Bitcoin miners have entered a selling spree, shedding more than 10,000 BTC in a single day, marking the largest daily decline in reserves in over a year. With Bitcoin trading around $42,677, the data reveals a significant shift in miner behavior as reserves reach their lowest levels since July 2021.

Miner Selling Peaks with Bitcoin Prices

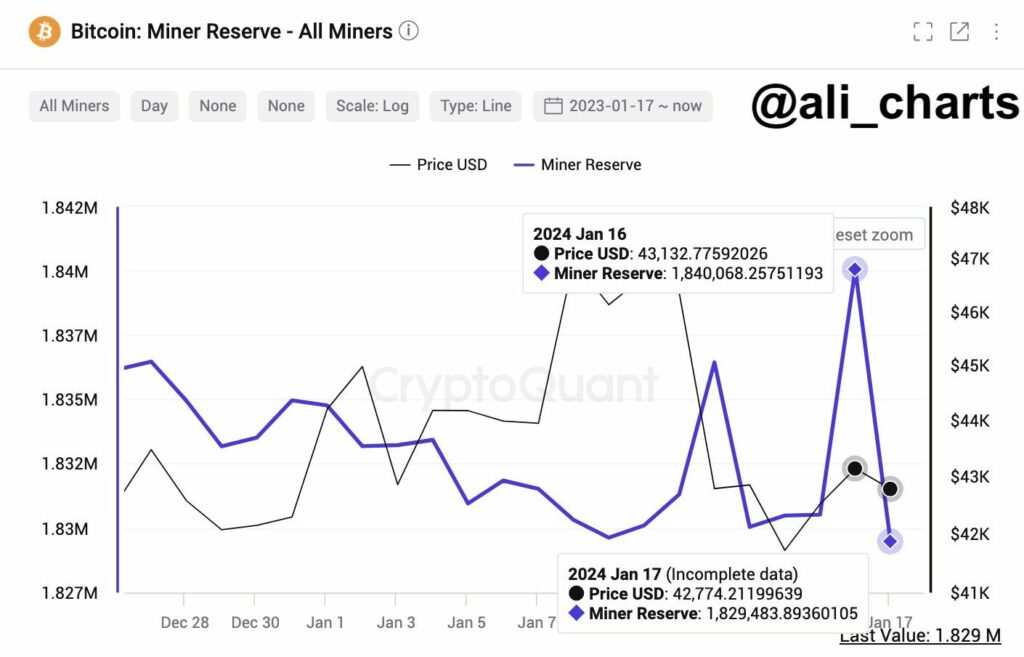

On January 17, Bitcoin miners collectively sold over 10,000 BTC, equivalent to approximately $450 million at current market prices. This drastic decline in reserves follows a historical pattern where miners move between phases of accumulation and selling. A 2023 Bitfinex report noted that miners had shifted to accumulating Bitcoin around mid-2023 during periods of lower prices and profitability. However, with recent price increases, miners have transitioned into a selling phase, a trend commonly observed to replenish cash flow or capture higher prices during market rallies.

Read more: What is Bitcoin ETF? How It Works and Where to Invest

Bitcoin Miner Reserves Plummet to Yearly Lows

The data from CryptoQuant highlights that Bitcoin miner reserves are currently at their lowest levels since July 2021, totaling 1.83 million coins. Despite the decrease, this remains a substantial reserve valued at approximately $78 billion. Over the past 12 months, miner reserves have seen a decline of 22,800 BTC, maintaining relative stability since early 2021. The Bitcoin Miners’ Position Index (MPI) started ticking up on January 15, indicating an imminent selling phase, as miners responded to market conditions and potential profitability.

Read more: MicroStrategy’s Soaring Stock: A 350% Surge Fueled by Bitcoin ETF Anticipation

Conclusion

As Bitcoin miners continue to navigate market dynamics, the recent sell-off of $450 million worth of BTC in a single day has drawn attention to the evolving landscape. The move aligns with historical patterns of miners adjusting their strategies based on price fluctuations and profitability. Additionally, with Bitcoin miner reserves hitting yearly lows, the industry is poised for potential shifts in market behavior. As Bitcoin’s value remains in the $42,000 to $43,000 range, monitoring miner activity will be crucial in understanding the broader dynamics influencing the cryptocurrency market.

![Pionex Review ([currentyear]): Trading Bots, Fees, and Pros & Cons 6 Pionex Review Featured Image](https://coinwire.com/wp-content/uploads/2023/08/pionex-review-featured-image-1024x683.jpg)

![Best Crypto Exchanges in UAE and Dubai to Buy Bitcoin ([currentyear]) 7 Best Crypto Exchanges In Uae And Dubai Featured Image](https://coinwire.com/wp-content/uploads/2024/01/best-crypto-exchanges-in-uae-and-dubai-featured-image-1024x683.jpg)

![Cardano vs Solana ([currentyear]): Is Cardano or Solana better? 8 Cardano Vs Solana Featured Image](https://coinwire.com/wp-content/uploads/2023/06/cardano-vs-solana-featured-image-1024x683.jpg)

![Paybis Review ([currentmonth] [currentyear]): Is It Safe and Legit? 9 Paybis Review Featured Image](https://coinwire.com/wp-content/uploads/2024/05/paybis-review-featured-image-1024x683.jpg)