The world of cryptocurrency is abuzz with the possibility of XRP‘s resurgence in the United States, driven by the potential adoption of Ripple’s On-Demand Liquidity (ODL) system by major banks. Notably, crypto lawyer John E. Deaton recently discussed how banks could utilize XRP via ODL, shedding light on the evolving landscape of XRP regulation and adoption. This follows a significant legal development where a U.S. judge clarified the status of XRP, offering hope for its broader utility.

XRP’s Legal Clarity and the Role of ODL

In a pivotal legal case, U.S. District Judge Torres issued a ruling that was seen as both a victory and a compromise for Ripple and the U.S. Securities and Exchange Commission (SEC). The judge determined that token sales to institutional investors should be considered securities, marking a crucial distinction. This decision has sparked optimism that banks may soon leverage Ripple’s ODL within the United States.

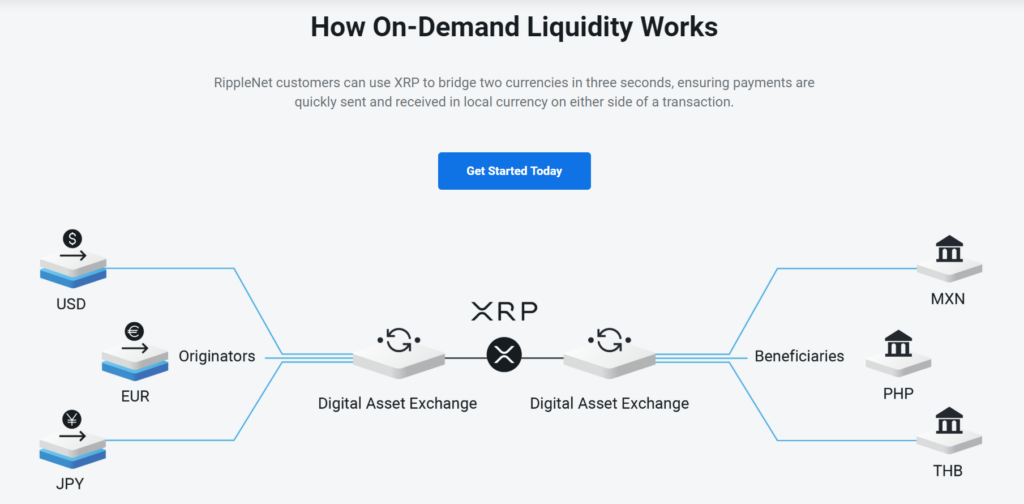

ODL, short for ‘On Demand Liquidity,’ is Ripple’s flagship cross-border payment system. It employs Ripple’s token to facilitate seamless transactions between sending and receiving entities, all without direct involvement from Ripple. This is in contrast to Ripple’s Liquidity Hub, where the company plays a more active role in facilitating transactions. The absence of XRP in the Liquidity Hub has drawn criticism from some quarters.

Exploring Opportunities for Banks to Embrace ODL

John E. Deaton believes that banks could embrace ODL, given that they are not making investments in Ripple’s token but merely utilizing it as a bridge currency. When employing ODL, XRP is not held, and there’s no need for prefunding, as seen in nostro and vostro accounts. Deaton argues that the swift nature of ODL transactions makes it unlikely for anyone to profit from the token within such a short timeframe.

For instance, Deaton suggests that a bank like Bank of America could acquire Ripple’s token from platforms like Coinbase or Uphold and use it as they see fit before potentially reselling it. This approach aligns with the concept of XRP as a bridge currency, a viewpoint shared by even SEC Chair Gary Gensler back in 2018.

While the legal landscape for Ripple’s token continues to evolve, with a scheduled jury trial in 2024 regarding Ripple CEO Brad Garlinghouse and Executive Chairman Chris Larsen’s roles, the SEC’s focus remains on “aiding and abetting” Ripple in its sales to institutional investors. Importantly, the SEC is not challenging the token’s status itself, emphasizing that it is essentially computer code with no inherent value.

Conclusion

As discussions around XRP’s regulatory status continue, the possibility of its finding renewed utility in the United States through Ripple’s ODL system remains a tantalizing prospect. Major banks exploring ODL as a bridge currency could be a game-changer, offering a fresh perspective on the role of XRP in the evolving cryptocurrency landscape. While legal proceedings continue, XRP’s value has held steady, signaling potential for growth in the near future as its use cases expand.