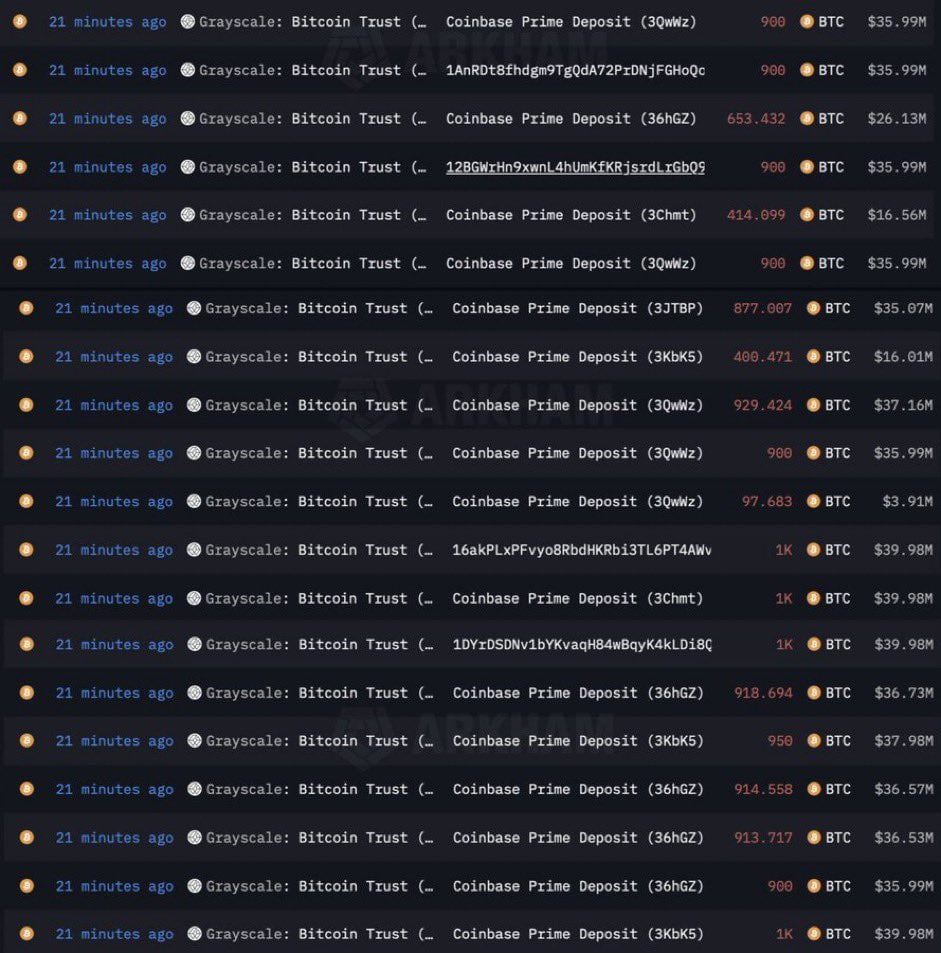

Bitcoin’s price landscape has faced increased volatility this week, with outflows from Grayscale’s Bitcoin Trust (GBTC) surpassing $1 billion per day. The movement of more than 113,000 Bitcoin from GBTC’s wallet since the launch of spot Bitcoin ETFs on Jan. 11 has put additional strain on the market. Notably, the majority of these transfers were directed to Coinbase Prime in preparation for potential sales, according to data compiled from Arkham.

Grayscale’s GBTC Outflows Amidst Fee Adjustments

Grayscale’s website revealed that GBTC now holds approximately 537,000 Bitcoin, marking a reduction of around 100,000 BTC since Jan. 11. The accelerated outflows from GBTC are attributed to several factors, with one significant driver being Grayscale’s decision to cut its management fee by 50 basis points to 1.50% post the conversion to a spot ETF. Despite this reduction, the management fee remains notably higher than its competitors in the bitcoin ETF space, causing assets under management (AUM) at Grayscale to decline by over $1 billion each day this week.

Read more: 9 Bitcoin ETFs Amass 100K BTC in 7 Days, Surpass MicroStrategy

Impact on Bitcoin’s Price and Market Sentiment

The rapid pace of bitcoin sales from GBTC has contributed to downward pressure on the overall price of bitcoin, which recently dipped below $40,000, reaching its lowest level in almost two months. Bitcoin’s current value at $39,800 reflects the challenges posed by the substantial outflows. While hopes among bitcoin bulls briefly rose earlier this week following reports of the FTX estate unloading its 22 million share GBTC holding, the continued high pace of GBTC exits has kept the pressure on bitcoin prices.

Read more: Grayscale CEO Warns of Limited Survival for Spot Bitcoin ETFs

Conclusion

As Grayscale’s GBTC experiences substantial outflows, exceeding 100,000 BTC since the introduction of spot ETFs, the cryptocurrency market witnesses heightened volatility. The interplay between Grayscale’s fee adjustments, massive bitcoin transfers, and their impact on the overall market underscores the complexities and sensitivities within the crypto space. Bitcoin enthusiasts and market participants will be closely monitoring developments to assess whether the current trends persist or if a shift in dynamics is on the horizon.

![Pionex Review ([currentyear]): Trading Bots, Fees, and Pros & Cons 5 Pionex Review Featured Image](https://coinwire.com/wp-content/uploads/2023/08/pionex-review-featured-image-1024x683.jpg)

![Best Crypto Exchanges in UAE and Dubai to Buy Bitcoin ([currentyear]) 6 Best Crypto Exchanges In Uae And Dubai Featured Image](https://coinwire.com/wp-content/uploads/2024/01/best-crypto-exchanges-in-uae-and-dubai-featured-image-1024x683.jpg)

![Cardano vs Solana ([currentyear]): Is Cardano or Solana better? 7 Cardano Vs Solana Featured Image](https://coinwire.com/wp-content/uploads/2023/06/cardano-vs-solana-featured-image-1024x683.jpg)

![Paybis Review ([currentmonth] [currentyear]): Is It Safe and Legit? 8 Paybis Review Featured Image](https://coinwire.com/wp-content/uploads/2024/05/paybis-review-featured-image-1024x683.jpg)