You know how volatile the crypto market can be. One day you are making huge profits, and the next day you are facing losses. But what if you could turn your losses into tax savings? That’s where crypto tax loss harvesting comes in.

Sounds too good to be true, right? Well, there are some tips, software, and risks that you need to know before you start.

Let’s cover some of the basic questions. Like, how crypto tax loss harvesting works, what it is, what tools you can use to do it, and what pitfalls you should avoid.

What is Crypto Tax Loss Harvesting?

Crypto tax loss harvesting strategy allows you to sell your crypto assets at a loss and use that loss to offset capital gains or taxable income.

When you sell or trade crypto, you may make a profit or a loss. Profit is called capital gain and loss is called capital loss.

You have to pay tax on your capital gain. But, you can use your capital losses to reduce your tax bill.

How does Tax Loss Harvesting Work?

The government asks you to pay tax on your earnings, but not on your losses. This is called capital gains tax.

- If you buy 1 Bitcoin for $10,000 and sell it for $15,000. You earn $5,000. You have to pay tax on this $5,000.

- Again, if you buy 1 Ethereum for $3,000 and sell it for $1,000, you lose $2,000. You don’t have to pay taxes at this time. Now, you can use your loss to lower your earning.

Instead of paying tax on $5,000, you only pay tax on $3,000 ($5,000 – $2,000). This way, you save some money on taxes.

To do crypto tax loss harvesting, you have to sell your crypto money when the value is low and buy it back when the value is high. You make a loss that you can use to lower your tax.

Some rules may prevent you from doing this too often or too soon. This is called the wash sale rule. They are different for different countries. You should check the rules before you do tax loss harvesting.

5 Tips for Tax Loss Harvesting in Crypto

- Sell crypto that has lost value before the end of the year. This will create a capital loss that you can use to reduce your capital gains from other crypto or investments.

- Buy back the same crypto after 30 days or buy a different crypto right away. It allows you to keep your crypto exposure and benefit from future price increases. However, you need to be careful about the wash sale rule, which says you can’t buy back the same asset within 30 days of selling it at a loss. This rule applies to stocks and bonds, but not to crypto yet. But it might change in the future, so be careful.

- Use crypto tax software to track your gains and losses. This will make it easier to calculate your taxes and find the best tax loss harvesting opportunities. You can also use crypto tax software to generate tax reports and file your taxes online.

- Harvest losses throughout the year, not just at the end. This will help you take advantage of market dips and volatility, which are common in crypto. You can sell your crypto at a loss when the price drops and buy it back when it recovers. This way, you can lower your taxes and increase your returns.

- Don’t harvest losses that are too small or too big. This will help you optimize your tax savings and avoid wasting time and money. If your losses are too small, they might not make a big difference in your taxes.

What are the best crypto tax loss harvesting tools and apps?

Many portfolio and tax tracker apps can help you do this, but here are three of the best ones:

1. Koinly: Best For Portfolio and Tax Tracking

Koinly is a platform that helps you with your crypto taxes and portfolio. It works with 400+ exchanges and wallets and supports different types of crypto transactions. You can import your data from the ledger, sync your exchange history, and connect your blockchain wallets.

It can make tax reports for many countries. This includes the US, UK, Canada, Australia, Germany, and more. It can also fill out IRS forms for you. Koinly’s tax reports are detailed and audit-proof.

Koinly also helps you in tax loss harvesting by finding ways to sell crypto at a loss and use that loss to offset your gains. Its AI looks for chances to do this with your crypto or NFTs.

The software also has a free crypto portfolio tracker that lets you see your gains and losses, how well your holdings are doing (PnL), and how to optimize your taxes.

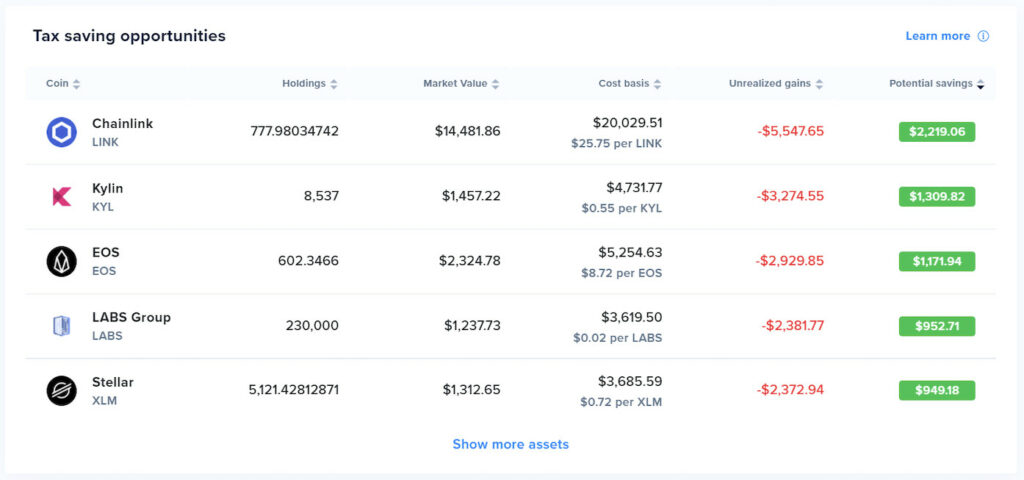

2. CoinTracker: Best For Tax Loss Harvesting Opportunities

CoinTracker is a software that helps you manage your crypto portfolio and taxes. It works with 500+ exchanges, wallets, and coins. It also connects with tax filing services.

CoinTracker’s tax loss harvesting in crypto feature is easy to use for beginners. It tells you which coins to sell and how much you can save. It also helps you see your tax lots and make better trades.

It also has a mobile app that lets you see your portfolio and coin prices anytime. Key features of CoinTracker are:

- Automated portfolio tracking of 10,000+ cryptocurrencies

- Optimizes cost basis accounting methods for tax-loss harvesting

- Integrate with Binance, Coinbase, Kraken, crypto.com, and other 500+ exchanges.

Read more: Koinly vs CoinTracker: Which is the Best Crypto Taxing Tool?

3. CoinLedger: Crypto Tax Report and Loss Harvesting

CoinLedger is a platform that helps crypto investors and traders to reduce their tax liability. It allows you to connect your wallets and exchanges, import transactions, and generate tax reports. It shows your capital gains and losses, as well as potential tax savings from harvesting losses.

It also offers a unique feature for NFT investors: the NFT Loss Harvestooor. This is a smart contract that can buy any NFT for a very low price (0.00000001 ETH), even if the NFT has no liquidity. This way, users can sell their NFTs that have lost value and claim the capital losses in the tax.

Some key features of CoinLedger are:

- Upload your tax reports to TurboTax or TaxAct platforms.

- Find tax-saving opportunities

- Track Cost Basis And Historical Prices

- It supports wallets, exchanges, and DeFi Platforms.

Tax Loss Harvest Crypto Guide Step-by-Step

We will use a CoinTracker tax loss harvesting tool for this example. Here is a complete advanced guide on how to use it for tax evasion and offset future gains:

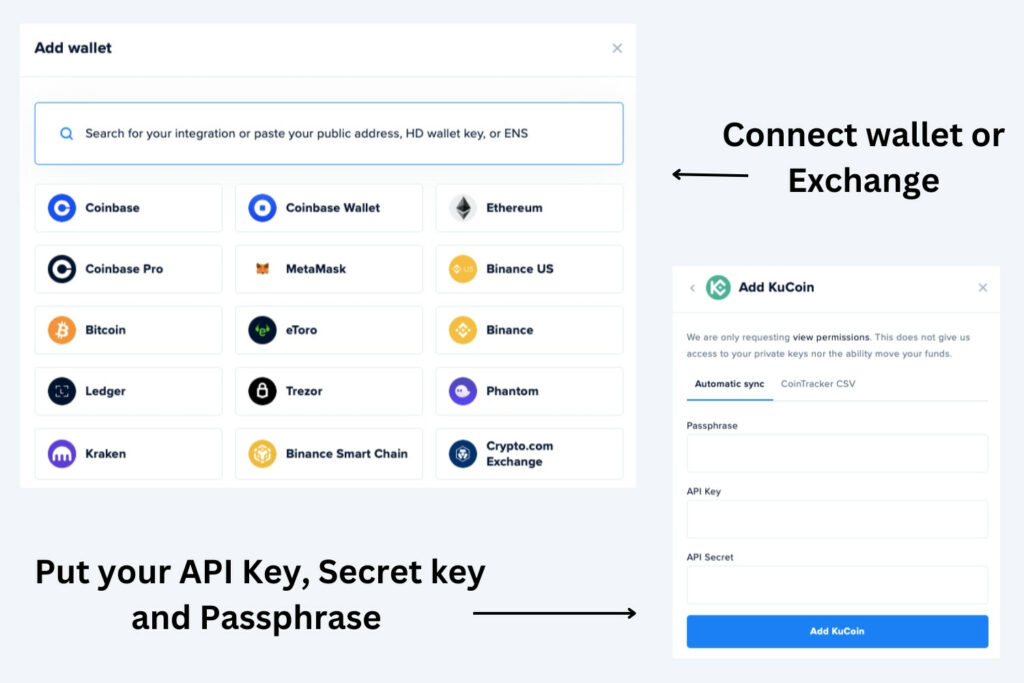

Step 1: Link your Wallets and Crypto Exchanges

You can link your wallet or crypto exchange by using an API key, a public address, a CSV file, or a manual entry. You can pick from over 500 supported services, including Coinbase, Binance, TrustWallet, MetaMask, Ledger, Trezor, and more.

This will allow CoinTracker to track your transactions and figure out your cost basis and gains/losses.

Step 2: Check your transactions on the “Performance” Page

You can see all your trades, transfers, income, spending, and mining activities across all your linked services. If needed, edit, delete, or add transactions manually.

You can also check your cost basis method on the “Dashboard” page on CoinTracker. It supports various cost-basis methods, including FIFO, LIFO, HIFO, and more. You can choose the one that suits your tax situation best.

Step 3: Use the Tax Loss Harvesting Strategy

To use the Tax Loss Harvesting Tool, you need to upgrade to a Pro subscription. This tool will show you which assets you can sell at a loss to lower your tax bill and how much you can save in taxes by doing so.

You will see a list of assets that have unrealized gains or losses and how much you can harvest from each one. It will also track your future capital gains taxes.

To harvest your losses, you need to sell the entire amount of the asset before the end of the tax year (e.g. December 31 in the US). You can sell it for fiat, a stablecoin, or any other cryptocurrency.

Step 4: Repurchase the same amount of the asset

If you want to keep the same composition of your portfolio as before, you can repurchase the same amount of the asset that you sold at a loss.

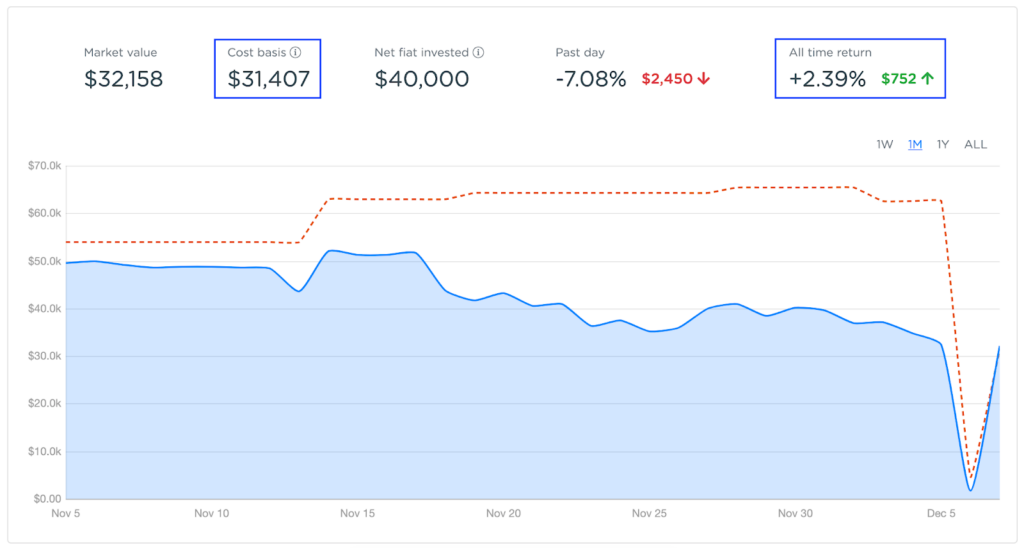

After harvesting crypto losses, your portfolio will show positive returns close to zero. This means you have not gained anything in the financial year. You can check by visiting the dashboard page and checking the “cost basis” and “All-time return”.

Step 5: Create your tax reports

You can create your tax reports by going to the Tax page on CoinTracker and choosing your tax year and country. This will show a summary of your taxable events and income sources, as well as a breakdown of your short-term and long-term gains/losses.

It also enables you to download your tax forms in various formats, such as Form 8949, Schedule D, TurboTax CSV, or TaxAct CSV. You can use these forms to file your taxes with TurboTax or your own accountant.

Benefits of Tax Loss Harvesting in Cryptocurrencies

- Tax Savings: It helps you to sell your cryptocurrency assets at a loss strategically. This reduces your taxable income and saves money on taxes.

- Lower Tax Liability: Using underperforming assets, you can minimize the amount of taxes you owe, especially if you’re in a higher tax bracket.

- Control and Flexibility: With tax loss harvesting, you have the freedom to manage your tax obligations based on your financial goals and adapt your strategy to market conditions and regulations.

- Diversify and Rebalance: This strategy lets you reinvest in other cryptocurrencies. This helps diversify your portfolio and potentially increase your long-term returns.

- Increase Cash Flow: Realizing losses through tax loss harvesting generates additional cash flow that can be reinvested or used for other financial purposes.

- Learn and Plan: Engaging in tax loss harvesting enhances your understanding of tax laws and investment strategies. This empowers you to make better financial decisions and develop a comprehensive financial plan.

- Reduce Emotional Stress: Actively managing your investments through tax loss harvesting can help alleviate emotional stress during volatile market periods. It helps you to focus on your long-term financial goals.

Risks of Crypto Tax Loss Harvesting?

Tax loss harvesting carries certain risks. Investors should be aware of this before implementing this strategy. Let’s discuss some potential challenges:

Crypto wash sale rules

When you sell a crypto coin at a low price and buy it back soon, you do a crypto wash sale. This rule is a tax rule that stops you from doing this with stocks and other securities.

You cannot deduct the loss if you buy the same or similar stock within 30 days of selling it. But this rule does not apply to crypto coins usually. The IRS says crypto coins are property, not securities.

The IRS says crypto wash sales must have a good reason, not just for taxes. If they think you did it only for taxes, they may not accept the loss and may charge you extra. But this law is not final yet in crypto and may change before it becomes official.

Short term Vs. Long-term capital gains

- Short-term capital gains risk: Selling assets held for less than a year can result in higher taxes as they are typically subject to ordinary income tax rates. This reduces the benefits of loss harvesting.

- Long-term capital gains risk: Profits from assets held for over a year are generally taxed at lower rates. However, changes in tax laws can affect the anticipated benefits, requiring harvesters to stay updated on regulations.

Which Cost basis method is best for tax loss Harvesting?

When it comes to tax loss harvesting in crypto, you have different cost-basis methods to calculate gains or losses. The method you choose affects your taxes and the effectiveness of your strategy.

Let’s explore the three common cost-basis methods in crypto:

1. FIFO (First-In, First-Out)

FIFO is the default method in most jurisdictions, including the US. It means you sell or dispose of the earliest acquired coins first when calculating gains or losses.

It’s simple and suitable for long-term holders who rarely sell early coins. However, it may not be ideal for tax loss harvesting as it restricts selling specific coins strategically.

2. LIFO (Last-In, First-Out)

LIFO assumes you sell or dispose of the most recently acquired coins first. It benefits tax loss harvesting because you can target and sell coins that have experienced losses.

Selling recent coins maximizes tax deductions. Note that LIFO may not be universally accepted and might have restrictions in certain jurisdictions.

3. Specific Identification

Specific identification allows you to choose which coins you sell or dispose of. You need record-keeping, documenting transaction details of individual coins.

It offers flexibility for tax loss harvesting by strategically selling coins for future tax years. But, it can be more complex if you have many transactions or multiple wallets/exchanges.

Cryptocurrency Tax Loss Harvesting FAQs

Can I Tax Loss Harvest Crypto and NFTs?

Yes, you can. If your NFTs are worth less than when you bought them, you can sell them and report the loss on your tax return. But, it is not easy to do tax loss harvesting with NFTs. You need to know their current value, find a buyer, and avoid wash sales.

Is Crypto Tax Loss Harvesting Safe and Worth it?

Crypto tax loss harvesting is usually safe, if you follow proper rules. Most jurisdictions see cryptocurrencies as property. So, you pay tax when you sell or trade them. By selling your crypto at a loss, you pay less tax on your profits from other sources.

What happens if you don’t report crypto losses?

If you don’t report crypto losses, you may lose money on taxes. Crypto losses are capital losses. But, if you don’t report your crypto losses, you can’t use these benefits and may pay more taxes than you should.

Also, if you don’t report your crypto transactions right and fully, the IRS or other laws may charge you penalties and interest for not reporting your income or lying on your return.

What types of Digital asset investments are applicable for taxes?

Here are some common investment activities in the crypto space that can have tax implications:

- Buying and Holding

- Trading

- Mining

- Staking and Masternodes

- Initial Coin Offerings (ICOs)

- Airdrops and Forks

How often should I harvest my losses?

The frequency of harvesting your losses depends on your tax situation and investment objectives. However, some general tips are:

- It may be more advantageous near the end of the tax year when you have a better idea of your total capital gains and losses.

- You can also harvest your losses when the market is down. When your crypto assets may have lost a lot of value. You can buy back the assets at a lower price later.

Is there a limit to crypto tax-loss harvesting?

Yes, there is a limit to how much you can deduct from your crypto tax-loss harvesting. According to the IRS, you can only deduct up to $3,000 of net capital losses from your ordinary income in any given tax year.

If your net capital losses are more than this amount, You may roll over excess net capital losses into subsequent tax years until they are fully used.

![How to Mint NFT on Solana: Ultimate Guide for [currentyear] 23 How To Mint Nfton Solana Featured Image](https://coinwire.com/wp-content/uploads/2022/10/how-to-mint-NFT-on-Solana-1024x683.png)

![Binance Margin Quiz Answers (Updated in [currentmonth] [currentyear]) 31 Binance Margin Quiz Answers Featured Image](https://coinwire.com/wp-content/uploads/2023/01/binance-margin-quiz-answers-featured-image-1024x683.png)

![Altrady Review [currentyear]: Features, Pricing, and Alternatives 32 Altrady Review](https://coinwire.com/wp-content/uploads/2024/05/altrady-review-1024x683.jpg)

![How to Buy Crypto Under 18 in [currentyear] with Minors 33 How To Buy Crypto Under 18 Featured Image](https://coinwire.com/wp-content/uploads/2023/10/how-to-buy-crypto-under-18-featured-image-1024x683.jpg)