As the crypto bull market continues to gain momentum, Ondo Finance, a U.S. Treasury tokenization protocol, is strategically positioning itself for the convergence of traditional finance and blockchain technology. With a recent $186 million total value locked (TVL) across its three products, Ondo Finance is making significant strides in the tokenized asset space.

Ondo Finance’s Tokenized Treasury Expansion in Asia

Last month marked a pivotal moment for Ondo Finance as it inaugurated its first office in Hong Kong, signaling its commitment to broadening on-chain treasury offerings for Asia Pacific investors. In an exclusive interview with Cointelegraph, Nathan Allman, CEO of Ondo Finance, highlighted the advantages of tokenized treasuries, emphasizing their 24/7 on-chain transferability, compatibility with smart contracts, and seamless interaction with decentralized and centralized exchanges.

Read more: a16z Invests $100M in EigenLayer, Ethereum’s Top Restaking Protocol

Innovative Products and Future Plans

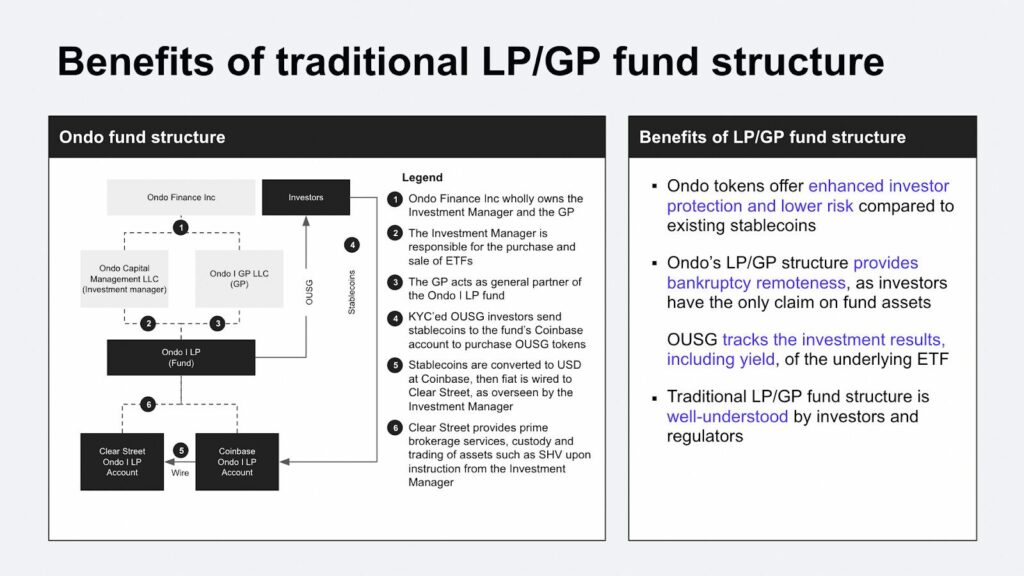

Ondo Finance currently offers three products – OUSG, providing exposure to U.S. Treasurys; OMMF, offering exposure to U.S. money market funds; and USDY, a yield-bearing alternative to traditional stablecoins. With an annual yield of around 5%, these pools are backed by U.S. Treasurys, ensuring government-backed security. Allman teased further expansion, stating, “Cash [Treasury] equivalents are only the first step, and we’ll be announcing soon our plans to bring the other $100T+ of securities on-chain.” Ondo Finance aims to address core infrastructure challenges, facilitating the widespread creation and use of tokenized securities on public blockchains.

Read more: Ex-SEC Enforcement Attorney Joins Law Firm Defending Crypto Firms

Regulatory Considerations and Global Expansion

Presently, Ondo’s tokenized assets are not available to U.S. investors due to regulatory uncertainties. Non-U.S. users interested in Ondo’s treasury pools must undergo Know Your Customer and Anti-Money Laundering verifications and hold the assets for at least 40 days before transferring. Allman acknowledged the importance of regulatory compliance, stating that the current structure of their products aligns with existing regulations and exemptions outside the U.S. With Hong Kong regulators actively embracing real-world asset tokenization, Ondo Finance positions itself strategically in a jurisdiction where the regulatory landscape is evolving.

Conclusion

Ondo Finance’s expansion into tokenized treasuries, coupled with its innovative product offerings, underscores the dynamic intersection of traditional finance and blockchain. As the crypto market continues its bullish trend, Ondo Finance’s vision for on-chain financial instruments and plans for broader tokenized security inclusion reflect the evolving landscape of decentralized finance. Investors and industry enthusiasts keen on the convergence of these realms eagerly await further developments from Ondo Finance.