The cryptocurrency market is witnessing a continued downward trend as Bitcoin‘s price retreats from the $40,000 threshold, now trading at $39,700. Over the last 24 hours, BTC has seen a 5% decrease, mirroring similar declines in many altcoins. This article explores the factors behind the ongoing decline and the recent liquidation activities in the crypto market.

Grayscale Outflows Impact Bitcoin Prices

A significant driver of the current market downturn is the outflows from Grayscale‘s GBTC product, leading to substantial BTC sales. Recent developments reveal that approximately $1 billion worth of BTC has been sold by FTX’s bankruptcy management since GBTC transitioned into a spot ETF. Following the sell-off, Grayscale’s GBTC product now holds 563,000 BTC, down from 613,000 BTC before the spot ETF era. This trend has contributed to the overall bearish sentiment in the market.

Read more: Alameda Research Drops Lawsuit as GBTC Faces Outflows Post-Conversion

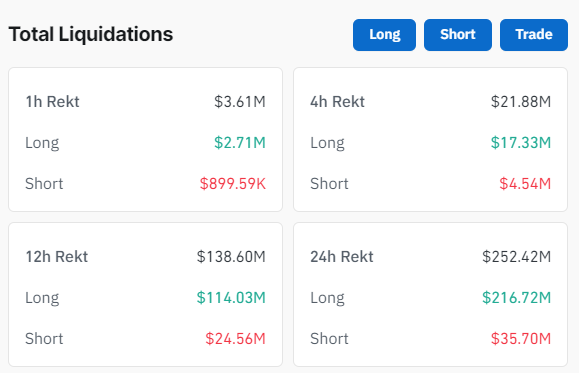

Liquidations Surge as Bitcoin Slides Below $40K

With the recent declines in cryptocurrency prices, a total of $65 million in liquidations occurred in the last hour. Of this amount, $63 million resulted from the liquidation of long positions, while $2 million came from short positions. Notably, $25 million of the liquidations in long positions affected Bitcoin, $12 million impacted Ethereum, and $4 million pertained to Solana. The market is experiencing heightened volatility, with liquidations adding to the selling pressure.

Conclusion

Bitcoin’s descent below $40,000, now down nearly 20% from post-ETF highs, indicates a challenging period for the cryptocurrency. Analysts, such as those at 10x Research, are eyeing the $38,000 level as a potential bottom. The market dynamics, driven by Grayscale outflows and liquidations, underscore the complexities facing the crypto space. As investors seek a bottom and navigate the evolving landscape, the coming weeks may provide insights into the market’s resilience and potential recovery paths.

![Pionex Review ([currentyear]): Trading Bots, Fees, and Pros & Cons 8 Pionex Review Featured Image](https://coinwire.com/wp-content/uploads/2023/08/pionex-review-featured-image-1024x683.jpg)

![Best Crypto Exchanges in UAE and Dubai to Buy Bitcoin ([currentyear]) 9 Best Crypto Exchanges In Uae And Dubai Featured Image](https://coinwire.com/wp-content/uploads/2024/01/best-crypto-exchanges-in-uae-and-dubai-featured-image-1024x683.jpg)

![Cardano vs Solana ([currentyear]): Is Cardano or Solana better? 10 Cardano Vs Solana Featured Image](https://coinwire.com/wp-content/uploads/2023/06/cardano-vs-solana-featured-image-1024x683.jpg)

![Paybis Review ([currentmonth] [currentyear]): Is It Safe and Legit? 11 Paybis Review Featured Image](https://coinwire.com/wp-content/uploads/2024/05/paybis-review-featured-image-1024x683.jpg)