Coinbase witnessed a remarkable surge of 12.7% in after-hours trading following a robust fourth-quarter earnings report. The company’s strong financial performance, including its first profitable quarter since Q4 2021, exceeded Wall Street expectations.

Stellar Financial Results

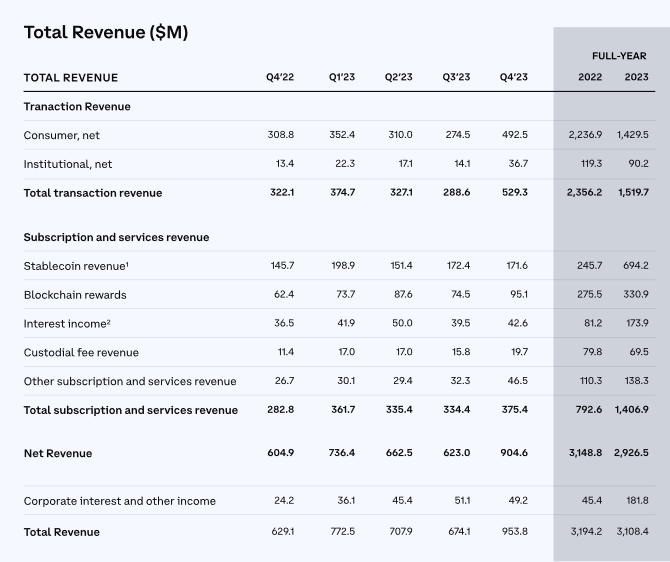

Coinbase reported a net revenue of $905 million in the fourth quarter, a substantial 45.2% increase from the third quarter, surpassing consensus estimates of approximately $825 million. The surge in transaction revenue, particularly from consumer crypto trading, played a significant role, reaching $529.3 million. Consumer crypto trading revenue nearly doubled from the previous quarter, contributing $493 million. Institutional transaction revenue also more than doubled to $36.7 million.

The company’s net income for Q4 2023 stood at an impressive $273 million, a remarkable turnaround from the net loss of $2 million in the previous quarter. Coinbase’s positive financial performance was attributed to the substantial growth in trading volume, which exceeded $29 billion from consumers, marking a staggering 164% quarter-on-quarter increase.

Read more: Coinbase Review: Can This Exchange be Trusted in 2024?

Coinbase’s Diverse Revenue Streams

In addition to transaction revenue, Coinbase diversified its income sources, generating $375.4 million from subscription and services revenue. Stablecoin and blockchain rewards contributed significantly, with $171.6 million and $95.1 million, respectively. This diverse revenue stream indicates the exchange’s ability to capitalize on various aspects of the cryptocurrency market.

Coinbase’s success in achieving its 2023 goal of generating positive Adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) was highlighted. The company reported a net income of $95 million and positive Adjusted EBITDA in all four quarters, totaling nearly $1 billion. The positive momentum was further fueled by increased confidence from investors, reflected in a 41.2% surge in Coinbase stock over the eight trading days leading up to the earnings release.

Read more: Coinbase vs. SEC: A Beanie Baby Analogy

Conclusion

The impressive financial results have positioned Coinbase as a formidable player in the cryptocurrency industry. With a positive outlook for 2024, including expectations of moderate headcount growth, the company remains committed to navigating the evolving landscape and capitalizing on emerging opportunities. As the cryptocurrency market continues to mature, Coinbase’s resilient performance underscores its significance as a leading platform for both retail and institutional investors.