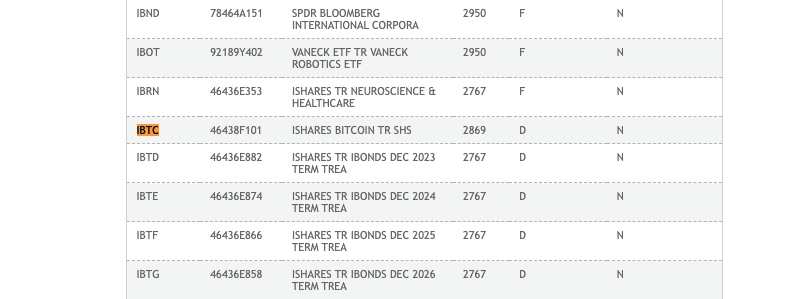

BlackRock’s iShares Bitcoin exchange-traded fund (ETF), IBTC, disappeared and then reappeared on the Depository Trust and Clearing Corporation’s (DTCC) website, sending shockwaves through the cryptocurrency market. The sudden appearance and disappearance of the ETF listing created significant buzz, causing Bitcoin‘s price to surge to new yearly highs. Investors were left on edge as they closely monitored the situation, highlighting the intense anticipation surrounding potential ETF approvals.

Market Volatility and Investor Speculation

The abrupt vanishing of IBTC from the DTCC’s website triggered a nearly 3% drop in Bitcoin’s price, underscoring the extent to which market activity is influenced by developments related to ETFs. Senior Bloomberg ETF analyst Eric Balchunas noted the unprecedented attention, mentioning that the incident briefly crashed the DTCC website.

Read more: SEC Decides Against Appealing Grayscale Bitcoin ETF Court Ruling

Observers pointed out subtle changes in the listing, with speculation suggesting that BlackRock might be preparing for a swift launch pending SEC approval. Despite the market volatility, Bitcoin managed to maintain relative stability, demonstrating its resilience amid the heightened speculation.

DTCC’s Clarification about iShares Bitcoin Trust: Market Response

Amidst the frenzy, a DTCC spokesperson clarified that the appearance of IBTC on the list was part of standard procedures in preparation for the launch of a new ETF. The spokesperson emphasized that being on the list did not indicate the outcome of any regulatory approval processes.

Despite the initial market jitters, Bitcoin’s price steadied following IBTC’s re-listing, showing a minimal 0.15% increase in the last hour according to CoinMarketCap data. This incident highlighted the cryptocurrency market’s sensitivity to ETF-related news and the significance of regulatory developments in shaping investor sentiment.

Conclusion

The roller-coaster ride of BlackRock’s iShares Bitcoin ETF listing on the DTCC’s website underscores the immense impact of ETF-related developments on the cryptocurrency market. As investors continue to closely monitor these events, the crypto industry remains on the edge of its seat, eagerly anticipating regulatory decisions that could reshape the landscape. The incident serves as a reminder of the market’s vulnerability to sudden news and the need for investors to stay vigilant amidst such uncertainties.

![Pionex Review ([currentyear]): Trading Bots, Fees, and Pros & Cons 11 Pionex Review Featured Image](https://coinwire.com/wp-content/uploads/2023/08/pionex-review-featured-image-1024x683.jpg)

![Best Crypto Exchanges in UAE and Dubai to Buy Bitcoin ([currentyear]) 12 Best Crypto Exchanges In Uae And Dubai Featured Image](https://coinwire.com/wp-content/uploads/2024/01/best-crypto-exchanges-in-uae-and-dubai-featured-image-1024x683.jpg)