The SEC recently announced that it has obtained a temporary asset freeze, restraining order, and other emergency relief against Digital Licensing Inc., also known as “DEBT Box”. This Utah-based crypto company and its four principals, Jason Anderson, Jacob Anderson, Schad Brannon, and Roydon Nelson, are facing enforcement action for allegedly selling unregistered securities since March 2021.

The Alleged Node License Scheme

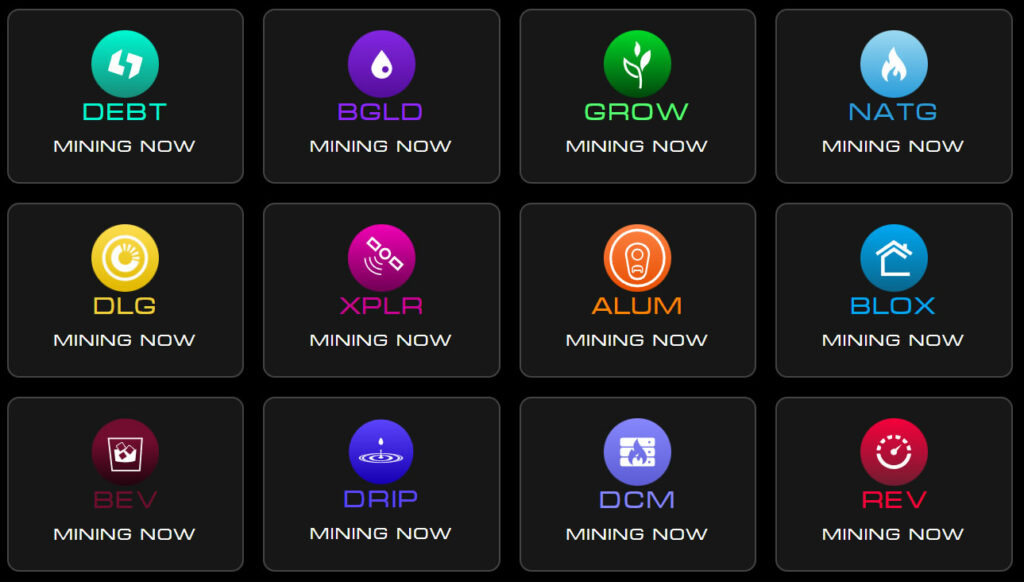

The SEC has accused DEBT Box of selling unregistered securities, referred to as “node licenses,” since March 20211. On its website, the company claims to be a decentralized eco-friendly blockchain platform where crypto meets commodities. The company offers “software mining licenses” that need to be activated before they can begin mining.

DEBT Box promises daily rewards through various “projects” tied to industries such as real estate, commodities, agriculture, and technology. These projects are presented as revenue-generating businesses that would drive up the token values, resulting in substantial gains for investors.

However, the SEC alleges that the company falsely claimed that these “nodes” would generate crypto tokens through mining and that the revenue-generating businesses would increase the token values. In reality, the SEC argues that the total supply of tokens was created by DEBT Box using blockchain code, making the node licenses a “sham”.

DEBT Box’s Claims and Online Presence

Despite the SEC’s allegations, the company has actively promoted its node licenses and projects online. With over 30,000 followers on Twitter, the company has maintained an active presence on social media platforms. However, since the SEC’s enforcement action, the native token of DEBT Box, DEBT, has experienced a significant decline of 52%.

SEC Seeks Permanent Injunctions and Penalties

The SEC is seeking permanent injunctions, the return of ill-gotten gains, and civil penalties against DEBT Box and its principals. Tracy Combs, the director of the SEC’s Salt Lake Regional Office, stated that DEBT Box and its principals lied to investors about various aspects of their unregistered offering of securities. The SEC claims that DEBT Box falsely represented its involvement in crypto asset mining and lied about the potential increase in token values through revenue-generating businesses.

Conclusion

The SEC’s temporary asset freeze and enforcement action against DEBT Box shed light on the alleged fraudulent node license scheme involving $50 million in unregistered securities. DEBT Box’s claims of generating crypto tokens through mining and increasing token values through revenue-generating businesses have been challenged by the SEC. Investors must exercise caution when engaging with crypto companies and thoroughly research their offerings to avoid falling victim to potential scams.

As the legal proceedings continue, the SEC’s actions serve as a reminder of the importance of regulatory oversight in the cryptocurrency industry. Investors should remain vigilant and seek reputable investment opportunities to protect their assets and avoid potential financial pitfalls.

![Best Crypto Exchanges for Day Trading [currentyear] - Top 6 Platforms 13 Best Crypto Exchanges For Day Trading](https://coinwire.com/wp-content/uploads/2023/10/best-crypto-exchanges-for-day-trading-1024x683.jpg)

![MEXC Referral Code ([currentyear]): Steps to Earn $1000 Sign-Up Bonus 14 Best Mexc Global Referral Code (Mexc-Cwrefcode)](https://coinwire.com/wp-content/uploads/2023/09/best-mexc-global-referral-code-featured-image-1024x683.jpg)

![MEXC Review [currentyear]: How Safe & Legit is MEXC Global? 15 Mexc Review](https://coinwire.com/wp-content/uploads/2023/09/mexc-review-1024x683.png)