As we approach the year 2024, the crypto community is abuzz with optimistic forecasts from over 30 crypto OGs. This compilation aims to distill the most reasonable projections for the crypto market in 2024. Key factors driving this optimism include the BTC Halving, the approval of a BTC ETF, and the U.S. elections, offering insights into potential market dynamics.

General Crypto Market Outlook for 2024

Enthusiastically, experts unanimously predict a robust surge in the crypto market. The primary catalyst identified is the BTC Halving, a recurring event that historically triggers a market boom. Projections suggest that Bitcoin may reach new heights within a year following the halving. Additionally, the approval of a Bitcoin ETF is poised to channel significant capital into the crypto sphere. The coinciding U.S. elections in 2024 are expected to provide stability, with the government possibly injecting funds and initiating interest rate cuts. A combination of reduced interest rates and approved Bitcoin ETF could result in a substantial inflow of funds into the crypto market.

Read more: Bitcoin Resurges to $43K as BlackRock’s BTC ETF Competes with Grayscale’s GBTC Volume

Projected Developments in Crypto Projects

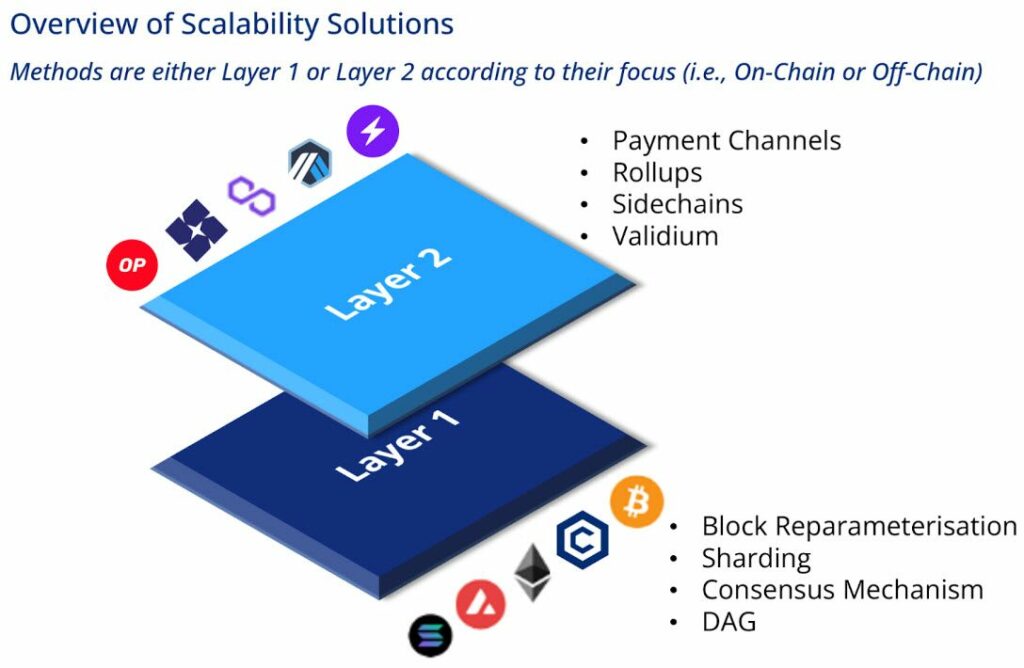

The landscape for Layer 2 (L2) blockchain solutions is expected to crystallize, with a few standout projects taking the lead. Branding and narrative-building are emphasized as critical factors for success in this domain, eclipsing the importance of having the lowest transaction fees. Approximately 50% of circulating Ethereum is predicted to be staked, with Ethereum upgrades failing to address the ongoing fee issues. Restaking is expected to gain traction on Ethereum and various L2 solutions. The focus on data availability is projected to rise, with branding playing a pivotal role. Notable projects such as EigenDA and Celestia are cited as examples.

Read more: Arbitrum Vs Optimism: Which is the Best Layer 2? Is Arbitrum better than Optimism?

Prominent L1 blockchains like APT, SUI, and Solana are forecasted to dominate the scene, with some Ethereum-based OG protocols branching out to develop versions compatible with Solana. Leading decentralized exchanges such as Uniswap and Binance have already introduced wallet applications, paving the way for more crypto wallets to launch their native tokens. The potential entry of Metamask into the token space is predicted to trigger a narrative-driven surge in wallet-related cryptocurrencies.

Rising trends include the growth of Real World Assets (RWA) TVL from $757 million to $5 billion, with expectations of a specific token gaining prominence within this sector. AI tokens are deemed somewhat speculative, lacking clear use cases, while GameFi anticipates the release of major gaming titles akin to the success of Candy Crush. SocialFi projects like Friend Tech and Lens are poised for explosive growth, and the introduction of tokens is expected to catalyze significant market activity.

Conclusion

Airdrops are making a comeback, set to continue their strong presence in 2024. Crosschain compatibility is identified as a key highlight, with projects capable of serving multiple chains and facilitating cross-chain interactions standing out. The article acknowledges potential bias in mentioning specific projects, encouraging readers to critically evaluate and contribute diverse perspectives in the comments section. As the crypto market evolves, these predictions offer valuable insights for investors navigating the dynamic landscape in 2024.

![Pionex Review ([currentyear]): Trading Bots, Fees, and Pros & Cons 8 Pionex Review Featured Image](https://coinwire.com/wp-content/uploads/2023/08/pionex-review-featured-image-1024x683.jpg)

![Best Crypto Exchanges in UAE and Dubai to Buy Bitcoin ([currentyear]) 9 Best Crypto Exchanges In Uae And Dubai Featured Image](https://coinwire.com/wp-content/uploads/2024/01/best-crypto-exchanges-in-uae-and-dubai-featured-image-1024x683.jpg)

![Cardano vs Solana ([currentyear]): Is Cardano or Solana better? 10 Cardano Vs Solana Featured Image](https://coinwire.com/wp-content/uploads/2023/06/cardano-vs-solana-featured-image-1024x683.jpg)

![Paybis Review ([currentmonth] [currentyear]): Is It Safe and Legit? 11 Paybis Review Featured Image](https://coinwire.com/wp-content/uploads/2024/05/paybis-review-featured-image-1024x683.jpg)