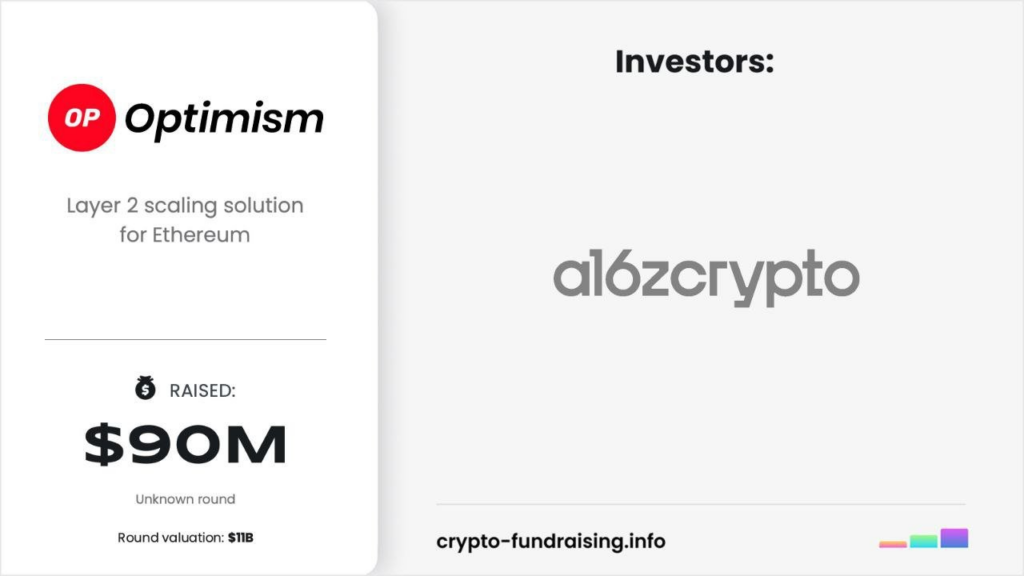

Venture capital giant a16z has made a substantial investment of around $90 million in Optimism’s native OP token, as confirmed by sources familiar with the matter. This move underscores the growing institutional interest in Ethereum Layer 2 solutions amid the cryptocurrency ecosystem’s rapid evolution.

Institutional Bet on Optimism

The investment by a16z, executed under a two-year vesting period, reflects a strategic move to capitalize on the burgeoning adoption of Optimism’s OP Stack within the blockchain community. Optimism’s technology enables developers to deploy Layer 2 blockchains on Ethereum, providing scalability and efficiency benefits crucial for decentralized applications (dApps) and smart contracts.

The decision by a16z to acquire OP tokens during a vesting period aligns with common practices among institutional investors seeking discounted purchases relative to market prices. This investment signals confidence in Optimism’s growth trajectory and its potential to shape the future of Layer 2 solutions in the Ethereum ecosystem.

Read more: Optimism Plans To Sale $160M Worth of OP Tokens

Optimism’s Ecosystem Expansion

Optimism has witnessed significant ecosystem expansion, highlighted by key partnerships such as the recent adoption by the Celo blockchain developers for their Layer 2 deployment. This endorsement underscores Optimism’s technical prowess and credibility within the blockchain industry.

Despite the absence of official comments from a16z and Optimism regarding the investment specifics, industry observers note the significance of a major player like a16z entering the Optimism ecosystem. The broader implications of this investment could extend beyond financial backing to include strategic collaborations and governance participation within Optimism’s ecosystem.

Conclusion

The a16z investment in Optimism’s OP token exemplifies the growing institutional interest in Ethereum Layer 2 solutions and the broader blockchain landscape. As Optimism continues to gain traction and expand its technology stack, partnerships with prominent investors like a16z are poised to accelerate innovation and adoption within decentralized finance (DeFi) and blockchain applications.

The evolving dynamics within the cryptocurrency market underscore the importance of Layer 2 scalability solutions in addressing Ethereum’s network congestion and high gas fees. Optimism’s success story reflects a broader trend towards blockchain scalability, offering promising opportunities for investors and developers alike to leverage transformative technologies shaping the future of decentralized finance.