Grayscale Investment CEO Michael Sonnenshein has expressed skepticism about the sustainability of most spot Bitcoin exchange-traded funds (ETFs) recently approved by the United States Securities and Exchange Commission (SEC). In an interview at the World Economic Forum in Davos, Sonnenshein predicted that the majority of the 11 approved spot Bitcoin ETFs are likely to face challenges and eventually exit the market.

Spot Bitcoin ETF Fee War Raises Concerns

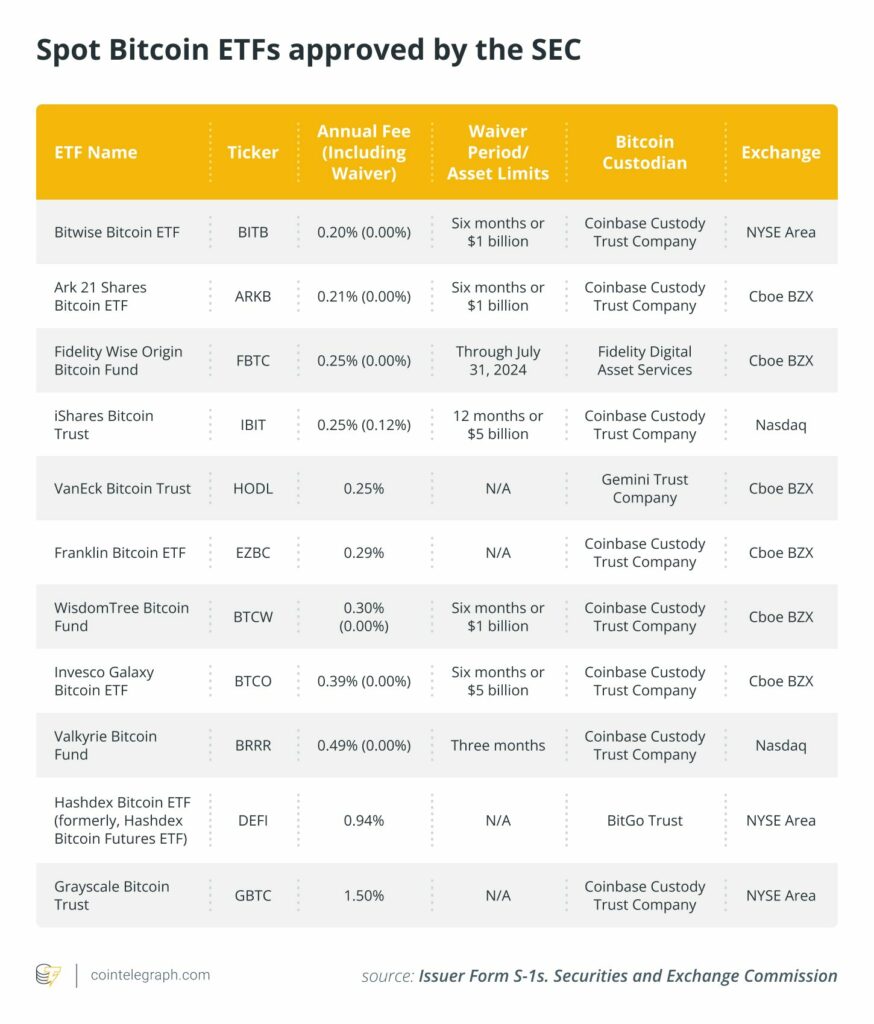

The U.S. SEC approved 11 spot Bitcoin ETFs on January 10, with 10 commencing trading the next day. The approval sparked a fee war among ETF issuers, with many lowering their trading fees to enhance competitiveness. While most approved ETFs set fees between 0.2% and 0.4%, Grayscale, holding the largest Bitcoin position among spot Bitcoin ETF issuers, charges as much as 1.5% without any waivers. Sonnenshein defended Grayscale’s fees, stating that only two or three spot Bitcoin ETFs are likely to endure, with the rest facing eventual withdrawal from the market.

Read more: SEC Delays Decision on Fidelity’s Ethereum ETF Amidst Coinbase Legal Battle

Grayscale CEO Questions Long-Term Commitment to Asset Class

Sonnenshein’s remarks, made on the fifth day of spot Bitcoin ETF trading in the U.S., hint at concerns about the commitment of some ETF issuers to the asset class. Grayscale, in contrast to other issuers, has been actively selling Bitcoin, offloading significant amounts since the trading launch. This divergence in approach raises questions about the long-term viability of the current multitude of spot Bitcoin ETFs. Analysts, including Quantum Economics founder Mati Greenspan, suggest that the saturation of the market with 11 spot ETFs could lead to consolidation as investors may prefer self-custody or holding assets directly.

Read more: The 7 Best Bitcoin ETFs: A Comprehensive Guide for Investors

Conclusion

As the spot Bitcoin ETF landscape unfolds, Grayscale’s CEO underscores doubts about the sustained presence of the majority of approved ETFs. The ongoing fee war and Grayscale’s unique position in charging the highest fees contribute to concerns about the viability of multiple spot Bitcoin ETFs. The industry may witness a period of consolidation, as some issuers may find it challenging to compete in the long term. The divergence in strategies among ETF issuers, exemplified by Grayscale’s significant Bitcoin sell-off, adds another layer of complexity to the evolving narrative of Bitcoin-focused exchange-traded funds.

![Pionex Review ([currentyear]): Trading Bots, Fees, and Pros & Cons 8 Pionex Review Featured Image](https://coinwire.com/wp-content/uploads/2023/08/pionex-review-featured-image-1024x683.jpg)

![Best Crypto Exchanges in UAE and Dubai to Buy Bitcoin ([currentyear]) 9 Best Crypto Exchanges In Uae And Dubai Featured Image](https://coinwire.com/wp-content/uploads/2024/01/best-crypto-exchanges-in-uae-and-dubai-featured-image-1024x683.jpg)

![Cardano vs Solana ([currentyear]): Is Cardano or Solana better? 10 Cardano Vs Solana Featured Image](https://coinwire.com/wp-content/uploads/2023/06/cardano-vs-solana-featured-image-1024x683.jpg)

![Paybis Review ([currentmonth] [currentyear]): Is It Safe and Legit? 11 Paybis Review Featured Image](https://coinwire.com/wp-content/uploads/2024/05/paybis-review-featured-image-1024x683.jpg)