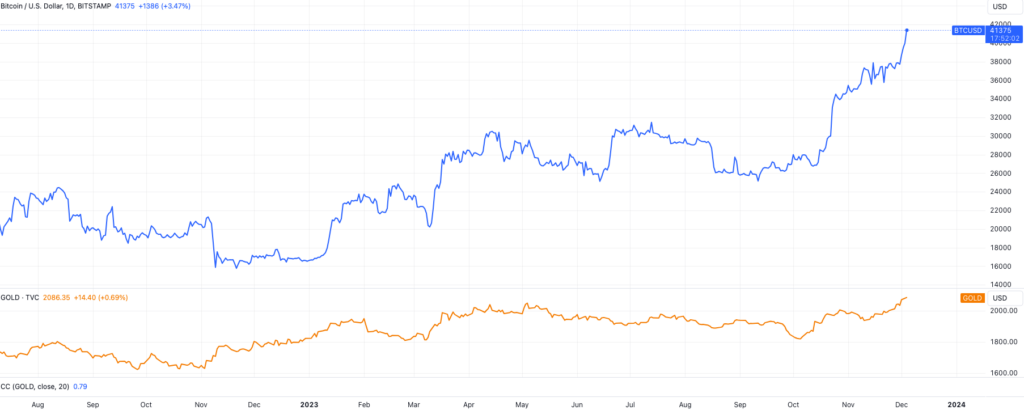

Both Bitcoin and gold are making waves in the financial markets, signaling a potential shift in investor sentiment. As the price of gold smashes through a new all-time high, surpassing $2,100 during the Asian session on December 4, Bitcoin is not lagging behind. BTC has broken the $41,000 barrier for the first time in 19 months, marking a triumphant return to levels unseen since the peaks of April 2022. This simultaneous surge in both assets hints at growing anticipation among investors, possibly in preparation for impending stock market turbulence.

Bitcoin’s Meteoric Rise and Projections for 2024

Bitcoin’s resurgence to the $40,000 threshold is nothing short of spectacular, with a swift 2% surge over a 24-hour period. This surge also signifies a remarkable 19-month peak for the cryptocurrency. Impressively, Bitcoin has recorded a staggering 140% increase since the beginning of the year. According to Markus Thielen, the head of research at Matrixport, historical patterns of post-bear market bull cycles and upcoming Bitcoin halving events suggest an even brighter future. Projections place Bitcoin at over $60,000 by April next year and potentially soaring to $125,000 by the end of 2024, riding on an expected surge of over 200%.

Read more: Bitcoin Surges Toward $40K with Short Liquidations, Reigniting Bullish Momentum

Anticipation Builds for a Bitcoin Spot ETF

Fueling the speculative flames is the potential approval of a spot Bitcoin exchange-traded fund (ETF) in the United States. With 13 bidders in the race, including industry giants such as BlackRock and Grayscale, all eyes are on the decision anticipated from the Securities and Exchange Commission (SEC). Bloomberg’s ETF analysts predict a high probability of simultaneous approvals for all pending bids by January 10. If this materializes, it could mark a new era of institutional participation and investment in Bitcoin, potentially acting as a catalyst for further price appreciation.

Conclusion

Bitcoin’s recent surge past the psychological $40,000 level is indicative of a bullish market sentiment. The concurrent rise with gold, coupled with the prospect of a spot Bitcoin ETF approval in January, has injected optimism into the cryptocurrency space. As regulatory advancements unfold and Bitcoin’s halving event looms, the next five months could see additional tailwinds propelling BTC to new heights. Investors are eagerly watching the evolving landscape, anticipating what could be a defining period for both Bitcoin and the broader cryptocurrency market.

![Pionex Review ([currentyear]): Trading Bots, Fees, and Pros & Cons 8 Pionex Review Featured Image](https://coinwire.com/wp-content/uploads/2023/08/pionex-review-featured-image-1024x683.jpg)

![Best Crypto Exchanges in UAE and Dubai to Buy Bitcoin ([currentyear]) 9 Best Crypto Exchanges In Uae And Dubai Featured Image](https://coinwire.com/wp-content/uploads/2024/01/best-crypto-exchanges-in-uae-and-dubai-featured-image-1024x683.jpg)