Bitcoin, the world’s largest cryptocurrency, experienced a rollercoaster ride on Wednesday, surging to an impressive $64,000 before swiftly plummeting 7% to $59,000. This abrupt reversal triggered widespread panic among leveraged traders, resulting in over $750 million in crypto liquidations within 24 hours, according to CoinGlass data.

Bitcoin Whirlwind Rally and Sudden Reversal

Bitcoin’s breakneck rally on Wednesday saw it surpass the $60,000 mark for the first time since November 2021. However, the celebration was short-lived as the cryptocurrency reached a staggering $64,037 before sharply falling to $59,400. The dramatic price swing caused a frenzy among traders and investors, marking a challenging day for the crypto market.

The surge in Bitcoin’s value, reaching a high of $64,000, instilled optimism in the market. Yet, the sudden and severe downturn to $59,000 took many by surprise, triggering a wave of panic selling. This volatility highlights the challenges faced by leveraged traders, as the market’s rapid fluctuations led to significant liquidations and losses.

Read more: Donald Trump’s Bitcoin Pivot Fuels 2024 Election Speculation

Crypto Leverage Wipe-Out and Market Impact

The sharp drop in Bitcoin’s price reverberated throughout the broader digital assets market, with the CoinDesk 20 Index (CD20) plunging almost 5% after hitting a fresh all-time high of 2,260 earlier in the day. Major cryptocurrencies, including ether (ETH), Solana’s SOL, XRP, Cardano’s ADA, dogecoin (DOGE), and Avalanche’s AVAX, also experienced substantial losses ranging from 4% to 9% within an hour.

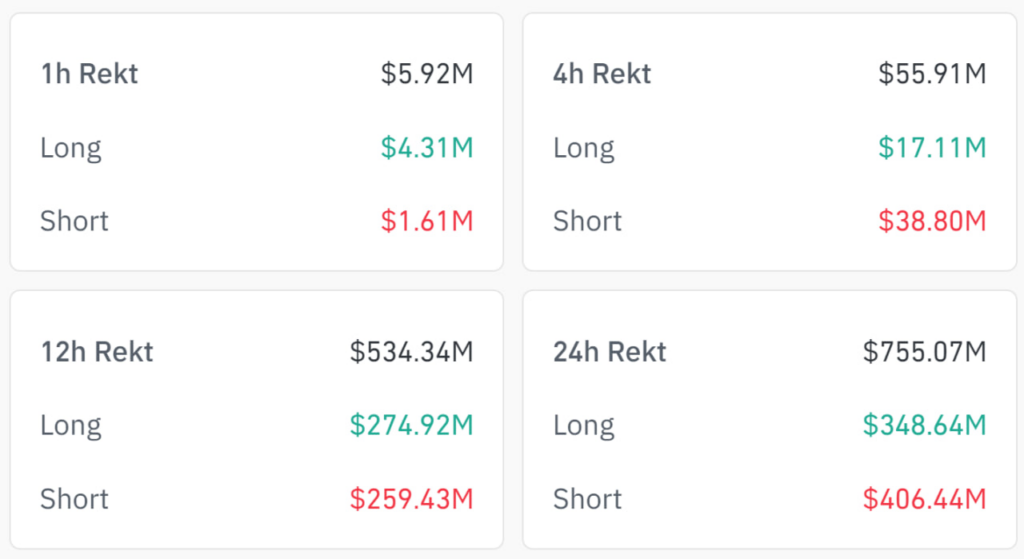

The market-wide impact of Bitcoin’s sudden plunge was evident in the $700 million worth of liquidations across various digital assets within a 24-hour period. Leveraged derivatives trading positions were swiftly wiped out, leading to significant losses for both long and short positions. This incident marks one of the largest wipe-outs since August, underscoring the inherent risks associated with leveraged trading in the volatile crypto market.

Read more: Bitcoin Hits $1 Trillion Market Cap Amid Positive Sentiment and ETF Approvals

Conclusion

Wednesday’s erratic price action not only caused substantial losses for leveraged traders but also set a record for trading volumes in U.S.-listed spot bitcoin exchange-traded funds (ETFs). BlackRock’s IBIT alone witnessed $3.3 billion in shares traded, more than doubling the previous day’s record. As the crypto market grapples with heightened volatility, the events of this day serve as a stark reminder of the challenges and risks associated with trading in the cryptocurrency space.