeks to balance this equation by offering a decentralized platform where risks are mitigated, and yields are more equitably distributed among its users.

In summary, Ethena Protocol’s USDe presents a compelling alternative to traditional stablecoins by addressing key issues like centralization, lack of yield opportunities, inflation resistance, and scalability. Its innovative approach could redefine what users expect from stablecoins, making it a significant player in the DeFi landscape.

Future Developments and Roadmap

Ethena Protocol’s roadmap and future developments are shaping up to be a pivotal evolution in the DeFi space, with several key milestones and innovations on the horizon. Here’s a glance at what’s coming:

- Governance Token and Airdrop:

- April 2, 2024: Launch of Ethena’s governance token, ENA, a significant event that will further democratize the protocol’s decision-making process.

- Eligibility: Holders of the “synthetic dollar” USDe will be eligible for the ENA airdrop, enhancing the value proposition of holding USDe within the Ethena ecosystem. On the TGE, 50% of ENA tokens will be fully liquid, with the remaining 50% undergoing a 6-month vesting period, ensuring a balanced introduction of the token into the market.

- Expansion and Accessibility:

- March 11th, 2024: Ethena’s expansion onto Injective, a decentralized platform known for cross-chain derivatives trading and zero gas fees, marks a strategic move to enhance USDe’s accessibility and utility across the broader crypto ecosystem.

- Community Engagement: The Shard Campaign, concluding on April 1st, incentivizes user participation and engagement within the Ethena ecosystem, with an emphasis on maintaining USDe holdings to be eligible for the ENA airdrop.

- Investment and Collaboration:

- Funding Milestone: Over the past year, EthenaLabs, the entity behind Ethena Protocol, raised $20.5 million from notable investors like Galaxy Digital, OKX, Dragonfly, Binance Labs, and Bybit, showcasing strong market confidence in Ethena’s vision and technology.

- Strategic Investments: The protocol has attracted investments from prominent figures and institutions in the investment space, including Arthur Hayes and Dragonfly Capital, underscoring its potential to redefine the DeFi landscape.

These developments not only underscore Ethena Protocol’s commitment to innovation and community engagement but also highlight its strategic positioning for future growth and influence in the DeFi and broader crypto markets. With the introduction of its governance token, ENA, and expansion efforts like the launch on Injective, Ethena is poised to offer a more accessible, decentralized, and user-empowered platform, setting a new standard for stablecoins and synthetic assets in the digital economy.

Conclusion

Through this exploration of Ethena Protocol, we’ve delved deep into its foundational principles, strategic implementations, and potential impacts that signify its substantial role in redefining the decentralized finance and cryptocurrency landscapes. By juxtaposing Ethena with traditional stablecoins, we underscored its innovative approach—emphasizing decentralization, yield generation, and stability through delta hedging. This not only sets Ethena apart but also positions it as a frontrunner in offering a more scalable, stable, and community-empowered crypto-native solution, ready to meet the evolving demands of the DeFi ecosystem.

Looking ahead, Ethena Protocol’s roadmap showcases a promising future with key developments such as the launch of the ENA governance token and its expansion onto platforms like Injective, aiming to enhance accessibility and utility across the broader crypto market. These strategic moves, coupled with the protocol’s commitment to community engagement and innovation, herald a new era for stablecoins. As we witness Ethena’s continued growth and influence in the DeFi space, it’s clear that its journey is not just about presenting an alternative stablecoin but about pioneering a transformative approach for the digital economy.

FAQs

What exactly is Ethena cryptocurrency?

Ethena cryptocurrency is centered around its USDe token, commonly called a “synthetic dollar.” This token aims to provide consistent returns to its investors by utilizing liquid staking tokens based on ether (ETH), such as Lido’s stETH. These are used as collateral assets. To maintain a value close to $1, Ethena pairs these assets with an equivalent value of short ETH perpetual futures positions on derivative exchanges.

How do Ethereum and ether differ from each other?

Ethereum is a blockchain platform that serves as the foundation for a variety of applications, including smart contracts and decentralized apps. On the other hand, ether is the native cryptocurrency utilized within the Ethereum blockchain. For instance, if you want to buy a Non-Fungible Token (NFT) on the Ethereum platform, you would need to use ether to complete the transaction.

![What is Renzo: A Comprehensive Guide About REZ in [currentyear] 12 What Is Renzo Featured Image](https://coinwire.com/wp-content/uploads/2024/04/what-is-renzo-featured-image-1024x683.jpg)

![Bybit Review [currentyear]: Exchange Features, Fee, Pros and Cons 15 Bybit Featured Image](https://coinwire.com/wp-content/uploads/2022/06/Bybit-review-1024x683.png)