Ethereum (ETH) has reclaimed the $2,000 price point, showcasing resilience in the face of regulatory challenges and bolstered by a surge in network activity. Despite recent regulatory actions against major cryptocurrency exchange Binance, Ethereum’s price is trading slightly higher, supported by improved decentralized applications (DApps) metrics, increased protocol fees, and its dominance in the non-fungible token (NFT) market.

Binance’s Regulatory Challenges and Ethereum’s Response

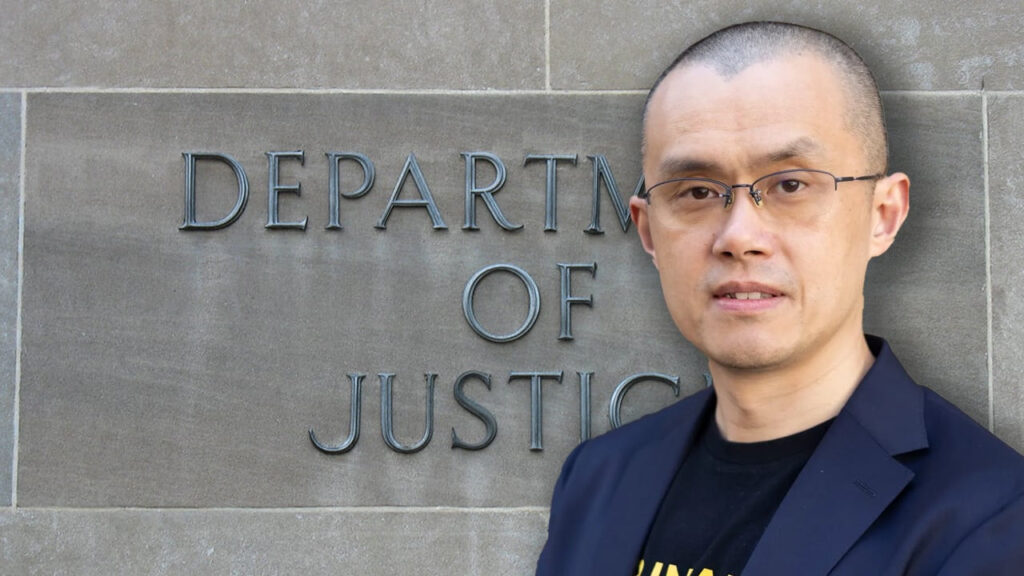

The recent regulatory hurdles faced by Binance, particularly its plea deal with the U.S. Department of Justice, initially raised concerns in the cryptocurrency market. Binance, a key player in Ether spot trading volume, accounted for 30% of ETH futures contracts’ open interest.

The closure of Binance’s substantial ETH derivatives contracts and net outflows of $1.53 billion between Nov. 21 and Nov. 23 added an element of uncertainty. Investors, grappling with fear and uncertainty, saw significant potential consequences. Some viewed Binance’s actions as evidence of sufficient reserves, while others grew wary of the $4.3 billion fine facing Binance and its former CEO, Changpeng “CZ” Zhao. This article explores the potential repercussions on Ethereum and its $2,000 price point in the wake of Binance’s regulatory challenges.

Read more: Changpeng Zhao (CZ) Resigns as Binance CEO Amid Money Laundering Charges

Regulatory Developments and Ethereum’s Positive Outlook

Amidst the regulatory uncertainties, there are positive developments that could shape the future of Ethereum. Binance’s move towards full compliance, despite the associated risks, might reduce the regulatory threats posed by unregulated exchanges. This shift increases the likelihood of the U.S. Securities and Exchange Commission (SEC) approving spot exchange-traded fund (ETF) instruments for cryptocurrencies.

Read more: BlackRock Files for Spot Ethereum ETF with SEC

Industry giants like BlackRock and Fidelity have expressed interest in launching Ether spot-based ETFs. Furthermore, the exclusion of Ether (ETH) from the SEC’s recent lawsuit against Kraken on Nov. 20 provides a silver lining amidst regulatory uncertainties. This article delves into the potential impact of these regulatory developments on Ethereum’s long-term prospects and market dynamics.

Conclusion

As Ethereum continues to navigate through the evolving regulatory landscape, its recent performance suggests a degree of resilience and optimism. Improved on-chain metrics, growing expectations of spot ETF approval, and reduced regulatory concerns stemming from the 2015 ICO have contributed to Ethereum’s positive trajectory. Despite challenges posed by Binance’s regulatory actions, Ethereum’s network health, and its leadership position in the NFT market paint a promising picture. Investors and enthusiasts alike will be closely watching how Ethereum maintains its momentum and adapts to the ever-changing dynamics of the cryptocurrency market.

![Best Crypto Exchanges for Day Trading [currentyear] - Top 6 Platforms 8 Best Crypto Exchanges For Day Trading](https://coinwire.com/wp-content/uploads/2023/10/best-crypto-exchanges-for-day-trading-1024x683.jpg)

![Best Free Crypto Sign Up Bonus Offers & Promotions in [currentyear] 9 Best Free Crypto Sign Up Bonus And Promotion](https://coinwire.com/wp-content/uploads/2023/08/free-crypto-sign-up-bonus-1024x683.jpg)

![Best Crypto Exchanges in Malaysia (Updated in [currentmonth] [currentyear]) 10 Best Crypto Exchanges In Malaysia Featured Image](https://coinwire.com/wp-content/uploads/2024/05/best-crypto-exchanges-in-malaysia-featured-image-1024x683.jpg)