With Binance, a major contender in the cryptocurrency exchange realm, gearing up to introduce Sei Network‘s intrinsic token – SEI – precisely at 12 PM UTC on August 15th, the world of crypto trading is rife with anticipation. As the imminent listing takes shape, SEI has already started creating ripples within the market, fueled by a resilient pre-listing futures market and well-calibrated strategies for future growth. In this article, we delve into the projected outcomes that traders can expect as SEI makes its debut on Binance, along with the ensuing progressions in the cryptocurrency domain.

Key Takeaways

- 3% of the SEI token supply allocated to the Season 1 airdrop (This is in 48% of the Ecosystem Reserve)

- There will be other airdrops in the future

- Sei Network won’t sell “ICO” or “community sale”

SEI Token’s Listing and Market Outlook

Binance’s decision to list SEI Network’s native token, SEI, marks a significant milestone for both the token and the cryptocurrency ecosystem. Based on data from Aevo’s pre-listing futures market, SEI is poised to launch with an anticipated trading price of 26 cents. This projection reflects the market’s initial sentiments towards SEI and sets the stage for its entry into the trading arena.

SEI Network has strategic plans beyond Binance, intending to launch its mainnet and secure listings on several other exchanges, including Bybit, Kucoin, Bitgetglobal, MEXC, Gate.io, and Kraken, among others. This comprehensive approach speaks to the platform’s ambition to establish SEI as a prominent player in the decentralized finance landscape. Notably, SEI’s climb to the 36th position on Binance Launchpool, raising $35 million, underscores its potential and market appeal.

Tokenomics Unveiled: Empowering the Community

Sei functions as a decentralized “Proof of Stake” blockchain, driven by the SEI token. The SEI token assumes a range of roles within the network:

- Network Fees: Facilitates the payment of transaction fees on the Sei blockchain.

- DPoS Validator Staking: Offers SEI holders the choice to delegate their holdings to validators or stake SEI for operating their own validator, enhancing network security.

- Governance: Empowers SEI holders to actively participate in the protocol’s future governance.

- Native Collateral: Provides the capacity for SEI to serve as native asset liquidity or collateral for applications built on the Sei blockchain.

- Fee Markets: Enables users to tip validators for transaction prioritization, fostering a reward-sharing mechanism with users who are delegating to that validator.

- Trading Fees: Facilitates the use of SEI as fees for exchanges constructed on the Sei blockchain.

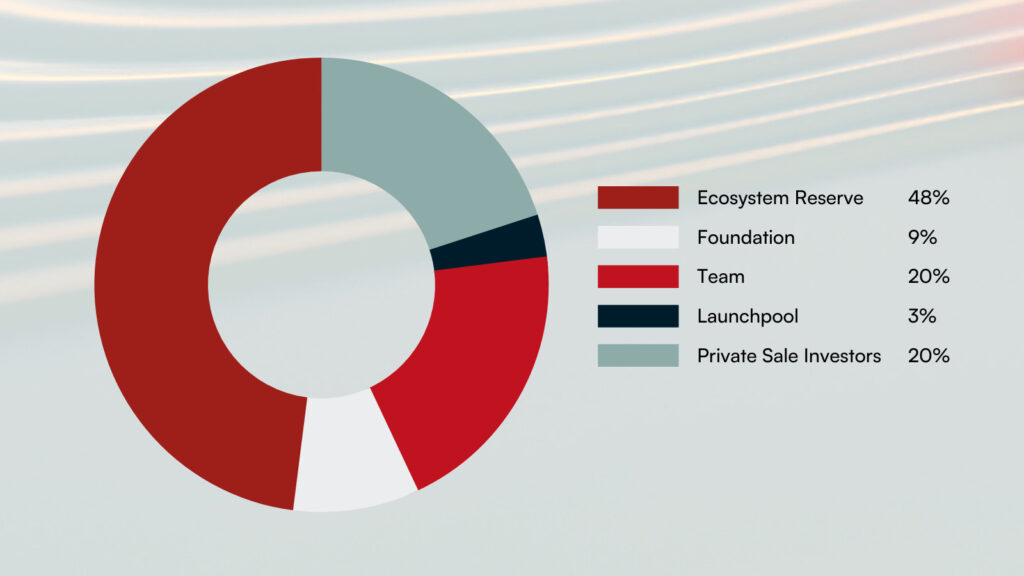

The total SEI token supply is capped at 10 billion tokens, with the majority strategically allocated to the community and projects advancing on Sei as detailed below:

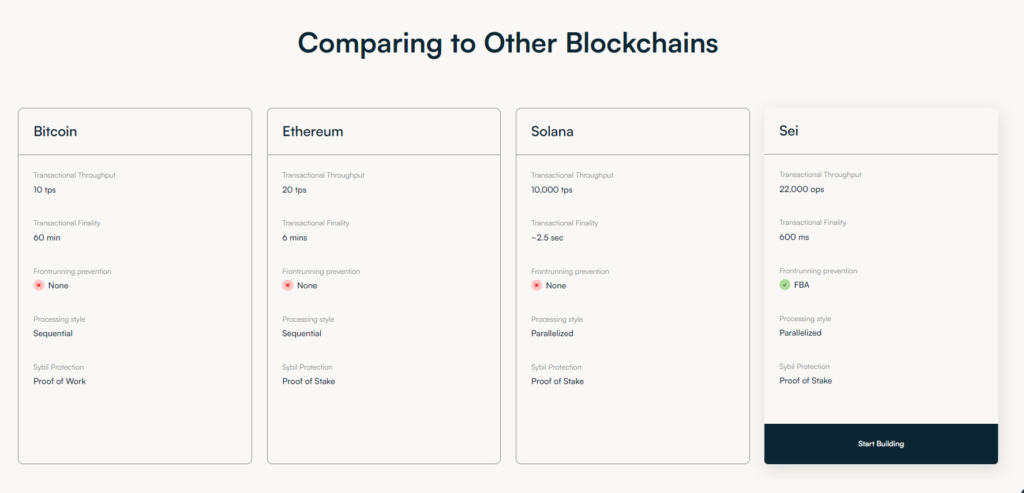

Comparing to Other Blockchains

SEI’s upcoming listing on Binance comes with distinct token metrics and trading instruments. The token’s circulating supply upon listing will consist of 1.8 billion tokens, a portion of the total supply of 10 billion. This distribution translates to an early market capitalization of $486 million, placing SEI in the ranks of the top 100 cryptocurrencies by market capitalization. An intriguing aspect of SEI’s launch is the planned airdrop distribution of 1% of the total supply to testnet participants, further engaging the community.

The Aevo platform, known for its pre-listing futures market, will adapt its offerings after SEI’s Binance debut. The transition to perpetual swaps introduces reference points for the index price, alongside funding rates that facilitate transactions between bullish long and bearish short positions. These mechanisms aim to align perpetual and spot prices, enhancing trading efficiency. Notably, sources reveal that the futures contracts will employ the dollar-pegged stablecoin USDC for margining and settlement.

About Funding Rounds Sei Network

Details:

- Token Name: Sei (SEI)

- Total Token Supply: 10,000,000,000 SEI

- Launchpool Token Rewards: 300,000,000 SEI (3% of total token supply)

- Initial Circulating Supply: 1,800,000,000 SEI (18% of the total token supply)

- Staking Terms: KYC required

Hourly Hard Cap per User:

- 33,333.33 SEI in BNB pool

- 6,250 SEI in TUSD pool

- 2,083.33 SEI in FDUSD pool

Trading pairs: SEI/BNB, SEI/BTC, SEI/FDUSD, SEI/TRY, and SEI/USDT

Furthermore, Binance Spot Grid will be enabled for the SEI/BTC, and SEI/USDT trading pairs within 48 hours of the trading start time. This addition will provide users with more digital asset investment opportunities on the platform.

Conclusion

SEI Network’s imminent token listing on Binance serves as a testament to the evolving dynamics of cryptocurrency trading. The market’s response to SEI’s pre-listing futures market indicates early optimism, while the platform’s extensive plans for mainnet launch and multi-exchange listings underscore its strategic vision. As traders gear up for SEI’s entry into the market, the involvement of prominent exchanges like Binance highlights the maturation of cryptocurrency trading practices. The SEI Foundation’s commitment to decentralization and incentivization further reinforces its position as a pioneering force in the Web3 application development landscape.