As Bitcoin continues to hover near 18-month highs, market observers are noting a surprising absence of the feared “fear of missing out” (FOMO) phenomenon, despite the cryptocurrency’s impressive 120% surge in price this year. The dynamics of Bitcoin’s profitability reveal intriguing insights into the current state of the market and the behavior of investors.

On-Chain Transactions and the Youthful Movement of Bitcoin

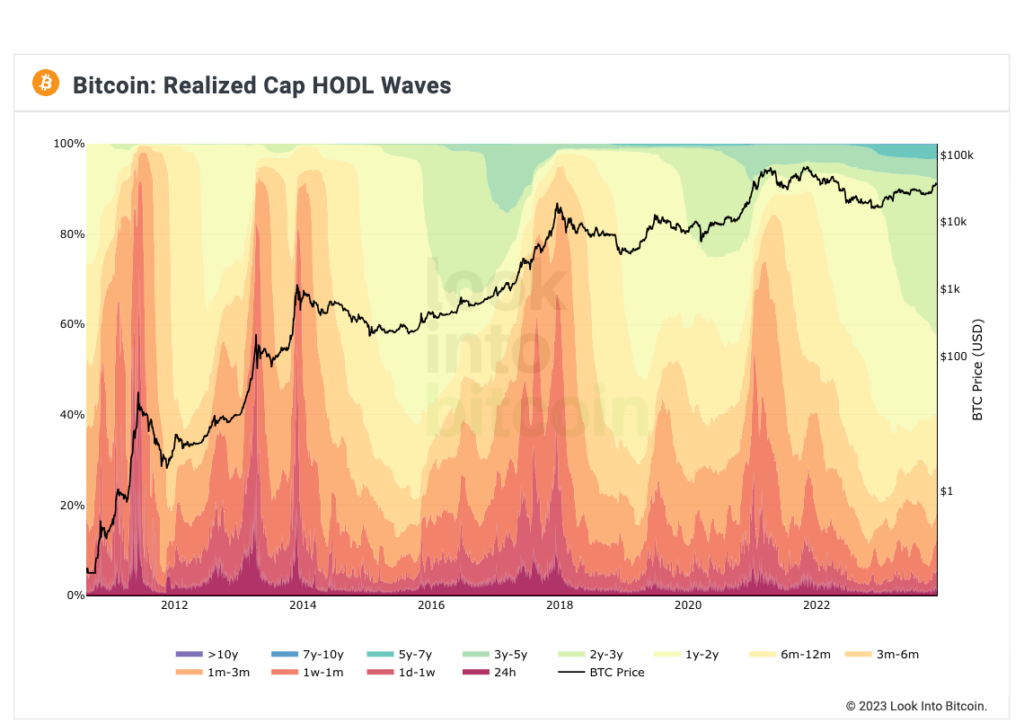

Data from Look Into Bitcoin indicates that on-chain transactions are showing a notable involvement of “younger” Bitcoin, suggesting the participation of newer market entrants. While smaller wallets are on the rise, there has not been a significant return of speculators to the network—those who typically hold Bitcoin for shorter periods. Look Into Bitcoin creator Philip Swift points to the Realized Cap HODL Waves metric, or RHODL waves, as evidence of this trend. The warmer colors in low timeframe waves are only just beginning to increase, indicating a lack of FOMO and suggesting that the market may still be in its early stages.

Read more: CoinShares Secures Option for Valkyrie’s Crypto ETF Unit Amid U.S. Regulatory Shifts

Bitcoin Profitability Nears a Potential Breakeven Point

Examining Bitcoin supply across different age bands, CryptoQuant’s Onchained highlights that those who increased their exposure to BTC in the lead-up to the 2021 all-time highs are currently underwater. The net unrealized profit/loss (NUPL) indicator, which offers profitability ratios for different cohorts of stored coins, reveals that all UTXO age bands are currently in a profitable state, except for holders with bitcoins held for 18 months to 3 years. However, CryptoQuant data suggests that this group may approach a potential breakeven point if Bitcoin continues its rally beyond $39,000, with their NUPL nearing the profitability benchmark of 0. The overall proportion of unspent transaction outputs (UTXOs) at a loss is currently at a modest 11.6%.

Read more: Grayscale in Talks with SEC on Spot Bitcoin ETF Approval

Conclusion

Despite Bitcoin’s impressive performance this year, the market appears to be lacking the FOMO typically associated with bull markets. The analysis of on-chain transactions and profitability dynamics suggests that the market may still be in its early stages, with potential shifts on the horizon as Bitcoin approaches the key $39,000 profit zone. As the cryptocurrency landscape continues to evolve, investors are closely monitoring these indicators to navigate the unique dynamics of the current bull market.

![Pionex Review ([currentyear]): Trading Bots, Fees, and Pros & Cons 9 Pionex Review Featured Image](https://coinwire.com/wp-content/uploads/2023/08/pionex-review-featured-image-1024x683.jpg)

![Best Crypto Exchanges in UAE and Dubai to Buy Bitcoin ([currentyear]) 10 Best Crypto Exchanges In Uae And Dubai Featured Image](https://coinwire.com/wp-content/uploads/2024/01/best-crypto-exchanges-in-uae-and-dubai-featured-image-1024x683.jpg)

![Cardano vs Solana ([currentyear]): Is Cardano or Solana better? 11 Cardano Vs Solana Featured Image](https://coinwire.com/wp-content/uploads/2023/06/cardano-vs-solana-featured-image-1024x683.jpg)

![Paybis Review ([currentmonth] [currentyear]): Is It Safe and Legit? 12 Paybis Review Featured Image](https://coinwire.com/wp-content/uploads/2024/05/paybis-review-featured-image-1024x683.jpg)