Coinbase, a leading cryptocurrency exchange, has introduced a new institutional lending service in the United States, targeting institutional investors. This move comes in response to the challenges faced by the crypto lending market in recent times. The exchange aims to leverage its position in the market to offer a reliable and secure lending platform to institutional clients.

The Rise of Institutional Crypto Lending

Coinbase has officially rolled out its institutional-grade crypto lending platform, adding to its existing offering, Coinbase Prime. This development allows institutional investors to participate in a digital asset lending program. Under this program, institutions can lend their digital assets to the exchange under standardized terms, and it falls under the Regulation D exemption.

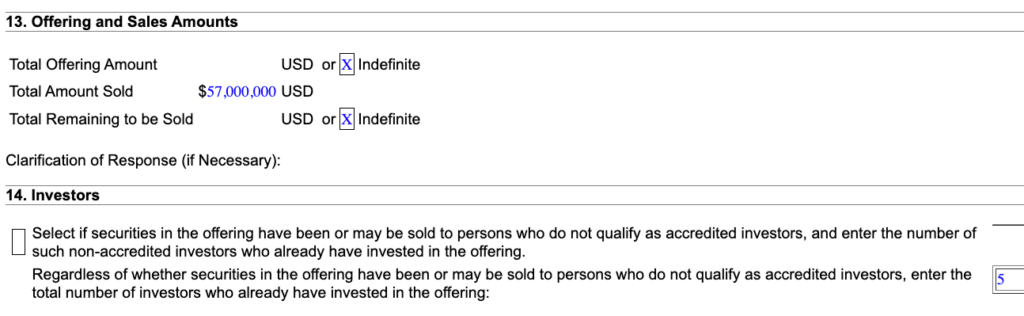

According to filings with the U.S. Securities and Exchange Commission, the lending program has already attracted $57 million in investments from its customers since its launch on August 28. By September 1, five investors had participated in the offering, signaling a strong interest in this new service.

This move aligns with Coinbase’s broader mission to modernize the financial system by harnessing the potential of cryptocurrencies. The exchange envisions using crypto to provide individuals with greater economic freedom and opportunities, challenging the traditional financial system that has been in place for over a century.

Read more: Coinbase Gains NFA Approval for Bitcoin and Ether Futures Trading in US

Coinbase on Past Endeavors

Coinbase’s latest crypto lending product builds upon the foundation laid by Coinbase Borrow, which temporarily halted the issuance of new loans in May 2023. The platform allowed users to receive loans of up to $1 million with Bitcoin collateral. This new institutional program operates under the entity known as Coinbase Credit, the same entity responsible for managing the Coinbase Borrow.

It’s worth noting that the exchange has faced regulatory challenges in the past. The U.S. SEC previously charged the exchange with offering and selling unregistered securities in connection with its crypto staking services. These services allowed users to earn yields by staking their crypto assets on the platform. The exchange vehemently disagreed with these allegations, but as a result of the legal proceedings, had to temporarily suspend its staking program in several states, including California, New Jersey, South Carolina, and Wisconsin.

Read more: Coinbase Fights Back: Claims SEC Overreach in Lawsuit Filing

Learning from Past Mistakes

The crypto lending industry experienced a significant crisis in the previous year. Major companies in the space, such as BlockFi, Celsius, and Genesis Global, faced financial difficulties, some even going bankrupt. This crisis was primarily driven by a lack of liquidity exacerbated by the bear market of 2022.

Crypto enthusiasts and experts have emphasized the importance of learning from these collapses and addressing issues related to short-term assets and liabilities within the crypto lending sector. Coinbase’s entry into the institutional lending space suggests a commitment to providing a more stable and secure lending environment, which could help mitigate some of the risks associated with this market.

Conclusion

Coinbase’s launch of a crypto lending platform for institutional investors in the U.S. marks an important step in the evolution of the cryptocurrency industry. It not only caters to the growing demand from institutional clients but also demonstrates The leading crypto exchange’s dedication to improving the crypto financial ecosystem. As the crypto lending market learns from past mistakes and regulatory challenges, Coinbase’s move has the potential to reshape and revitalize this sector, offering a more secure and reliable lending option for institutions in the United States.

![Pionex Review ([currentyear]): Trading Bots, Fees, and Pros & Cons 14 Pionex Review Featured Image](https://coinwire.com/wp-content/uploads/2023/08/pionex-review-featured-image-1024x683.jpg)

![Best Crypto Exchanges in UAE and Dubai to Buy Bitcoin ([currentyear]) 15 Best Crypto Exchanges In Uae And Dubai Featured Image](https://coinwire.com/wp-content/uploads/2024/01/best-crypto-exchanges-in-uae-and-dubai-featured-image-1024x683.jpg)

![Cardano vs Solana ([currentyear]): Is Cardano or Solana better? 16 Cardano Vs Solana Featured Image](https://coinwire.com/wp-content/uploads/2023/06/cardano-vs-solana-featured-image-1024x683.jpg)

![Paybis Review ([currentmonth] [currentyear]): Is It Safe and Legit? 18 Paybis Review Featured Image](https://coinwire.com/wp-content/uploads/2024/05/paybis-review-featured-image-1024x683.jpg)