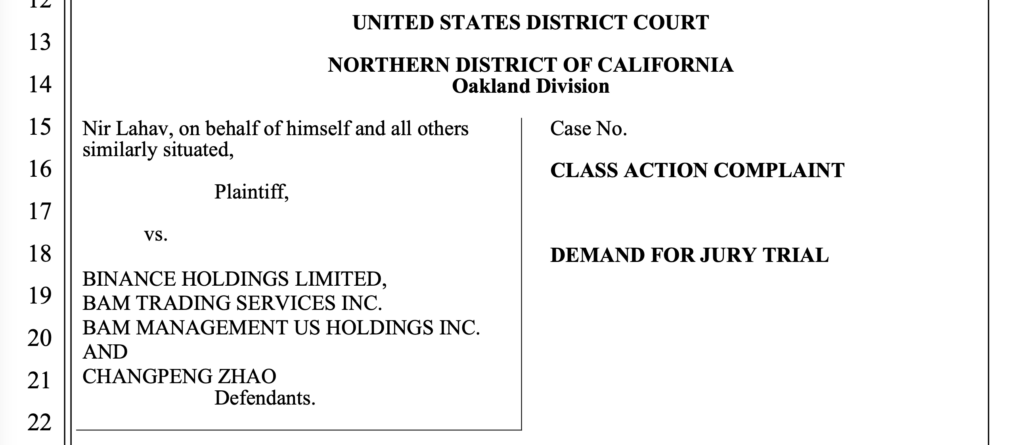

Binance, one of the world’s leading cryptocurrency exchanges, and its CEO Changpeng Zhao are facing a class-action lawsuit filed by a California resident. The lawsuit, filed in the District Court of Northern California, alleges that Binance and Zhao violated federal and California laws on unfair competition. The plaintiff, Nir Lahav, claims that tweets by Zhao in November led to the collapse of FTX, a rival cryptocurrency exchange, sparking a heated legal battle in the crypto world.

Allegations and X (Formerly Twitter) Posts Leading to FTX Collapse

The lawsuit revolves around tweets made by Changpeng Zhao on X (Formerly Twitter) in early November, coinciding with the collapse of FTX. These tweets, coupled with the exchange’s decision to liquidate its holdings in FTX’s utility token FTT, allegedly caused significant harm to FTX. The plaintiff estimated that Binance owned up to 5% of all FTT tokens. Zhao’s statements about Binance’s intent to acquire FTX and subsequent withdrawal from the deal were cited as crucial factors contributing to FTX’s downfall.

According to the lawsuit, these actions were not in good faith and led to a sharp decline in FTT’s market price, ultimately pushing FTX into bankruptcy.

Legal Claims Against Binance and Demands for Compensation

The class-action suit filed against Binance and Zhao lists seven counts, including violations of federal and state laws related to unfair competition. The plaintiffs are seeking monetary damages, court costs, and disgorgement of ill-gotten gains. The lawsuit alleges that the leading cryptocurrency exchange attempted to monopolize the cryptocurrency market by harming its competitor FTX, resulting in substantial losses for investors. The plaintiffs argue that these actions were deliberate and led to the collapse of FTX without giving the exchange’s executives an opportunity to salvage the situation and protect their clients and users.

Conclusion

The legal battle between Binance and FTX continues to unfold, with both exchanges also facing scrutiny from regulatory authorities. As the case progresses, it raises important questions about fair competition and ethical practices within the cryptocurrency industry. The outcome of this lawsuit could have significant implications for the future of cryptocurrency exchanges, underscoring the need for transparency, accountability, and adherence to regulatory guidelines in the rapidly evolving world of digital assets. The crypto community awaits further developments in this high-stakes legal confrontation.

![Best Crypto Copy Trading Platforms in [currentyear] (Free & Profitable) 6 Best Crypto Copy Trading Platforms](https://coinwire.com/wp-content/uploads/2023/06/best-crypto-copy-trading-platform-1024x683.jpg)

![BingX vs KuCoin [currentyear]: Features, Fees, and Security 9 Bingx Vs Kucoin](https://coinwire.com/wp-content/uploads/2024/05/bingx-vs-kucoin-1024x683.jpg)