Bitcoin and Ethereum ETF trading has been made available to clients of HSBC, the largest bank in Hong Kong. This groundbreaking move not only positions HSBC as the first bank in Hong Kong to facilitate ETF trading but also expands the accessibility of cryptocurrencies for residents of the region. With the introduction of Bitcoin ETFs gaining traction in the crypto industry, HSBC’s decision highlights the growing acceptance of digital assets within the financial sector.

HSBC Enables Bitcoin and Ethereum ETF Trading, Expanding Access to Cryptocurrencies in Hong Kong

HSBC’s recent announcement represents a significant milestone for the cryptocurrency industry in Hong Kong. By allowing clients to buy and sell Bitcoin and Ethereum ETFs, the bank has paved the way for broader access to digital assets. This move comes at a time when Bitcoin ETFs have been attracting attention globally, with numerous platforms seeking approval for similar products in the United States.

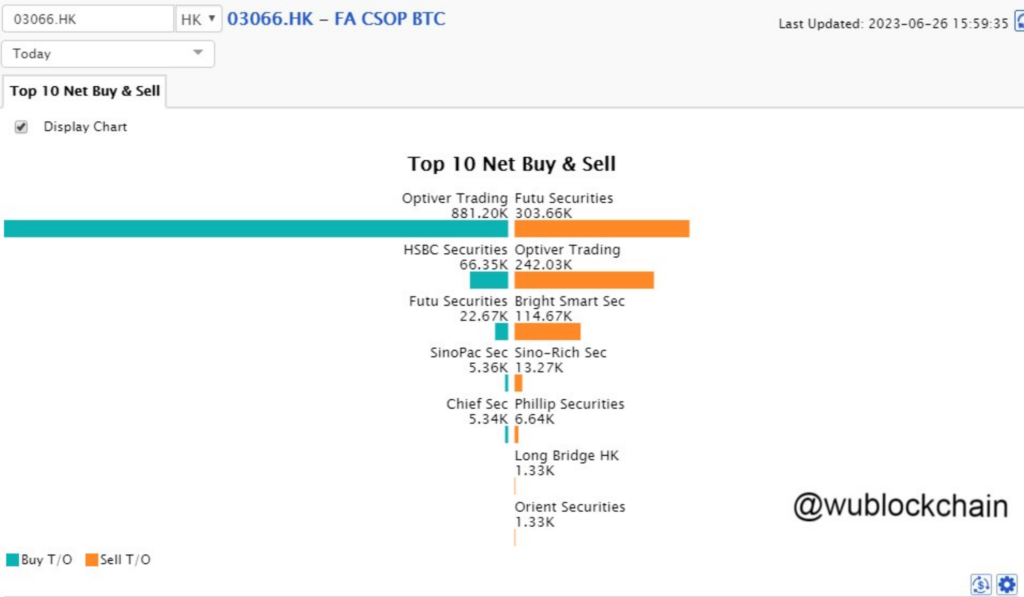

HSBC’s decision to facilitate ETF trading marks a historic moment in the banking industry of Hong Kong. While investors in the region already had access to cryptocurrency ETFs like the CSOP Bitcoin Futures ETF and CSOP Ethereum Futures ETF, HSBC’s entry into the market expands the range of options available. This move demonstrates a shift in attitude toward digital assets, as banks had previously been cautious about engaging with cryptocurrency exchanges due to concerns related to money laundering and potential involvement in unlawful activities.

HSBC Launches Virtual Asset Investor Education Centre to Promote Crypto Knowledge and Risk Awareness

In addition to enabling ETF trading, HSBC has taken a proactive step by launching the Virtual Asset Investor Education Centre. With this initiative, the bank emphasizes the importance of educating clients about virtual assets and ensuring they have a comprehensive understanding of the associated risks. Investors are required to review and confirm educational materials and risk disclosures provided by the Virtual Asset Investor Education Centre before engaging in virtual asset-related products through HSBC’s digital banking platforms.

Read more: The First Leveraged Bitcoin Futures ETF To Be Approved by SEC in the US

Conclusion

HSBC’s decision to enable Bitcoin and Ethereum ETF trading in Hong Kong marks a significant development in the cryptocurrency landscape. As the first bank in the region to embrace ETFs, HSBC has expanded access to digital assets for Hong Kong residents.

By simultaneously launching the Virtual Asset Investor Education Centre, the bank demonstrates its commitment to educating clients about virtual assets and mitigating associated risks. This move aligns with Hong Kong’s regulatory efforts to embrace the crypto industry and highlights the growing acceptance and integration of digital assets into the traditional financial system.