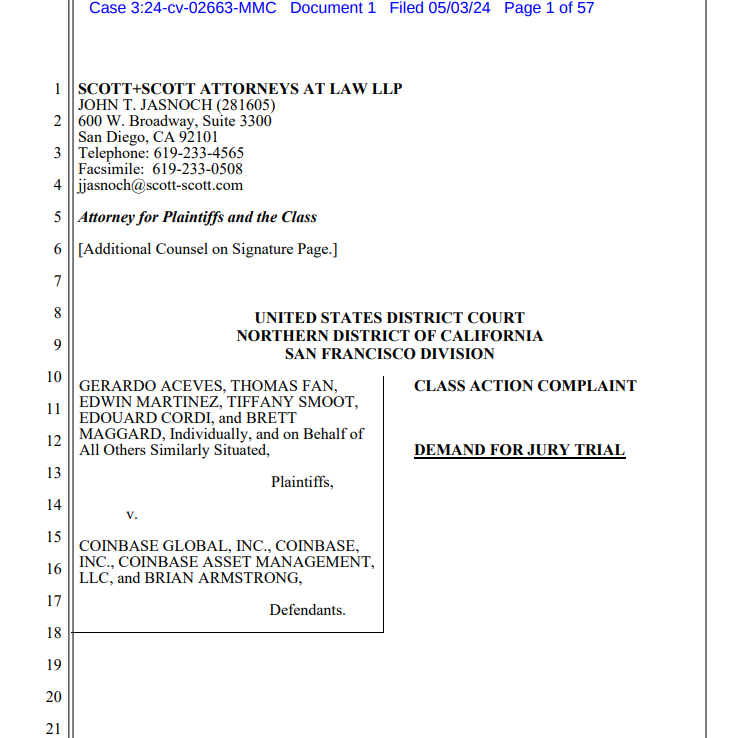

A new class-action lawsuit has been filed against Coinbase and its CEO, Brian Armstrong, accusing them of misleading investors into purchasing securities and operating an illegal business model. The lawsuit, brought in the United States District Court for the Northern District of California San Francisco Division, alleges that Coinbase’s digital asset sales have violated state securities laws since its inception. The plaintiffs claim that several tokens listed on Coinbase, including Solana (SOL), Polygon (MATIC), Near Protocol (NEAR), Decentraland (MANA), Algorand (ALGO), Uniswap (UNI), Tezos (XTZ), and Stellar Lumens (XLM), are considered securities.

Allegations Against Coinbase’s Business Model

The lawsuit contends that Coinbase knowingly violated state securities laws by selling digital assets that qualify as securities. The plaintiffs argue that Coinbase’s user agreement acknowledges it as a “Securities Broker,” indicating that the digital asset securities sold on the platform are investment contracts or other forms of securities. Additionally, the lawsuit points to Coinbase Prime as operating as a securities broker, further supporting the claim.

The plaintiffs seek various remedies, including full rescission, statutory damages under state law, and injunctive relief, all to be determined through a jury trial. This lawsuit mirrors previous legal actions alleging consumer harm resulting from Coinbase’s sale of securities. Coinbase has previously defended itself against claims that secondary crypto asset sales should be subject to securities regulations.

Read more: Polygon vs Solana: Which is the Better Blockchain in 2024?

Distinction from SEC Legal Battle

This new lawsuit is separate from Coinbase’s highly publicized legal dispute with the U.S. Securities and Exchange Commission (SEC), which also questions the classification of tokens sold on Coinbase as securities. Coinbase recently filed an interlocutory appeal following a judge’s decision to allow the SEC case to proceed.

In a related development, John Deaton, a prominent crypto lawyer currently running for a Senate seat, filed an amicus brief supporting a motion for interlocutory appeal on behalf of thousands of Coinbase customers. This underscores the broader legal challenges facing Coinbase and the crypto industry as regulatory scrutiny intensifies.

Conclusion

Despite legal challenges, Coinbase reported robust performance in the first quarter of 2024, driven by strong market dynamics and the launch of spot Bitcoin exchange-traded funds. The company’s financial results revealed significant revenue and earnings growth, underscoring its resilience amid regulatory uncertainties and legal battles. The outcome of these lawsuits will likely have far-reaching implications for Coinbase and the broader crypto ecosystem, shaping the future regulatory landscape for digital assets.