Camelot is a decentralized exchange (DEX) based on the Arbitrum network. Being relatively new in the space, it is good to know what this exchange offers. And in this Camelot DEX review, we will examine what is Camelot DEX, understand its features, security, benefits, and drawbacks, as well as its native coin, and show you how to open a Camelot account.

Exchange Overview

| Official Website | https://camelot.exchange/ |

| Launched in | 2022 |

| Native Token | $GRAIL |

| Supported Cryptocurrency | Ethereum (ETH) USD Coin (USDC) Camelot Token (GRAIL) Arbitrove Governance Token (ROVE) Factor (FCTR) DAI Stablecoin (DAI) Plutus DPX (plsDPX) VelaToken (VELA) Tether USD (USDT) Wrapped BTC (WBTC) |

| Fees | Trading fees ranging from 0.1-0.5% |

| 24-Hour Trading Volume | 10.28 M |

| Customer Support | Email and Telegram |

Pros and Cons

| Pros | Cons |

|---|---|

| Supports a wide variety of altcoins, mainly in the Arbitrum ecosystem. | Engaging in liquidity pools may lead to impermanent loss. |

| Has many ways in which users can earn, through yield farming and nitro pools. | The exchange seems complex for beginners. |

| Gives support for Arbitrum-based projects, thus expanding the ecosystem. | Like other decentralized exchanges, the platform is at risk of being hacked. |

| Liquidity pools in Camelot help facilitate decentralized lending and trading. | |

| The multi-sig factor in Camelot allows users to be secure while using the platform |

What is Camelot?

Camelot is a decentralized exchange mainly focused on the ecosystem and the community, built on Arbitrum. Started in 2022, the name Camelot comes from King Arthur’s Camelot Palace, symbolizing the Round Table. As such, the users and projects that use Camelot to build liquidity pools are “Knights,” symbolizing the knights of the Round Table.

The structure of the exchange constitutes a highly efficient and customizable protocol. It paves the way for builders and users to have deep, sustainable, and adaptable liquidity. The exchange also brings a new way of thinking to DEXs, with a focus on offering a customized approach that puts composability first. So, they are different from regular DEXs because they offer special features like Nitro Pools and spNFTs.

What’s more, Camelot aims to partner with and bring on native Arbitrum projects through their DEX and launchpad features.

Camelot DEX allows protocols to define structured trading fees within their pools, such as dynamic directional fees. On the other hand, spNFTs are wrapped liquidity tokens that give more options to liquidity providers. It enables them to create lock durations for liquidity and utilize Camelot’s plugin features for a multiplier on their yield.

The exchange also assists new projects by offering guidance on structuring a fair launch based on their unique goals. As a result, they obtain liquidity and token listings seamlessly.

Read more: Top 10 Best DEX – Which One Has the Lowest Fees?

Camelot’s Key Services and Features

One essential factor is that Camelot is a unique and highly efficient decentralized exchange built to support and be the native DEX of the Arbitrum ecosystem. It does so by building a resilient and sustainable DEX. As such, it orients the community and optimizes capital for investors. It does so through some key features. Let’s explore these key features.

Automated Market Maker (AMM)

AMM is the core system of the Camelot ecosystem. Its development orientation follows the following methods:

- Dual liquidity: Create a high degree of flexibility and customization.

- Active in fees: Improve transaction efficiency, and optimize fees for users.

- Referral: Support other protocols in the ecosystem to generate more profit.

Besides, AMM allows the trading of digital assets in an automatic and permissionless manner through liquidity pools. As such, it ends up replacing traditional markets of buyers and sellers.

Before engaging, you should understand the benefits and drawbacks of providing liquidity.

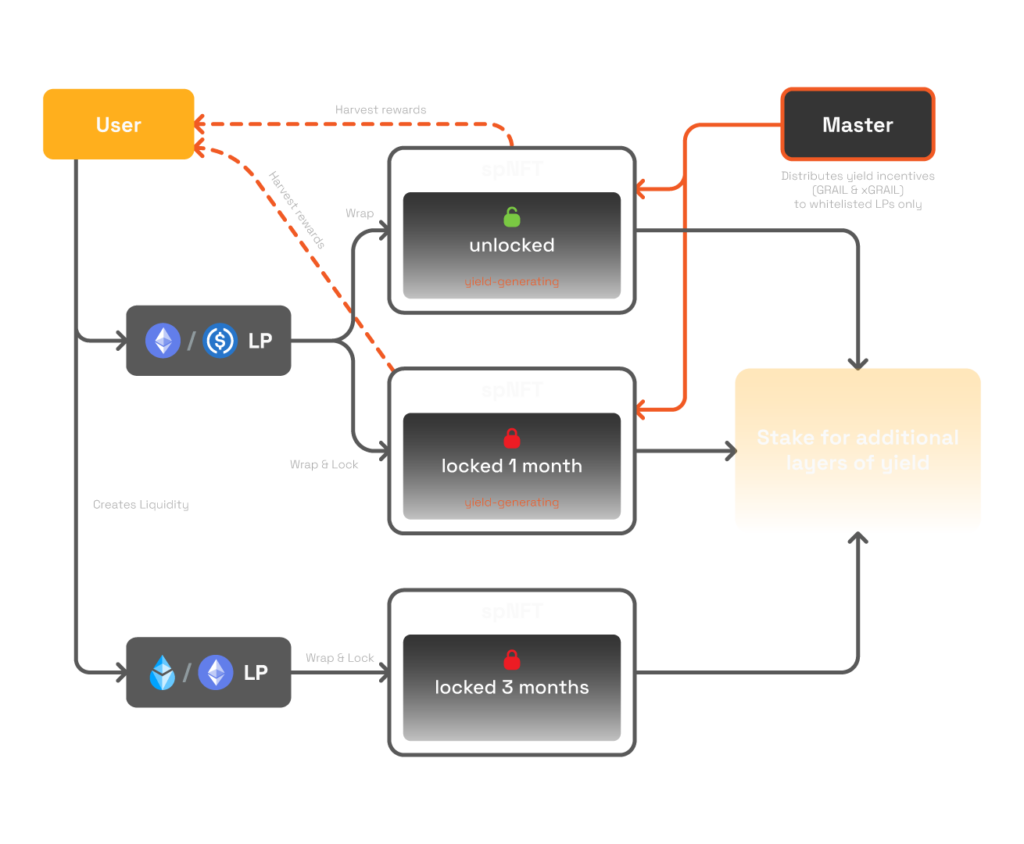

Stake Positions (spNFTs)

Camelot develops a new liquidity approach with “staked position Non-Fungible tokens,” dubbed spNFTs. With spNFTs, each Camelot liquidity pool has its own staking positions (in this case, spNFTs) that users can mint by wrapping liquidity pool tokens.

spNFTs are treated as a deposit receipt by users and have improved features compared to regular liquidity providers in that;

- They have a unique ID

- They have full parameters of the user’s position, such as the number of tokens

- Provide the value of tokens

- They have an annual percentage yield (APY) and lock time with Multipliers Point

Staked positions act as wrapping layers on the liquidity provider tokens, providing virtually any liquidity or a single asset. spNFTs users can create advanced custom strategies through an unlimited number of different staked positions for the same liquidity pool. One can do this with different amounts, lock settings, or boost mechanisms.

Yield Farming

As Camelot has a dual liquidity mechanism, users who provide liquidity will receive rewards from the liquidity pool, resulting in “yield farming.” Additionally, they will be in an incentive program with rewards of $GRAIL and xGRAIL, having a ratio of 80/20, respectively.

The exchange has two primary ways that one can boost returns from yield-generating staked positions:

- Through locks, where users lock their assets for a certain period to earn rewards for their tokens.

- Through the YieldBooster plugin, users can use their xGRAIL for a staking position (spNFT) for profit.

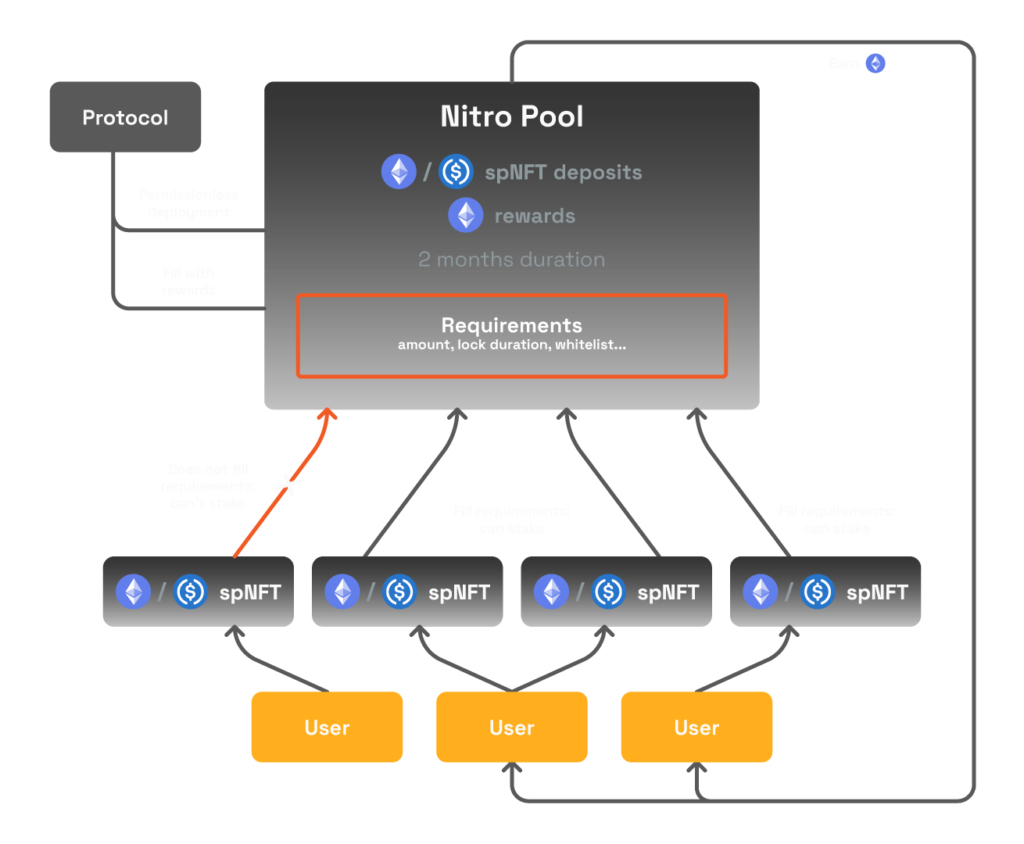

Nitro Pools

Nitro pools signify a place to create pools that provide liquidity for Camelot’s partner projects and the user community. In addition to the reward from providing liquidity, the project also creates a new reward layer in ETH in the Nitro Pool. This, in turn, encourages liquidity for the projects inside. After staking in a Nitro pool, users will earn PLS emissions, xGRAIL, and GRAIL all at once.

There are two types of Nitro Pools:

- Official Nitro Pools: Created by Camelot

- Community Nitro Pools: Can be created by anyone

The liquidity for projects in the Arbitrum ecosystem is limited. As such, it is a perfect way to encourage liquidity for Camelot’s partner projects. In this way, Camelot will likely be the largest liquidity center for existing partner projects such as GMX, Buffer Finance, Sperax, JonesDAO, Dopex, etc.

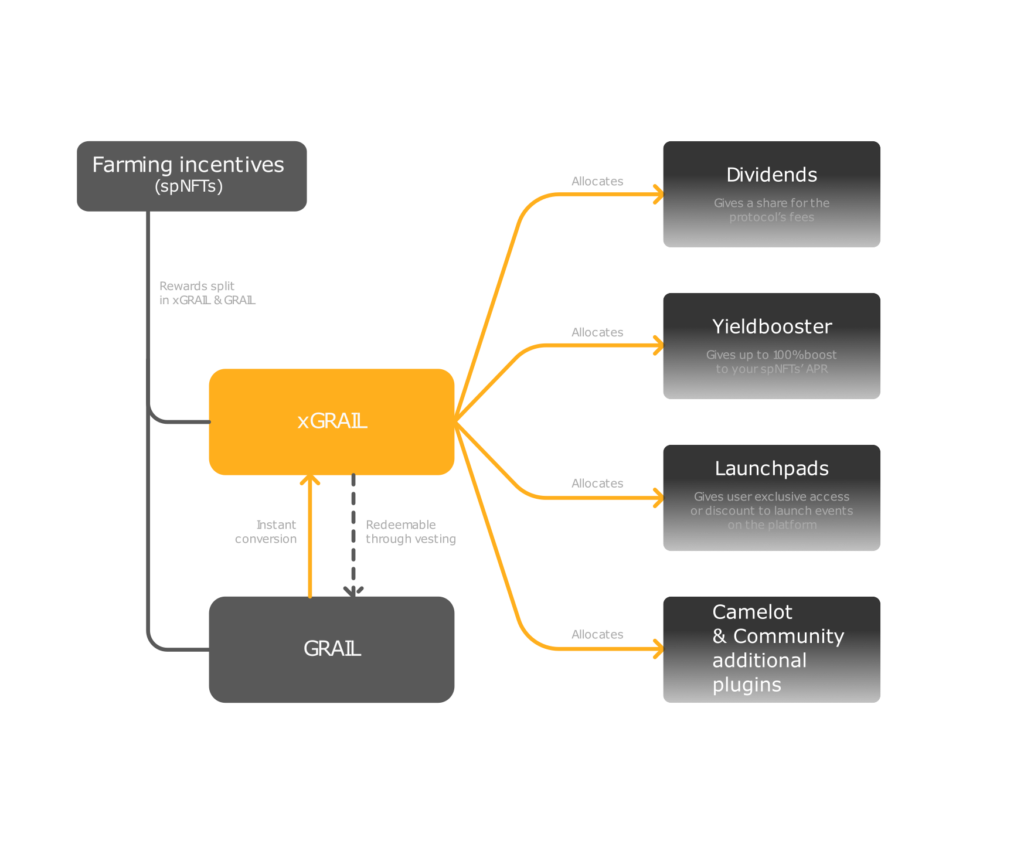

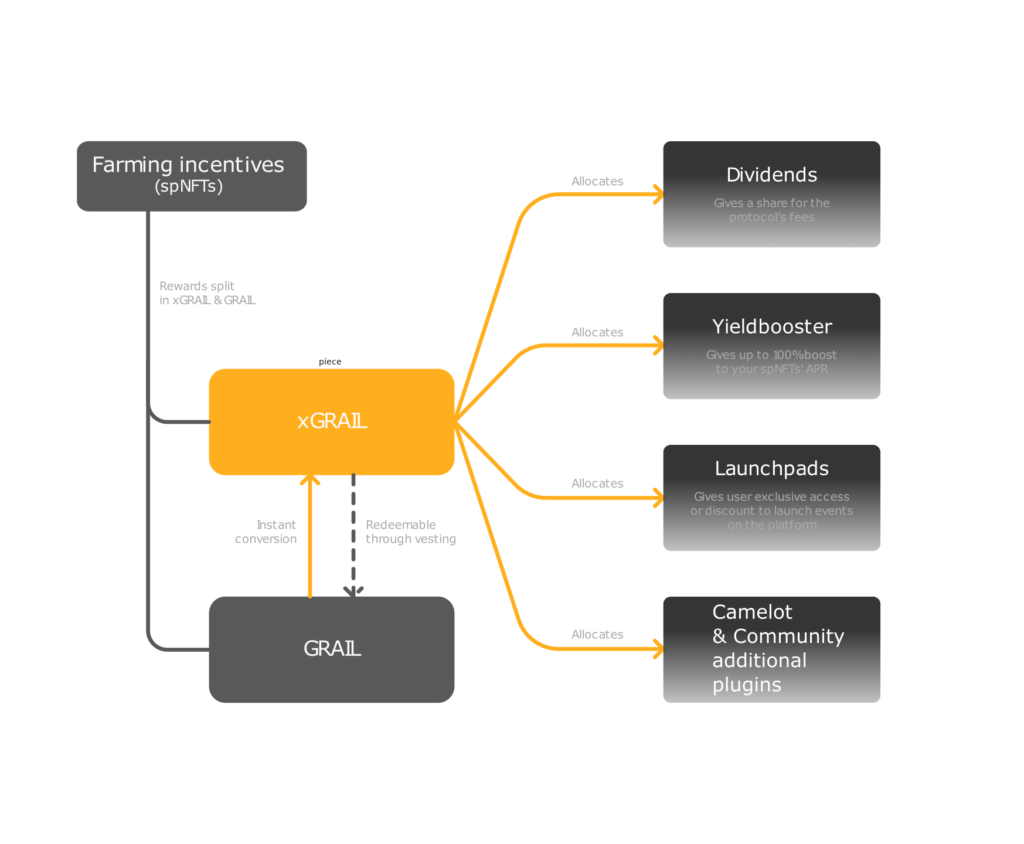

xGRAIL Plugins

xGRAIL plugins are contracts linked to the xGRAIL contract. Anyone in the Camelot ecosystem can integrate these plugins. However, the responsibility of creating the original plugins falls on the Camelot team.

Some of the plugins include:

- Dividends Plugin– The majority of the earnings from the protocol are redistributed to users in the form of xGRAIL through this plugin. Dividend distribution happens continuously in each weekly cycle.

- YieldBooster Plugin– Through this plugin, users can use their xGRAIL for a staking position (spNFT) to earn more profits.

- Community Plugins– Constitute plugins deployed by any other protocol or user. However, users must be careful with such plugins as third parties authorize them. Hence, Camelot will not be responsible for such plugins, which demand much care when approving new contracts to avoid unnecessary losses.

Governance and DAO

Community members can use their xGRAIL balance to act as a governance token. The token allows them to vote for official proposals. As such, more xGRAIL represents more voting power. This process does not require any transactions and is gasless.

When the community approves a proposal through this process, a DAO consisting of team members and advisors executes the necessary contracts or transactions and makes the final decision.

Revenue

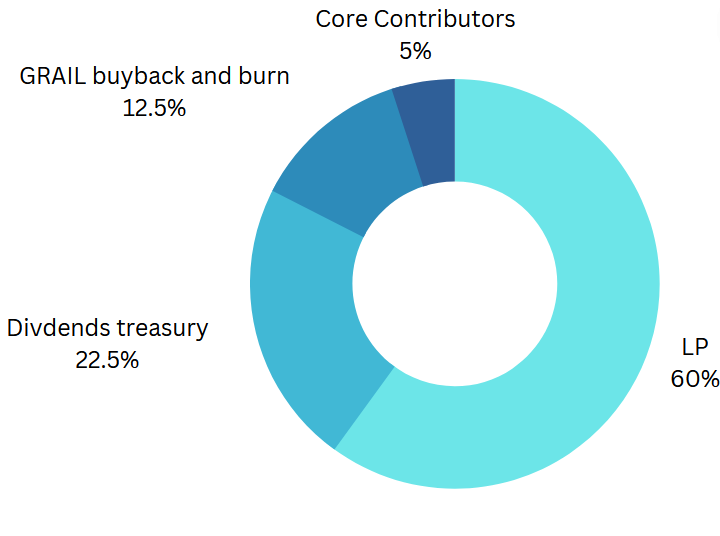

The primary source of Camelot’s exchange is its transaction fees. The main fees come from their Launchpad projects or fees emanating from spNFT or Nitro Pools users.

The distribution of the revenue collected will be as follows:

- Bonus for liquidity providers will be 60%

- The payout for xGrail holders will be 22.5%

- Buyback and burn of Grail will be 12.5%

- Excerpts for core contributors will be 5%

Camelot Native Token

What is Grail and xGrail Token?

Coinciding with the official launch of Camelot Exchange was the public sale of the Camelon Token ($GRAIL). The token is mainly there to increase project awareness and secure financial reserves that will help develop the project further. It is important to note that the GRAIL token has a maximum supply of 100,000, which makes it relatively scarce.

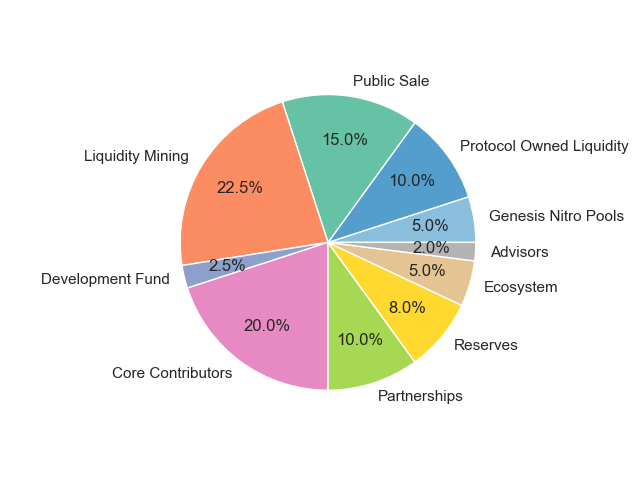

At the genesis, 15% of the public sale was distributed upfront (5% xGrail and 10% GRAIL). 10% of the public sale goes to protocol-owned liquidity, and 5% goes to the Genesis Nitro Pools. 22.5% goes to liquidity mining over the next three years; 20% goes to the core contributors over three years; 10% goes to partnerships; 8% goes to reserves; 5% goes to the ecosystem; 2% goes to development; and 2% goes to advisors.

It is essential to take note of xGRAIL, which is the escrowed token and is non-transferable. Users can earn xGrail from yield-generating staking positions or by converting their GRAIL assets. xGRAIL is the governance token and can be used to stake in dedicated contracts through plugins to unlock multiple benefits.

Should You Buy Grail and xGrail?

Holding Grail and xGrail allows users to earn yield rewards, allocate xGrail to Plugins for benefits, and participate in governance through voting power. Nevertheless, there is also a need to consider the vesting period and deflationary measures established in tokenomics.

To benefit, users can allocate their xGrail to plugins, but it cannot be used for anything else. Users can also redeem xGrail for Grail, but the process involves vesting. In the process, users can choose the duration of which xGrail can be used for governance, with more xGrail equating to more voting power.

Furthermore, Grail and xGrail tokens have several deflationary measures, which decrease the overall supply. For example, Grail tokens are reserved for buyback and burn, which continuously raises the buying pressure. When xGrail is redeemed with a vesting period shorter than the maximum, excess Grail is burned. Additionally, when there is a deallocation of xGrail from a plugin, a deallocation tax is imposed, and a corresponding Grail amount is destroyed.

As such, Grail and xGrail aim to encourage staking and involvement in the Camelot ecosystem, offer advantages to token holders and gradually decrease the token supply.

Grail Tokenomics and Price Performance

Holders of the token continue to grow, this week recording a 11% rise to around 15,371 holders. There are a total of 4,952 dividend allocators, with most users allocated less than 1 Grail.

The protocol’s revenue is falling around 33% recently. It is vital to note that revenue in the past is valued with prices from the past. There may be upcoming burns, with a 14 days outlook, with a lot less fast-redemptions coming through. Up to 183 Grail could be burned in the next 14 days through redemptions. In total, 1,617.41 Grail has been burned through redemption burns, deallocation burns, and buyback burns.

Grail is trading at $1,573, with a 24-hour trading volume of $5,170,073. Grail is -1.78% in the last 24 hours. It is currently -28.89% from its 7-day all-time high.

From its launch on December 7, 2022, Camelot’s Grail has hit $11 million in liquidity from an initial $4 million. In addition to Camelot DEX, Grail is also live on multiple exchanges including MEXC Global, BingX, Uniswap (Abitrum One), and Bitget. Camelot DEX remains to be the top exchange in terms of Grails’s trading volume.

Fees

| Deposits | Zero fees |

| Trading and swapping | 0.1-0.5% depending on the type of asset being traded |

| Directional fee | 0.001% on the buy side and 2% on the sell-side |

Camelot’s Security

Currently, there are two major disclosed code audit reports found in its document. The two were done by Paladin, which included the smart contract codes for Grail and xGrail. The audit also includes major codes related to primary infrastructure like YieldBosster and Nitro pool. Investors should feel safe because the problems discovered have been fixed by the Camelot team.

Why Should You Use Camelot?

Camelot has distinct features that you, as a crypto trader and enthusiast, may miss. The exchange provides a variety of features and services to assist investors in increasing their profit margins. Camelot also provides cutting-edge functionality that can be easily integrated, built upon, and leveraged by other protocols in the ecosystem.

The platform also applies the real yield narrative to a DEX and liquidity provisioning. This creates innovative strategies that leverage more sustainable tokenomics, aligning incentives with builders, users, and the protocol.

How to Buy Grail

Here is how to buy Grail on KuCoin. Use this link to get a mystery box worth up to $500.

Step 1: Click on the link above and log in or create a new KuCoin account if you don’t have one and click TRADE NOW.

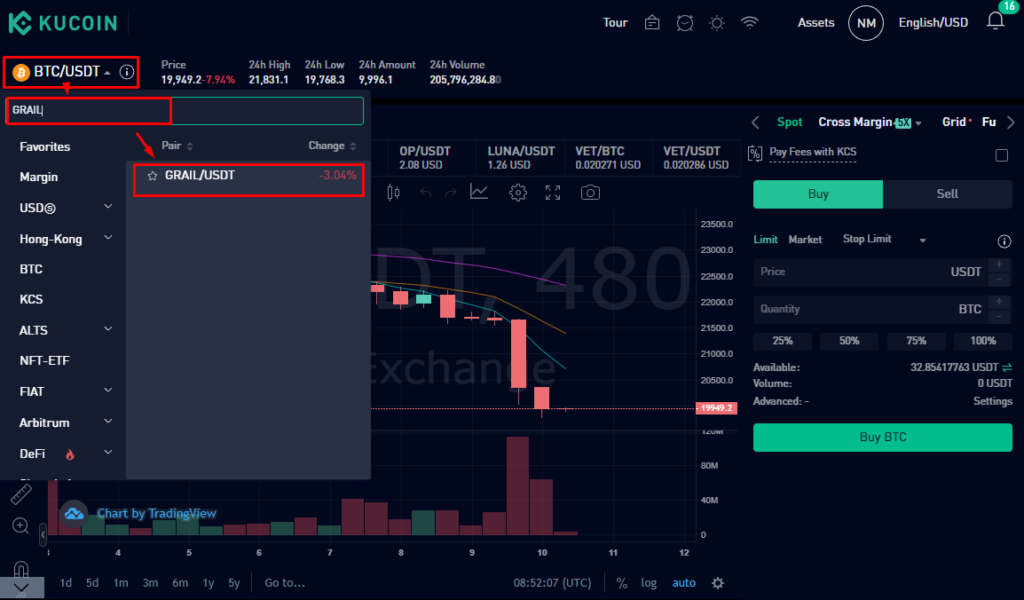

Step 2: You will be taken to your Spot Trading. Here make sure you have funds. Then Search for Grail below the KUCOIN logo on the top left, and click GRAIL/USDT.

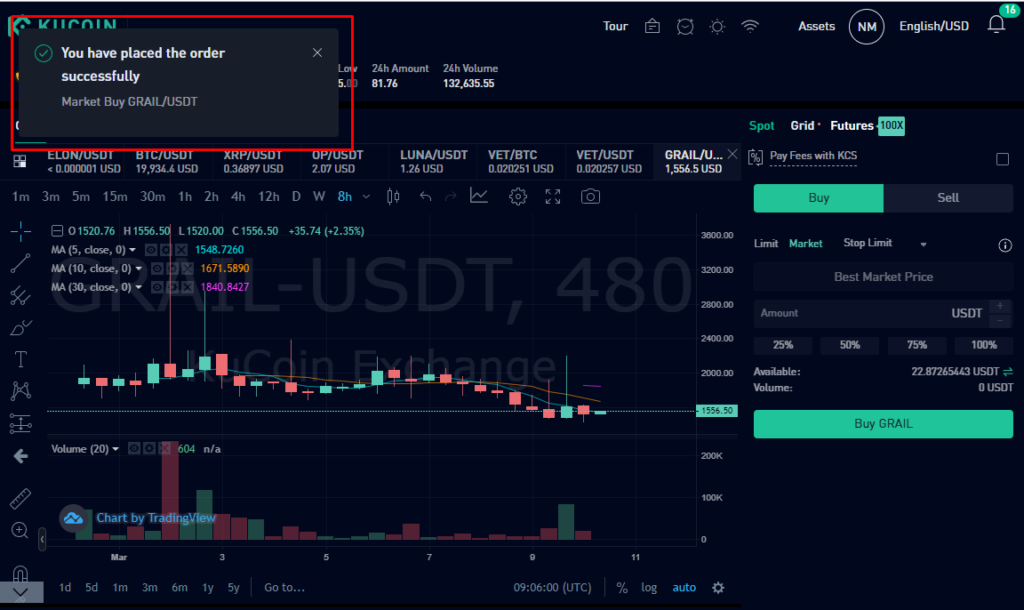

Step 3: On the right side Click Market, enter the amount of GRAIL you want to buy and click BUY GRAIL.

Step 4: If the transaction went through you will see the you have placed the order successfully.

How to Swap on Camelot

Camelot’s Systems Ensure a Long-Term Sustainability

The setup of a supply hard cap, carefully crafted emissions, and additional deflationary mechanisms ensure the long-term sustainability of Camelot’s tokenomics. Additionally, the exchange contributes to the steps toward total decentralization, allowing the community to drive the protocol forward as a DAO.

![Bybit Review [currentyear]: Exchange Features, Fee, Pros and Cons 40 Bybit Featured Image](https://coinwire.com/wp-content/uploads/2022/06/Bybit-review-1024x683.png)