The cryptocurrency world is abuzz with excitement as Bitcoin approaches its all-time high of $69,000, currently trading at $68,300 at the time of writing this article. Enthusiasts are fueling the optimism on social media, predicting unprecedented growth based on historical patterns and a range of bullish indicators

Bitcoin’s Historical Doubling Act

Bitcoin has a remarkable track record of rapid surges after reaching new all-time highs. In March 2013, the cryptocurrency witnessed a 158% rally in a month, doubling its price in just 10 days. A similar pattern unfolded in November 2013 and December 2020, with Bitcoin soaring to new heights shortly after surpassing its previous peaks. Notably, the current surge is occurring well before the scheduled halving event in April 2024, hinting at the potential for even more explosive growth in the coming months.

Read more: Bitcoin Records Unprecedented Daily Withdrawals as $2 Billion Exits Exchanges

The Greed Index, ETFs, and Institutional Demand

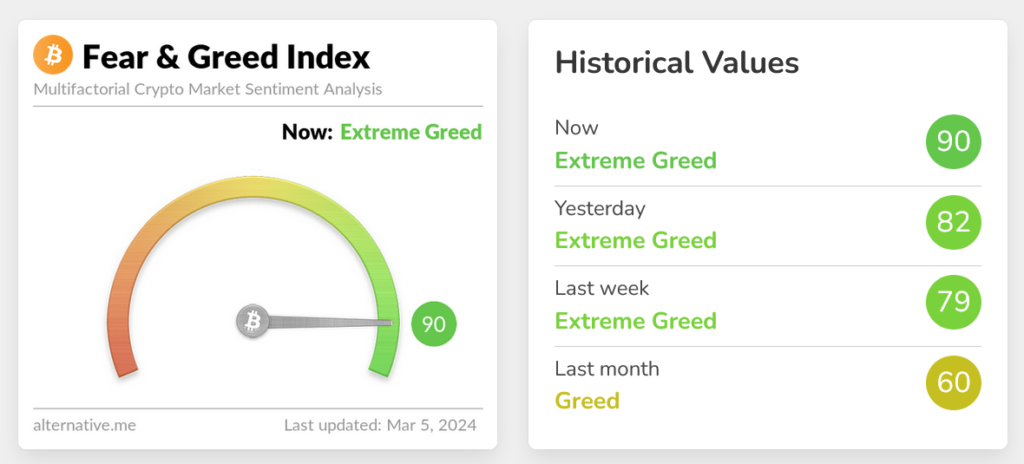

Bitcoin’s Fear & Greed Index is currently at an extreme level of 90, the highest since February 2021. Traditionally, such high levels signal a potential market correction. However, with the growing interest and demand for Bitcoin, fueled by the recent launch of spot Bitcoin exchange-traded funds (ETFs) in the United States, this bull market seems to be breaking traditional norms.

The ETFs have attracted a staggering $7.35 billion in net inflows since January 11, with BlackRock’s iShares Bitcoin Trust (IBIT) achieving the $10 billion asset milestone faster than any ETF in U.S. history. According to investor Ric Delman, Bitcoin ETF flows could reach $150 billion by the end of 2025, driven by the enthusiasm of financial advisors looking to include Bitcoin in their portfolios. This institutional influx is further supported by the demand-supply dynamic, with some days seeing ETF issuers buying over 10 times the amount of Bitcoin mined.

Read more: Donald Trump’s Bitcoin Pivot Fuels 2024 Election Speculation

Conclusion

Bitcoin’s current position as the ninth-largest asset by market cap, surpassing traditional benchmarks like the Swiss franc, underscores its growing significance in the financial landscape. The confluence of historical doubling patterns, extreme greed in the market, and the rising institutional interest through ETFs paints an exceptionally bullish picture for the cryptocurrency. As Bitcoin inches closer to its all-time high, the stage is set for a potentially historic bull market that may reshape the landscape of digital assets in the months to come. Investors and enthusiasts alike are eagerly watching as Bitcoin continues to defy expectations and break new ground.