Mt. Gox, the infamous crypto exchange that fell victim to a massive hack nearly a decade ago, is gearing up to initiate reimbursements of 200,000 Bitcoin (BTC) to its creditors. This move follows the recent commencement of PayPal repayments by Mt. Gox in December 2023. However, concerns are rising in the crypto community about the potential market impact as the exchange prepares to release this substantial amount of BTC.

Mt. Gox’s Long-awaited Repayments

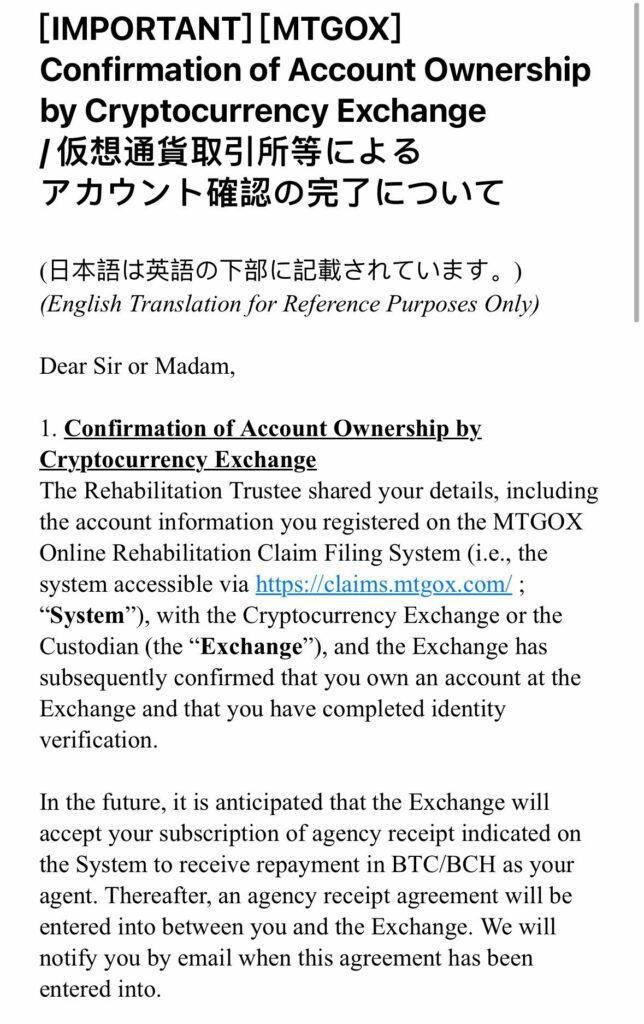

For the past decade, Mt. Gox has repeatedly delayed plans to refund creditors who lost a total of 850,000 BTC due to the 2014 hack. Recently, creditors have reported receiving emails from the Mt. Gox trustee, requesting identity verification details for crypto exchange accounts designated as payment addresses for both Bitcoin (BTC) and Bitcoin Cash (BCH). This indicates a crucial step toward the long-awaited reimbursement process.

Read more: Mt. Gox Unveils Cash Repayment Plans: Hope for Creditors

Impending Concerns Over Market Impact

The major concern arising from Mt. Gox’s impending reimbursements is the potential flood of 200,000 BTC into the market. This amount is comparable to the Bitcoin holdings of major players like MicroStrategy, which currently holds approximately 189,000 BTC. Market observers are on high alert as they anticipate a significant impact on BTC prices if recipients of Mt. Gox payments decide to sell their newly acquired assets. The fear is that such a massive sell-off could lead to a notable dip in the cryptocurrency’s value.

Read more: Mt. Gox Trustee Extends Repayment Deadline to October 2024

Conclusion

Mt. Gox, once the world’s largest exchange, is on the verge of unlocking a substantial amount of Bitcoin for creditor repayments. As the countdown begins for the likely release of 200,000 BTC in the next two months, the crypto community is bracing for potential market turbulence. The concerns surrounding the impact of this influx on Bitcoin prices highlight the delicate balance between restitution for affected parties and the broader stability of the cryptocurrency market. The crypto community will undoubtedly keep a close eye on how this unfolding situation unfolds in the coming weeks.

![Pionex Review ([currentyear]): Trading Bots, Fees, and Pros & Cons 8 Pionex Review Featured Image](https://coinwire.com/wp-content/uploads/2023/08/pionex-review-featured-image-1024x683.jpg)

![Best Crypto Exchanges in UAE and Dubai to Buy Bitcoin ([currentyear]) 9 Best Crypto Exchanges In Uae And Dubai Featured Image](https://coinwire.com/wp-content/uploads/2024/01/best-crypto-exchanges-in-uae-and-dubai-featured-image-1024x683.jpg)

![Cardano vs Solana ([currentyear]): Is Cardano or Solana better? 10 Cardano Vs Solana Featured Image](https://coinwire.com/wp-content/uploads/2023/06/cardano-vs-solana-featured-image-1024x683.jpg)

![Paybis Review ([currentmonth] [currentyear]): Is It Safe and Legit? 11 Paybis Review Featured Image](https://coinwire.com/wp-content/uploads/2024/05/paybis-review-featured-image-1024x683.jpg)