A blockchain network is purportedly being developed by the largest names in the business, including Goldman Sachs, Deloitte, Cboe Global Markets, Microsoft, and the fintech company Digital Asset. The aforementioned blockchain network is designed to support the execution of financial product smart contracts for institutional crypto assets while upholding security and regulatory standards.

Unveiling the Canton Network

The financial technology company co-founded by DRW’s Don Wilson is creating a privacy-enabled blockchain dubbed the Canton Network, and the biggest names in banking and technology are on board. According to the release, this would be a privacy-enabled interoperable blockchain specifically tailored for institutional assets.

They are joined in this latest initiative by companies like BNP Paribas, Broadridge, Cboe Global Markets, Cumberland, Deloitte, Deutsche Börse Group, DRW, Liberty City Ventures, Paxos, Right Pedal LendOS, S&P Global, SBI Digital Asset Holdings, Umbrage, Versana, VERT Capital, Xpansiv, and Zinnia.

Sankar Krishnan, head of Capgemini’s digital assets and fintech division, cites Canton Network as an illustration of how the company and its other partners are “harnessing the power of blockchain to build a financial ecosystem that everyone can depend on.”

The head of issuer services and new digital markets at the exchange, Jens Hachmesiter of the Deutsche Börse Group, asserted that the blockchain aims to provide “seamless connectivity across various blockchain networks in the industry,” which is a crucial “building block for future digital and distributed financial market infrastructures.”

The aforementioned press release also disclosed that in July, the participating companies will start testing the interoperability capabilities of the blockchain across multiple applications and use cases.

Decentralized Blockchain?

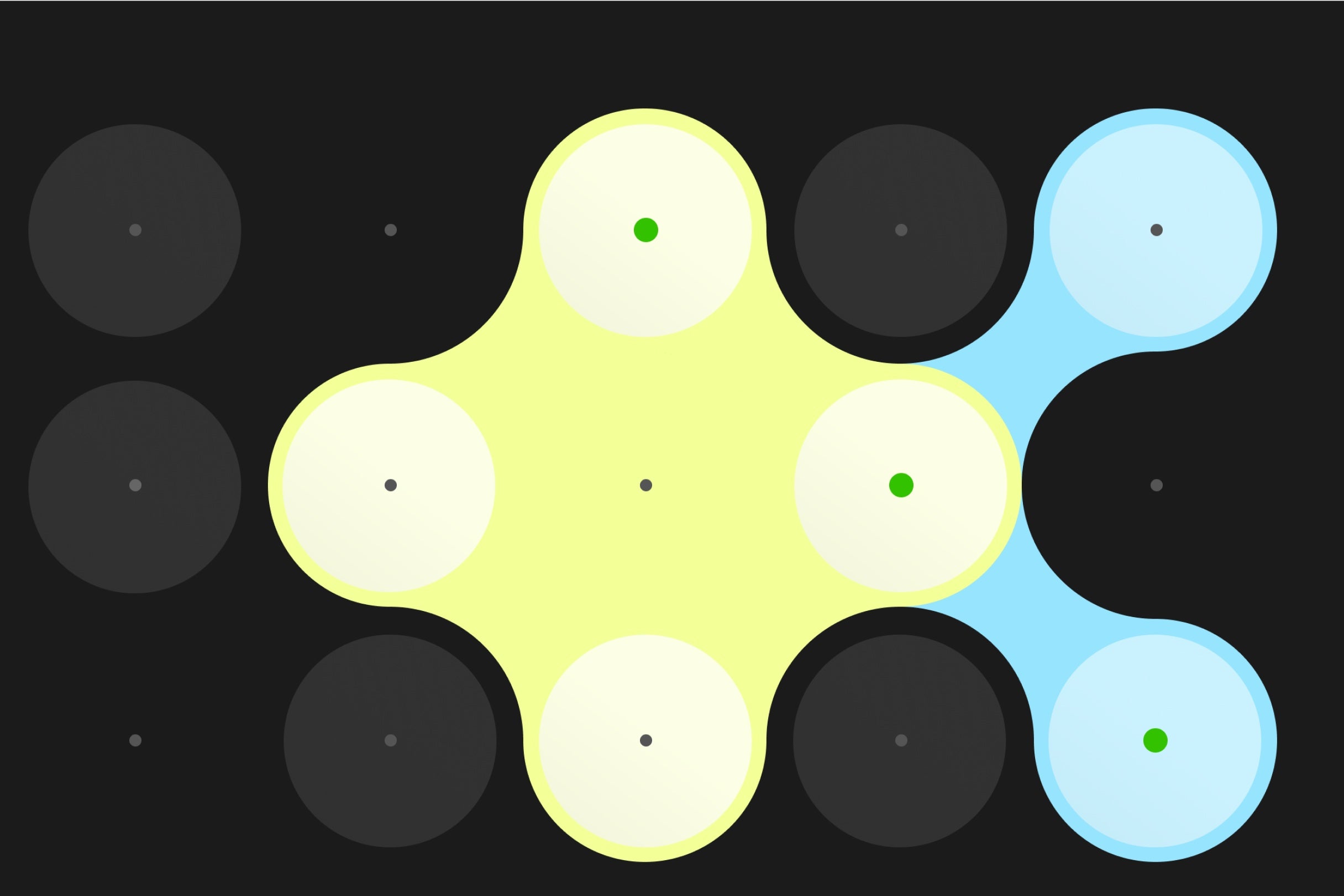

According to reports, Canton Network won’t operate exactly the way the present blockchains do. Canton Network’s security and privacy stem from the fact that transactions are only confirmed by the participants in the transactions, unlike conventional blockchains that repeat the same data across all network nodes. As a result, only information that is necessary for or permitted for each node to know is available to them.

The Canton Network is anticipated to function more like a permissioned blockchain than public blockchains like Bitcoin and Ethereum, which are considered to be permissionless. Individual users must access the system through a participating financial intermediary.

Although permissioned blockchains have received a lot of criticism, many experts have argued that decentralization may not be necessary for these kinds of controlled assets. However, there have been a number of previous examples of similarly built blockchains that have failed for a variety of reasons, like Meta’s Diem venture.

As was already mentioned, the Canton Network will continue to function for a while with restricted access for its users. It is also important to note that, according to Digital Asset, “By early 2023, financial institutions transact over $50 billion daily on limited-access subnets of the Canton Network.”