Bitcoin again breached the $1 trillion market cap threshold as its price surged above $51,000. The current circulating supply of Bitcoin is 19,627,443 BTC, constituting 93.46% of its total hard-capped supply of 21 million. Positive investor sentiment, fueled by a sustained bull market and recent exchange-traded fund (ETF) approvals in the United States, has played a pivotal role in this significant market milestone.

Sustained Price Appreciation Fueled by Increased Investments

The surge in Bitcoin’s market value is attributed to the rising positive sentiment among both individual and institutional investors. The recent approval of spot Bitcoin ETFs in the United States has added to the optimistic atmosphere, providing further legitimacy to Bitcoin as a viable investment asset. This sustained price appreciation mirrors the cryptocurrency’s resilience and growing acceptance within the broader financial landscape.

Bitcoin had previously achieved the $1 trillion market cap milestone in November 2021 during a bullish period that propelled it to a momentary all-time high of $69,000. The surge wasn’t limited to Bitcoin alone, as the entire crypto ecosystem recorded a combined market capitalization of $3 trillion for the first time.

Read more: MicroStrategy Expands Bitcoin Holdings to $8.1 Billion with $37 Million Purchase in January

Bitcoin Halving and its Impact on Market Dynamics

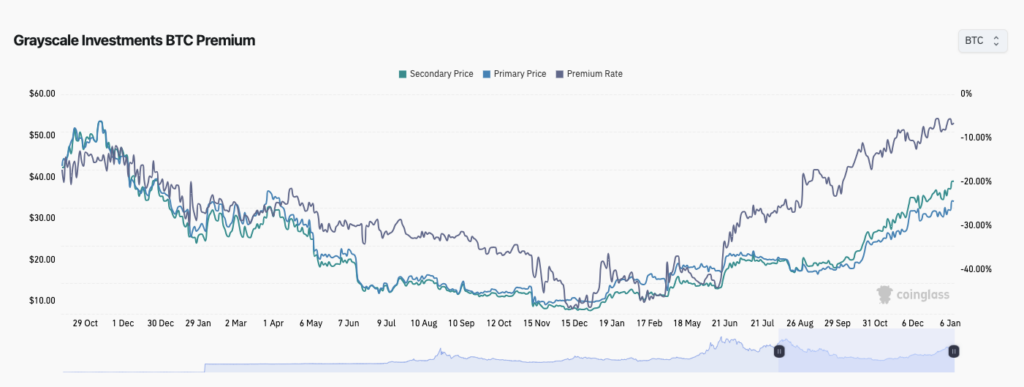

The upcoming Bitcoin halving is anticipated to be a significant factor influencing the cryptocurrency’s market price. According to a Grayscale analysis, Bitcoin ETFs can potentially alter the demand-supply dynamics, counteracting the selling pressure associated with the halving. Currently, with a mining rate of 6.25 Bitcoin per block, maintaining the market prices would require approximately $14 billion in annual buy pressure.

Post-halving, when the mining reward decreases to 3.125 Bitcoin per block, the annual buy pressure is expected to decrease to $7 billion, effectively alleviating the selling pressure. This analysis underscores the importance of Bitcoin’s price in supporting the operational costs of the mining community and ensuring the viability of the mining business model.

Conclusion

Bitcoin’s latest achievement of surpassing a $1 trillion market cap reaffirms its position as a significant player in the financial markets. The interplay of positive investor sentiment, institutional adoption, and regulatory developments, coupled with the impending Bitcoin halving, continues to shape the cryptocurrency’s market dynamics. As Bitcoin maintains its upward trajectory, the crypto community eagerly anticipates how these factors will contribute to the evolving narrative of digital assets in the global financial landscape.