Pros

- Cheap and competitive trading fees

- Easy to use with a fast learning curve

- Advanced and highly rated mobile platform

- Nice variety of solid cryptocurrencies

Cons

- Some major cryptocurrencies, like Solana and Polkadot, are not available

- Not available to United States investors

- Charges a 15% commission from users’ stake rewards

- Doesn’t offer margin trading or lending features

Is Bitstamp the right cryptocurrency exchange for you? In this Bitstamp review, we’ll compare it to other exchanges and help you decide if it’s the right platform for your needs. We’ll also cover how to use Bitstamp, fees, security, and more.

What is Bitstamp?

Bitstamp exchange was founded in 2011 by Damian Merlak and has been running since then. The cryptocurrency exchange was initially based in the United Kingdom but later relocated to Luxembourg in 2016.

The exchange can be accessed by traders from most parts of the world, including Europe and Africa. Due to the stringent compliance rules of the US SEC, Bitstamp is not available to U.S. citizens. They have a separate US-based organization for U.S. citizens.

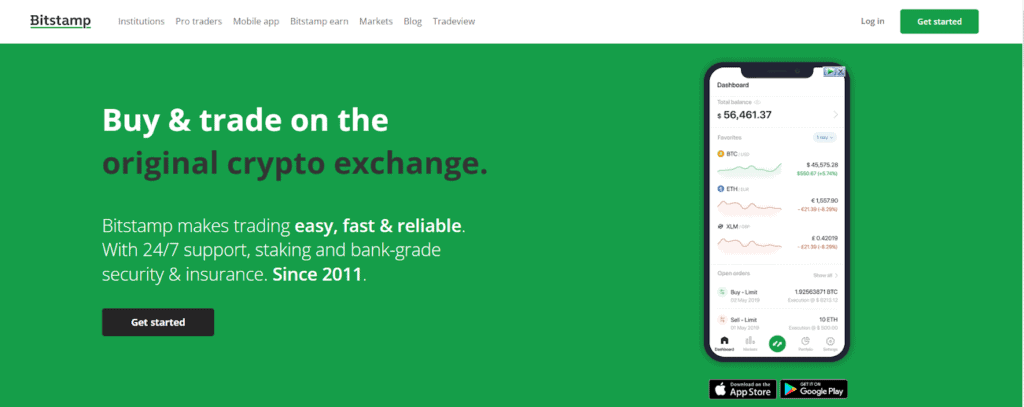

The platform can be accessed on both Windows and macOS. Additionally, they have dedicated applications for both Android and iOS on Google Play and the Apple Store, respectively. The platform offers speed and security to its customers, ensuring that they store the assets of their customers offline. With the ease of trading, even the greenest person in crypto can quickly learn how to use the exchange.

They boast the longest uptime of all of the current crypto exchanges. Bitstamp was created to provide competition to Mt. Gox, which was the most dominant exchange in Europe in 2011.

Trading Options and Order Types

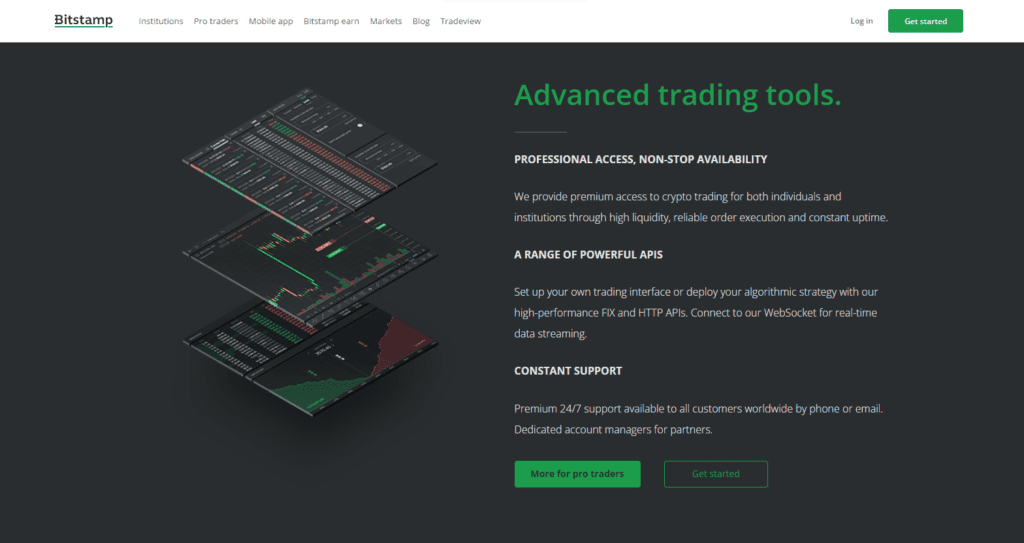

Trading Options

Spot Trading

Bitstamp only provides spot trading, which is also the default option for many crypto exchanges. The spot trading option allows traders to use the different order types mentioned previously to make successful trades. Spot trading also offers a trading chart for traders to analyze their trades before placing their orders.

Order Types

Bitstamp allows traders to convert their fiat to crypto in order to have more freedom on the blockchain. The platform has several order types that traders can use to get optimal use of the platform. The order types on Bitstamp include; Instant order, market order, limit order, stop order and trailing stop order.

Instant Order

The instant order type allows users to open and close trades in the shortest time possible. For example, if you want to buy Bitcoins worth $100 quickly, the order will locate sellers in the order book and settle your trade in the shortest time possible. It does not matter how much Bitcoin they have. The order will continue to wipe the sell orders from these sellers until your $100 bitcoin buy order is 100% filled.

Instant order is the most common type of order used by the majority of traders on most occasions. Additionally, users can set and specify the price at which they want to spend.

Market Order

A market order allows the traders to buy or sell their preferred cryptocurrency at the current market price. The market order type lets the trader set the amount of cryptocurrency they want to spend. For this option, the user is just interested in buying a certain amount of crypto, say 10 ETH. Whatever amount they have to pay to get it is not a priority. This option is best if you are in a hurry to cash out.

Limit Order

A limit order is also popular among traders who want to spend their crypto but are not in a hurry to do so. This type of order gives the user a lot of control over how much they spend. For example, you might want 1 BTC but only be willing to pay $19,000 for it. You can set your limit order at $19,000, and your order will be filled when the price of BTC falls below that point.

Stop Order

The stop order is designed to help traders cut losses and take profits. A stop order will help save your trade if you expect the markets to turn and suspect you might not be near your computer or phone. For instance, if you wanted to sell 10 bitcoins if the price fell below $19,000, you would put a stop order at that price. This will cut your losses and prevent you from incurring further losses.

On the other hand, the stop order can also be used if you expect your trade to hit a specific price in profit and you would like to lock in your profits.

Trailing Stop Order

A trailing stop order is a type of stop order. The uniqueness of this order type is that it can trace the asset’s price in whichever direction it is headed. Hence, if you place a stop-sell BTC order at $20,000 and it drops to $18,000, your trailing stop loss will trace after the price at the same distance and will execute if the price attempts to reverse, locking your profits.

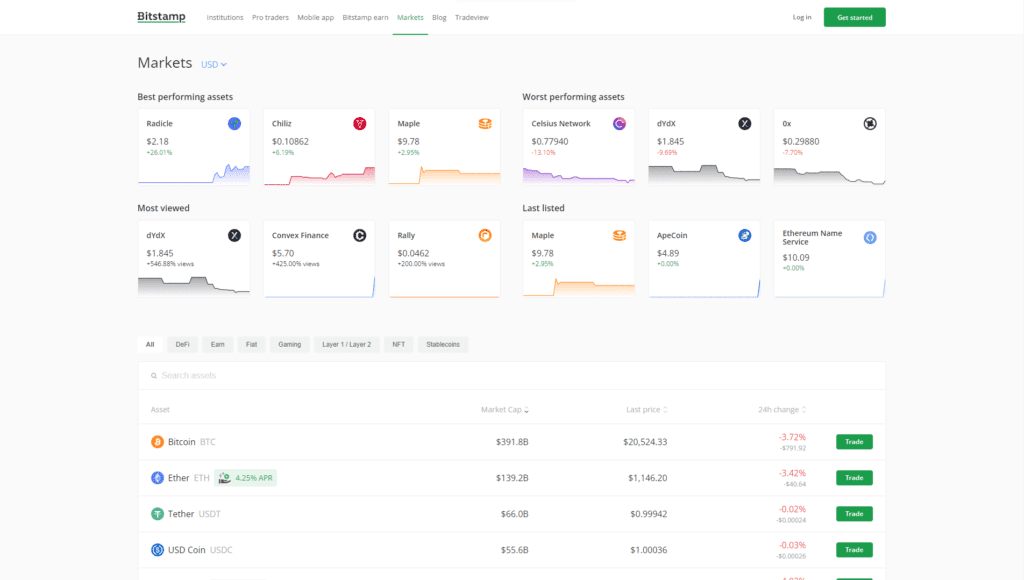

Currencies & Payment Methods

Bitstamp supports over 75 cryptocurrencies. Traders on Bitstamp can deposit funds using several different methods, including cryptocurrencies, bank transfers, IOUs, or an auto-convert feature that converts your Algorand and Ethereum staging rewards into BTC. Some of the major crypto assets on Bitstamp include:

- Bitcoin (BCH)

- Ethereum (ETH)

- Algorand (ALGO)

- Litecoin (LTC)

- Cardano (ADA)

- Chainlink (LINK)

- Uniswap (UNI)

- Dogecoin (DOGE)

- Avalanche (AVAX)

Bitstamp allows users to purchase cryptocurrencies using several options, including USD, EUR, GBP, BTC, and ETH. However, some assets like Bitcoin and Ethereum have many more options available to use as payment options.

Fees

Bitstamp charges very competitive fees compared to other cryptocurrency exchanges. The platform has a fee structure for different modes of deposit and also for different levels of investors.

For investors, the fees are reduced with an increase in the investment amount. Investors who deposit $10,000 or less will trade with 0.50% fees. Traders with $20,000 or less will incur 0.25% fees on their trades. This fee drops as the level of investment increases. The lowest is 0% for investors with $20,000,000,000 or more.

Depositing using SEPA will cost you nothing while withdrawing through the same channel incurs a 3.00 EUR fee. Any purchase made with a card automatically has a 5% fee. International wire transfers cost 0.05% for deposits and 0.1% for withdrawals.

All crypto deposits are free of charge, but withdrawals incur different fees depending on which crypto you will be withdrawing.

Additionally, if your Bitstamp account is inactive, your account will be charged 10 EUR per month starting August 2022.

Limits

Trading on Bitstamp has a few limitations. First of all, all traders must verify their accounts before making any deposits or trades. Verification includes phone, email, and face verification. Moreover, the minimum order size for opening trades on Bitstamp is 10 EUR/GBP/PAX/USD/USDC/USDT for EUR/GBP/PAX/USD/USDC/USDT-denominated trading pairs.

However, for BTC-denominated pairs, users can open trades with as little as 0.0002 BTC. Additionally, for ETH-denominated pairs, users can open trades if they have 0.002 ETH or more.

Security

Bitstamp is very keen on the security of its users. In February 2014, the exchange suspended withdrawals after suffering a DDOS attack. Furthermore, in January 2015, the platform was hacked, and 19,000 BTC were stolen.

Following these incidents, Bitstamp took drastic measures to make sure users’ funds are safe. 98% of users’ assets are stored offline in cold wallets. This means hackers cannot get their hands on them. The platform also implements high encryption of personal data to prevent leaks. Furthermore, you can now whitelist addresses and transactions to prevent anyone without proper authorization from making transactions.

Customer Service

Bitstamp has several email addresses that users can use to ask questions or make complaints. Also, users in the United Kingdom, the United States, and Luxembourg can always call customer service. Bitstamp also has a detailed FAQ page and a blog that answers most of the questions and problems that users might have while using the platform.

Bitstamp has previously received between 3 and 4 stars in different reviews across the internet, with mixed feedback from current and past users. Most complaints mainly touch on slow withdrawal and poor customer service interaction.

Alternative Exchanges

Bitstamp has some serious competition from across the cryptocurrency exchange space. Here are some of the exchanges that Bitstamp has to compete with:

Binance

Binance is the most popular exchange in the world in terms of volume and number of users. On Twitter alone, Binance has over 9 million followers. Compared to Bitstamp’s 490,000 followers, the platform has some mileage to cover.

Additionally, Binance offers margin, lending, and futures trading on their platform, which attracts many users. What is more, Binance has a wide range of staking options. In contrast, Bitstamo only offers staking options for ETH and ALGO.

Huobi

Huobi is the 6th largest exchange in the world in terms of volume. On a daily basis, the exchange processes over $950 million worth of trades daily on average. The platform offers perpetual crypto futures and leveraged ETFs.

In comparison, Bitstamp has only $165 million worth of trades daily on average. The platform is the 34th largest exchange in the world and has around 1.35 million visitors per month. Exchanges with more products have more visitors and rake in more revenue compared to those that have limited amounts of coins and trading options.

How to Open an Account

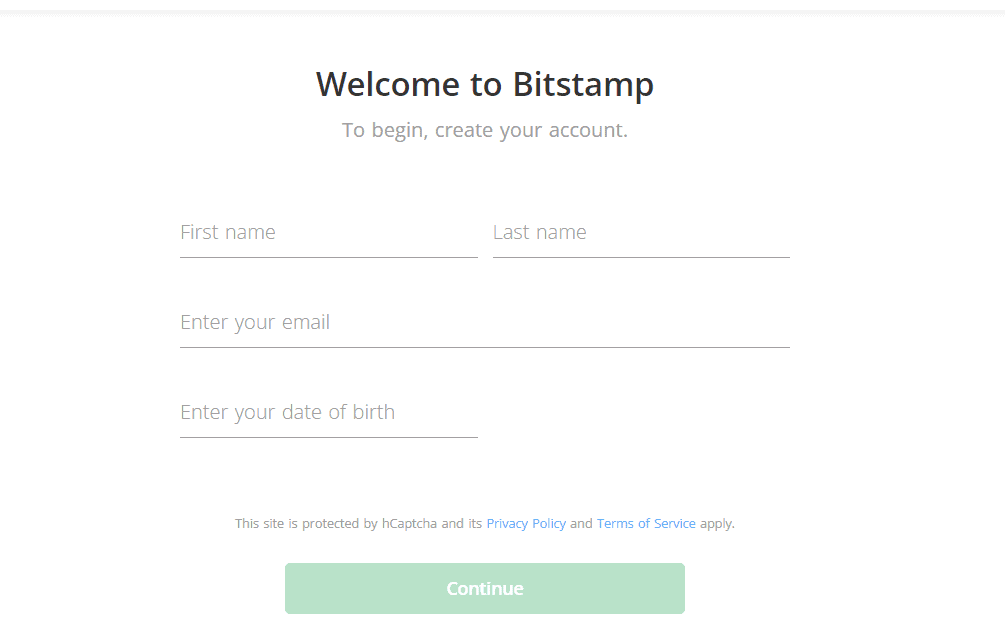

Opening an account on Bitstamp is simple and straightforward:

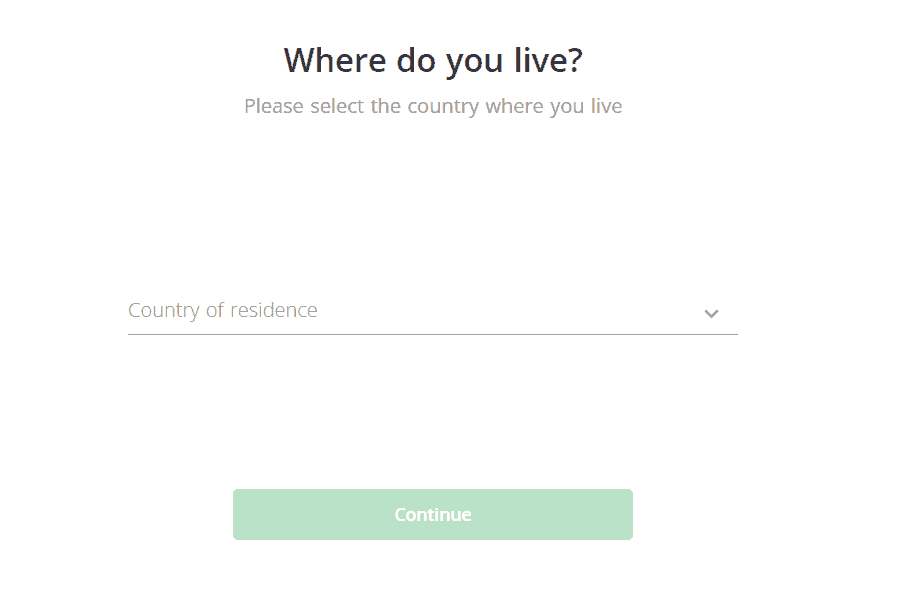

- Step 1: Go to the Bitstamp website and click on Get Started.

- Step 2: Fill in your personal details, including email and date of birth, and click on Continue.

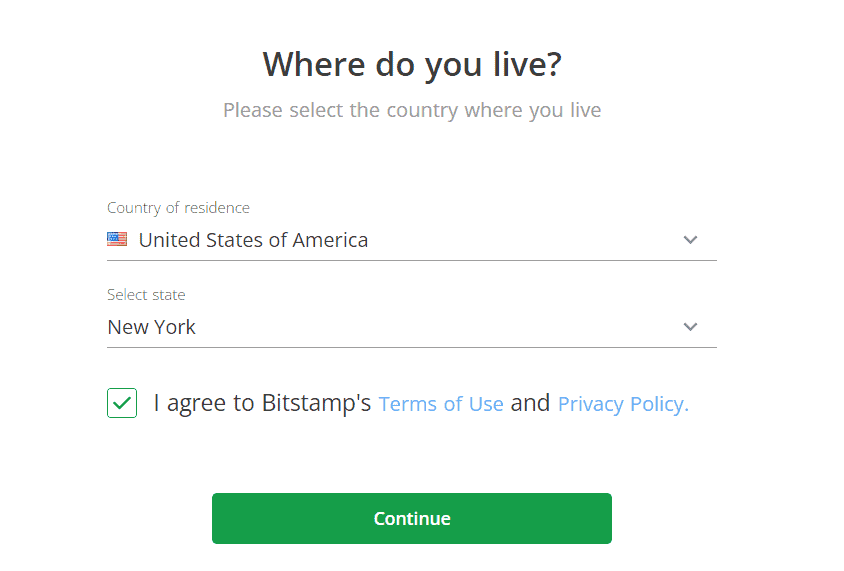

- Step 3: Choose the United States as your country of residence and select your State.

- Step 4: Review the terms and conditions of Bitstamp’s services and then click on Continue.

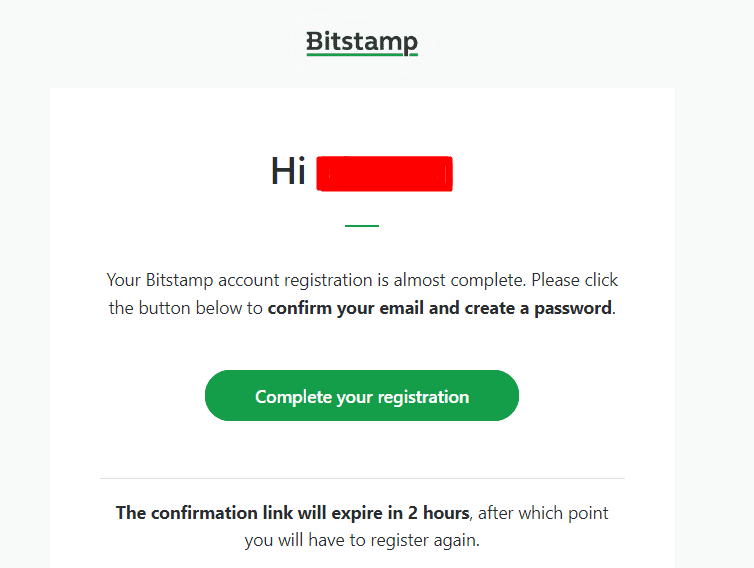

- Step 5: Confirm your email by clicking on the Confirmation link sent to your email inbox from Bitstamp.

- Step 6: Complete the verification process in order to deposit and begin trading.

FAQ

Is Bitstamp Safe and Legit?

Bitstamp has suffered two hacks in a span of over ten years. Despite these hacks, the platform has managed to survive. Bitstamp is safe and legit to use. It is the 34th largest crypto exchange worldwide and has over $160 million in daily transaction volume.

Is Bitstamp Available in the USA?

Bitstamp is not available in the USA. However, the company has a separate branch called Bitstamp USA that can operate in the virtual currency business in New York. American users can deposit on Bitstamp US using the ACH deposit route.

Who Should Use Bitstamp?

Users located outside the USA can use Bitstamp without any problems. However, those in the USA can use a separate platform called Bitstamp USA. Bitstamp is a very secure site so if you value security and safety then this should be your exchange of choice.

However, if you are looking to perform perpetual and margin trading this won’t be an ideal exchange for you as Bitstamp only offers spot trading options. For more trading options, you can check one of these other exchanges and choose one that offers what you seek.

Does Bitstamp Have Trading Fees?

Bitstamp has trading fees that vary depending on the amount of investment you have made. However, the fees are reduced as the number of investments increases. The highest fee is 0.5% for traders with $10,000 or less, and it goes down to 0% for traders with $20 billion or more.

![Bybit Review [currentyear]: Exchange Features, Fee, Pros and Cons 29 Bybit Featured Image](https://coinwire.com/wp-content/uploads/2022/06/Bybit-review-1024x683.png)

![MoonPay Review ([currentyear]): Fees, Pros & Cons, and Sign-Up Guide. 32 Moonpay Review Featured Image](https://coinwire.com/wp-content/uploads/2023/09/moonpay-review-featured-image-1024x683.jpg)

![Binance Futures Quiz Answers (Updated in [currentmonth] [currentyear]) 33 Binance Futures Quiz Answers Featured Image](https://coinwire.com/wp-content/uploads/2022/12/binance-futures-quiz-answers-1024x683.png)