James Wallis, Ripple’s Vice President for Central Bank Engagements and Central Bank Digital Currencies (CBDCs), shed light on the significant impact that CBDCs can have in breaking financial barriers and advancing global financial inclusion. Wallis emphasized that the primary goal of financial inclusion is to extend financial services to individuals worldwide, particularly those with low incomes and no ties to traditional financial institutions.

The Challenge of Financial Exclusion

Wallis identified key factors contributing to financial exclusion, including low incomes and a lack of existing connections with financial institutions, resulting in the absence of a credit history. In regions marked by financial exclusion, commercial banks often prioritize shareholder interests, making it challenging to serve individuals with limited resources, as generating profits from this demographic proves difficult.

Read more: Mastercard Tests CBDC Transactions on Ethereum: Web3 Milestone

CBDCs as a Solution for Financial Inclusion

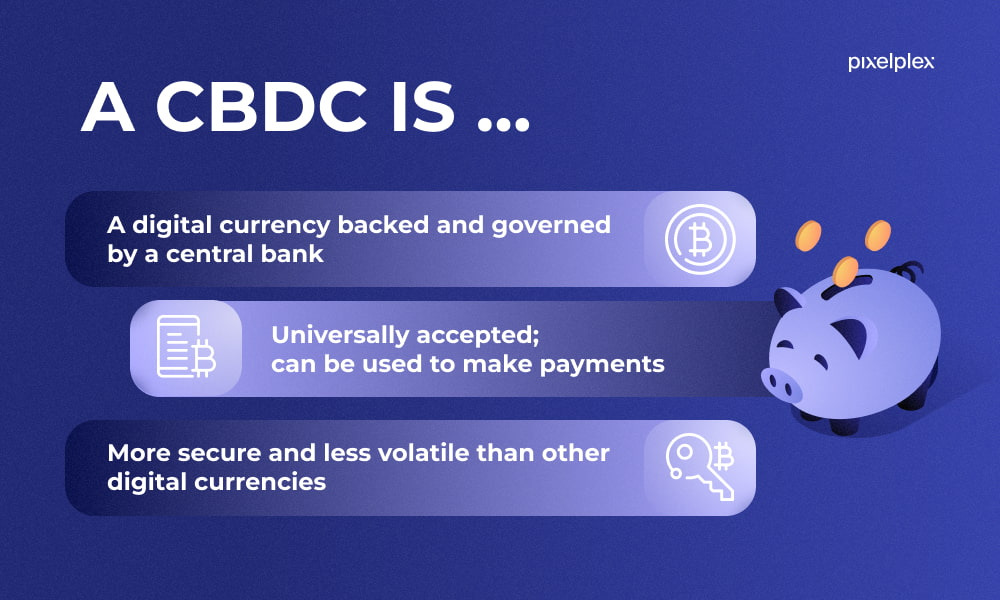

According to Wallis, CBDCs offer a cost-effective solution by enabling financial services at a significantly lower cost than traditional methods. These digital currencies provide streamlined payment options and opportunities to establish credit, even for those without prior connections to financial institutions.

Conclusion

In conclusion, James Wallis underscored the transformative potential of CBDCs in addressing global challenges related to financial inclusion. Ripple’s active involvement with over 20 central banks globally on CBDC initiatives reflects the company’s commitment to leveraging technology for positive change. As the digital landscape continues to evolve, CBDCs stand out as a promising tool to break down financial barriers, foster innovation, and drive sustainable economic growth on a global scale.