As the race for a Bitcoin exchange-traded fund (ETF) approval intensifies, BlackRock, a global investment management firm, has strategically revised its spot Bitcoin ETF application. The updated model focuses on providing easier access for Wall Street banks, addressing concerns related to market manipulation and regulatory restrictions. This move could potentially reshape the landscape for institutional involvement in the crypto space.

In-Kind Redemption Model for Banks’ Participation

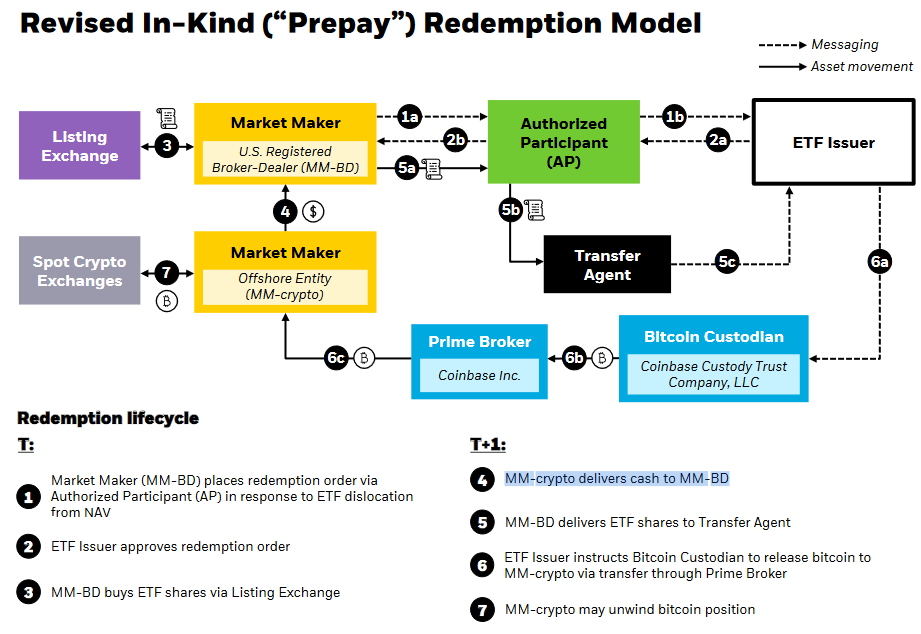

In a bid to accommodate major financial institutions like JPMorgan and Goldman Sachs, BlackRock has introduced an innovative in-kind redemption “prepay” model. This allows authorized participants, typically large banks, to create new shares in the ETF using cash instead of direct cryptocurrency holdings. By leveraging this structure, banks can sidestep regulatory constraints that limit their ability to hold Bitcoin or other cryptocurrencies directly on their balance sheets.

Read more: Bitcoin Surges Past $41K as Gold Hits Record High: A Bullish Prelude to 2024?

The new process involves authorized participants transferring cash to a broker-dealer, which then converts it into Bitcoin. Subsequently, the converted Bitcoin is stored with the ETF’s custody provider, in this case, Coinbase Custody. This revised mechanism not only enables banks to participate more actively but also serves to reduce the regulatory hurdles they face when engaging with digital assets.

BlackRock Enhanced Resistance to Market Manipulation and Investor Protections

BlackRock’s revised ETF model claims to offer “superior resistance to market manipulation,” a factor that has been a consistent concern for the U.S. Securities and Exchange Commission (SEC) when evaluating previous spot Bitcoin ETF applications. By shifting risk away from authorized participants and placing it in the hands of market makers, the updated structure aims to address the SEC’s apprehensions.

Moreover, BlackRock asserts that the new model strengthens investor protections, lowers transaction costs, and contributes to greater simplicity and harmonization within the broader Bitcoin ETF ecosystem. These enhancements are crucial in garnering regulatory approval and fostering confidence among institutional investors seeking exposure to the cryptocurrency market.

Read more: BlackRock’s SEC Meeting: Potential Game-Changer for Bitcoin Spot ETF

Conclusion

BlackRock’s strategic revision of its spot Bitcoin ETF application signifies a potential game-changer for Wall Street banks seeking entry into the crypto space. The move not only addresses regulatory constraints but also aims to build a more secure and transparent framework for ETF participation. As the SEC evaluates the application, the financial industry eagerly anticipates the decision, which could have far-reaching implications for other pending Bitcoin ETF applicants. The outcome of this regulatory scrutiny may pave the way for increased institutional adoption of cryptocurrencies in the traditional financial sector.

![Pionex Review ([currentyear]): Trading Bots, Fees, and Pros & Cons 8 Pionex Review Featured Image](https://coinwire.com/wp-content/uploads/2023/08/pionex-review-featured-image-1024x683.jpg)

![Best Crypto Exchanges in UAE and Dubai to Buy Bitcoin ([currentyear]) 9 Best Crypto Exchanges In Uae And Dubai Featured Image](https://coinwire.com/wp-content/uploads/2024/01/best-crypto-exchanges-in-uae-and-dubai-featured-image-1024x683.jpg)

![Cardano vs Solana ([currentyear]): Is Cardano or Solana better? 10 Cardano Vs Solana Featured Image](https://coinwire.com/wp-content/uploads/2023/06/cardano-vs-solana-featured-image-1024x683.jpg)

![Paybis Review ([currentmonth] [currentyear]): Is It Safe and Legit? 11 Paybis Review Featured Image](https://coinwire.com/wp-content/uploads/2024/05/paybis-review-featured-image-1024x683.jpg)