The Bitcoin market is experiencing a surge in activity as the leading cryptocurrency witnesses an unprecedented outflow from exchanges. Recent data indicates that Bitcoin is leaving trading platforms at a rate not seen since mid-2021, potentially setting new historic records in U.S. dollar terms.

Accelerated Exodus: Bitcoin Withdrawals Reach New Heights

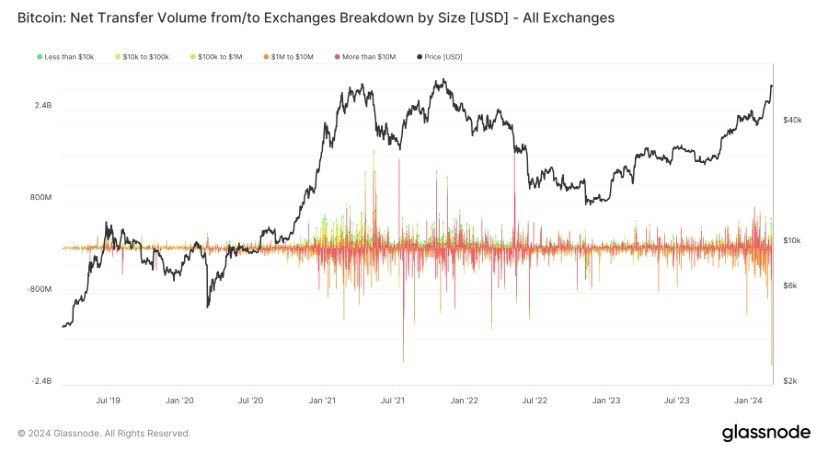

The most recent data, highlighted by James Van Straten, a research and data analyst at CryptoSlate, reveals a remarkable surge in Bitcoin withdrawals. On March 1 alone, withdrawals exceeded $2 billion, marking one of the most substantial outflows in over five years. The total assets available on major trading platforms, monitored by Glassnode, have now reached their lowest point since March 2018, standing at 2,286,347 BTC ($142.5 billion) as of March 2. This accelerating exodus is reminiscent of the peak withdrawals witnessed in June 2021, hinting at a potential shift in market dynamics.

Read more: Bitcoin’s Abrupt Plunge: $64K High Sparks $700M in Liquidations

The Role of ETFs and Changing Market Composition

Van Straten points to the influence of United States spot Bitcoin exchange-traded funds (ETFs) in driving these massive withdrawals, with Binance and Coinbase experiencing significant outflows. Notably, Binance’s outflows, unrelated to ETF activities, have been particularly noteworthy. Concurrently, analysis of Bitcoin market composition by Crypto Dan from CryptoQuant indicates a shift in investor demographics. New entities are entering the market, as reflected in changes in unspent transaction output (UTXO) ages. Younger coins are now more actively involved, suggesting a fresh wave of interest from new investors.

Read more: Donald Trump’s Bitcoin Pivot Fuels 2024 Election Speculation

Conclusion

The substantial outflows from Bitcoin exchanges, coupled with the changing composition of the market, signify a dynamic shift in the cryptocurrency landscape. While mainstream investors may not have fully returned to the crypto space, the surge in withdrawals points to increased activity and interest from both institutional and individual investors. As Bitcoin strives for all-time highs, these developments set the stage for a potentially transformative period in the cryptocurrency market, ushering in new participants and shaping the trajectory of the digital asset in the coming months.