US charges KuCoin crypto exchange with anti-money laundering failures

KuCoin, a major cryptocurrency exchange, faces charges from federal prosecutors in Manhattan for violating U.S. anti-money laundering laws. Allegations include failure to vet customers properly and allowing illicit fund transfers since 2017. The exchange is accused of soliciting business from U.S. customers without registering with the Treasury Department or implementing required identity verification procedures. Founders Chun Gan and Ke Tang, Chinese nationals, are charged with conspiracy and remain at large. The U.S. Commodity Futures Trading Commission also filed a civil lawsuit against KuCoin for unregistered futures and swaps activities.

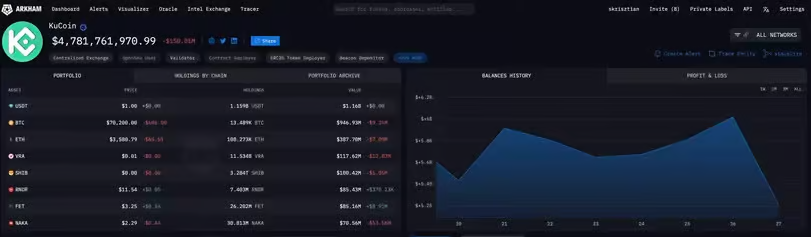

As a result of the bad news, KuCoin experienced significant outflows totaling $1.083 billion via Ethereum Virtual Machine-compatible (EVM) chains, while only $144 million flowed into the exchange. Net outflows on the Ethereum network alone amounted to $840 million, representing a more than 15% drop in the exchange’s held assets. Blockchain data from Arkham Intelligence revealed that the total value of crypto assets, including Bitcoin, held by tagged KuCoin addresses declined from $6 billion to $4.8 billion. This decrease was likely due to investors withdrawing assets from the platform, despite minimal fluctuations in crypto markets during the same period.

PUMP Memecoin Presale Raises $280M Amid Crypto Fervor

The presale of PUMP, a Chinese BNB memecoin, has surpassed expectations, raising $280 million. This highlights the crypto community’s keen interest in speculative ventures. Despite criticisms, PUMP attracted significant support from BNB Chain holders, accumulating 280 million tokens. Similar to Dogecoin’s early success, PUMP’s trajectory underscores the speculative and community-driven nature of meme coins.

After listing, the token kept decreasing in value and now has around 17.8M Marketcap. Looks like this memecoin went viral too late and not getting the fomo of the community as the trend ended itself.

FED Chairman Jerome Powell Statement & PCE index

The Federal Reserve Chairman stated that inflation is progressing as expected. He emphasized caution in reducing interest rates too soon, indicating a preference for maintaining rates if inflation hasn’t met targets. The U.S. economy’s strength suggests no immediate need for interest rate cuts. However, the Fed remains vigilant and may adjust policy if the labor market weakens unexpectedly. Overall, the Chairman expressed confidence in the economy, stating that the likelihood of a recession is low.

- PCE Y/Y +2.5% (Forecast = 2.5%, Previous month = 2.4%)

- Core PCE Y/Y +2.8% (Forecast = 2.8%, Previous month = 2.8%)

All three inflation measures: CPI, PPI, and PCE, have shown slight increases.

Especially, PCE is the inflation measure closely monitored by the Federal Reserve. In a recent meeting, the Fed noted that inflation “has moderated but remains elevated” and will not cut interest rates until inflation reaches 2%.

- PCE inflation is as expected, showing significant progress according to everyone.

- Cutting interest rates too early will have detrimental consequences. The Fed wants to be more confident before lowering them. If inflation hasn’t reached the target, they will maintain interest rates longer.

- The U.S. economy is strong enough, so there’s no need to rush to lower interest rates.

- If the labor market unexpectedly declines, the Fed may consider pivoting its policy.

- The likelihood of a recession currently is low. There’s no reason to believe the economy is in recession or on the brink of one.

Market Analytics

In our previous analytics, BTC’s downward momentum has slowed, leading to a sideways movement between 68k-72k. Both upper and lower bounds serve as significant resistance/support levels. In the Altcoin market, apart from newly launched Binance Launchpool projects, most coins are trading sideways. Attention is focused on select coins, especially RWA, which have seen substantial price increases. Our expectations on Mar 28 included a potential correction for broader participation in this trend, along with potential gains in newer Binance projects like JUP, PYTH, as well as established coins like FTM, TON, and ZK.

Two trends are observed: RWA and MEME, with certain meme coins like Doge, Shiba, and PEPE showing signs of resurgence. Attention should also be directed towards Euro-related assets, particularly Binance coins associated with football events, ahead of the Euro comeback. Specific entry points and assets will be suggested following a BTC correction for optimal timing. All the big memecoins will surge in the uptrend first, therefore you should take a note.

In our previous analytics, from a technical standpoint, the situation is straightforward: a bullish push is evident. However, analyzing price movements allows for the identification of potential entry opportunities.

Looking at price action, AEVO is currently experiencing an upward wave, potentially confirming a wave 1 push if wave 2 continues to break previous highs.

Regarding support and resistance levels, there is currently no resistance :)) The closest support zones are delineated in two areas as depicted in the image. Zone 1 spans between 3-3.2, while zone 2 ranges from 2.5-2.7.

For spot trading, it’s recommended to diversify entries within these price ranges and set stop-loss and take-profit targets at 5U.

Our plan hits correctly as you can see above with the AEVO case.

Bitcoin Update

Today, BTC is still confined within its established trading range. Resistance and support levels remain steady, with the upper limit around 71.5k-72k and the lower limit between 68.5k-69k. Currently, the market awaits a breakthrough beyond one of these boundaries to establish a corrective wave pattern.

Looking at the daily chart, the market displays an Outside Bar candlestick with moderate volume, followed by a bullish candlestick with volume at only half, indicating subdued trading activity. Given these indicators and recent positive news such as ETF inflows, etc., I anticipate a market downturn for a retest of the lower boundary.

Total2, as previously analyzed, is currently facing resistance on the daily chart. Continuous rejection signals are noticeable, with price consistently failing to breach the upper resistance zone, as depicted by candlesticks touching the red line and closing below it.

The majority of altcoins are gradually declining, but today, mining coins are gaining traction, likely due to upcoming halving events, offering some benefits to POW mining coins. Notably, ETHW, BCH, and LTC have emerged as top performers in the past 24 hours. BCH and ETHW have both broken past their previous highs, confirming their upward trajectories. The green zones indicate the nearest support levels for these mining coins.

Subscribe to our newsletter to receive the latest information about our Newsletter series: click here