The Omni Network is redefining Ethereum’s infrastructure by integrating rollups to provide universal access to the platform’s liquidity and functionalities without any compromises. As a pioneering Actively Validated Service (AVS), it has secured over $1B in restaked ETH commitments, marking its position as a keystone for Ethereum-native interoperability.

This article offers an in-depth Omni Network price prediction, focusing on the OMNI token, its tokenomics, and providing insights into the factors influencing its price and its price prediction.

An Overview About the Omni Network

The Omni Network serves as a pivotal blockchain platform designed to enhance Ethereum’s functionality by securely uniting all rollups. This integration infrastructure not only optimizes for speed but also leverages Ethereum’s robust security measures, making it a cornerstone for rollup ecosystems. Here are some key features and components of the Omni Network:

- Operational Mechanics:

- Utilizes a novel architecture centered around ‘restaking’ where validators manage protocol integrity and rewards, while delegators enhance network security by staking their Ethereum tokens.

- Combines the Tendermint consensus mechanism with the flexibility of the Cosmos SDK, facilitating smooth EVM integration and enabling Solidity use across multiple chains.

- Ecosystem and Development:

- Supports a growing number of projects including EigenLayer, Sushi, Injective, Arbitrum, Flow, and Optimism.

- Continuously expanding with a roadmap featuring milestones like mainnet launch and the inclusion of new data availability systems.

Omni Network’s strategic design allows developers to create global applications benefiting from economic advantages across all rollups, ensuring a seamless user experience and broad application integration.

The OMNI Token and its Tokenomic

The OMNI Token and its Tokenomic

The OMNI Token is integral to the Omni Network, serving multiple roles including governance, staking, and transaction fees. Here’s a breakdown of its key metrics and functions:

The total supply of OMNI tokens stands capped at 100,000,000, strategically distributed to build a robust and sustainable network ecosystem. Here’s a breakdown of the allocation:

- Private Sale Investors: 20.06%

- Public Launch Allocation: 5.77%

- Binance Launchpool: 3.50%

- Team: 25.25% (subject to vesting schedule)

- Advisors: 3.25% (subject to vesting schedule)

- Ecosystem Fund: 29.50%

- Community Fund: 12.67%

This token’s utility and capped supply, combined with its role in a growing ecosystem, underscore its potential for value appreciation influenced by market dynamics such as supply and demand.

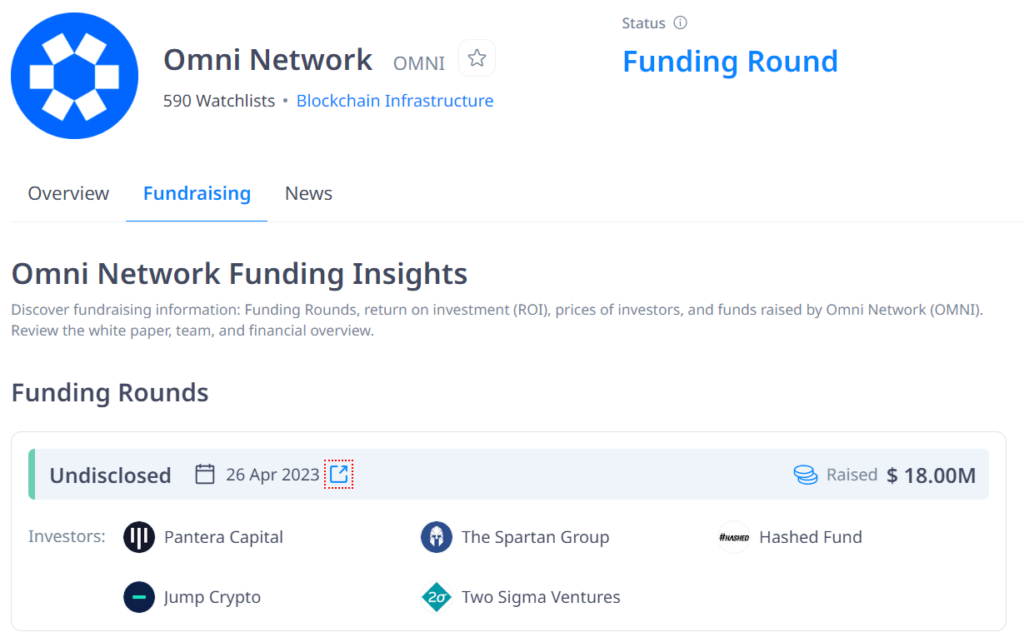

Omni Network Investors and Fundraising

Omni Network’s fundraising journey showcases robust investor confidence and strategic capital infusion aimed at accelerating its growth within the sharing economy. OmniNetwork is funded by 5 investors. Jump Crypto and The Spartan Group are the most recent investors.

This strategic financial backing is pivotal for Omni Network as it continues to innovate and expand its technological and market footprint.

Factors Influencing OMNI Price

Several factors influence OMNI’s price, each playing a significant role in its market dynamics:

- Platform Development: The continuous enhancement and expansion of the Omni Network are crucial. As the platform evolves, it can lead to a gradual appreciation in OMNI’s price due to increased functionality and user engagement.

- Adoption and User Growth: The growth in the number of users and their engagement with the platform directly impacts the demand for OMNI tokens. As more users join and participate, the intrinsic value of OMNI increases.

- Market Sentiment: The general sentiment towards blockchain projects, especially those related to gaming and NFTs, can significantly affect OMNI’s price. Positive perception and investor confidence tend to drive prices up.

- Partnerships and Collaborations: Forming strategic alliances with prominent gaming companies and other blockchain projects can enhance the network’s credibility and market exposure, attracting more investors and, consequently, increasing the token’s value.

- Overall Market Conditions: The broader cryptocurrency market trends, including the performance of major cryptocurrencies like Bitcoin and Ethereum, often influence OMNI’s price movements. Market volatility can lead to rapid changes in investor sentiment, impacting OMNI’s price accordingly.

- Whale Activity: The actions of large holders, or ‘whales,’ can have a substantial impact on OMNI’s price. A significant sell order from a whale can lead to sudden price drops, affecting market stability.

- Institutional Adoption and Political Regulations: The level of adoption by large institutions and the regulatory environment can also significantly impact OMNI’s value. Positive regulatory frameworks and increased institutional interest often contribute to price stability and growth.

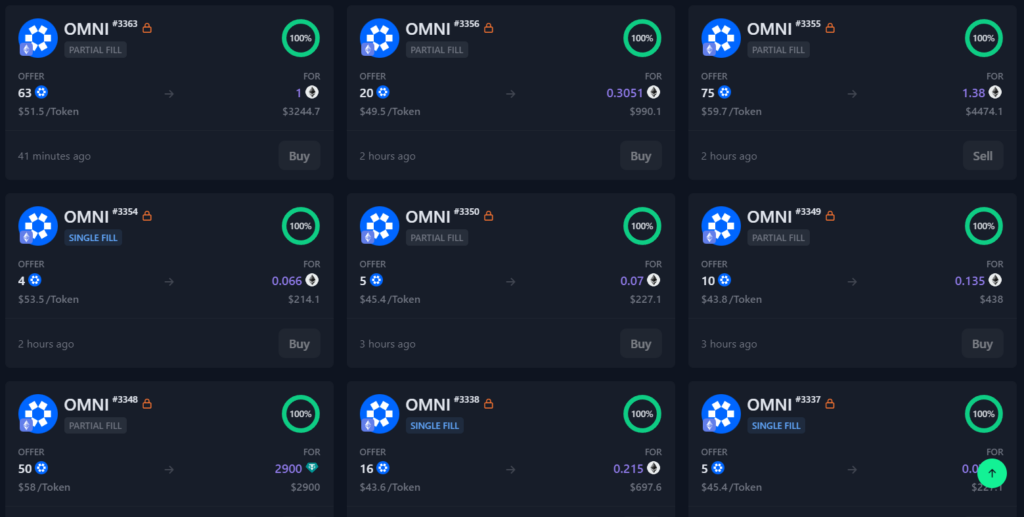

The OMNI Price on the OTC market

Tracking the performance of OMNI on the OTC market reveals significant insights into its trading dynamics:

Price Prediction Analysis

Post-listing on Binance, the OMNI token is being traded on the OTC market from $40 – $70 range. With a total supply of 100,000,000; 3,000,000 of which (3% of the total $OMNI supply) will be distributed as part of the airdrop. ETHFI average prices could be around the mark $55 by the time it lists Binance.

If you have the price prediction of your own, share with us and receive the price of up to $100 USDT.

https://twitter.com/bsc_daily/status/1779093434869100769

https://twitter.com/ETH_Daily/status/1779091572078027214

If you do not have a Binance account, you can register via this CoinWire’code to gain -10% trading fee)

Join Binance Community Now for the Latest Updates

- https://www.binance.com/en/community

- https://bit.ly/BinanceVietnamTelegram (for Vietnamese community)

Conclusion

Throughout this article, we have explored the revolutionary aspects of the Omni Network, detailing its unique infrastructure that integrates rollups to augment Ethereum’s ecosystem and examined the potential of the OMNI token within this pioneering framework. The token’s pivotal roles in governance, staking, and transaction fees, coupled with its intricately designed tokenomics, clearly indicate its significance in fostering a more interconnected and efficient blockchain landscape. Furthermore, the comprehensive analysis of factors influencing OMNI’s price, underscored by robust investor confidence and ongoing platform developments, reinforces its promising outlook in the dynamic cryptocurrency market.

As the Omni Network continues to push the boundaries of Ethereum-native interoperability, embedding itself as a key player in the blockchain evolution, it opens up unprecedented opportunities for investors and developers alike. To participate directly in this groundbreaking venture and align with its growth trajectory, readers are encouraged to join the Binance Launchpool to acquire the OMNI token. This strategic move not only positions stakeholders at the forefront of blockchain innovation but also empowers them to partake in shaping the future of decentralized finance, highlighting the Omni Network’s critical role in the broader digital economy and its potential for sustained value appreciation.