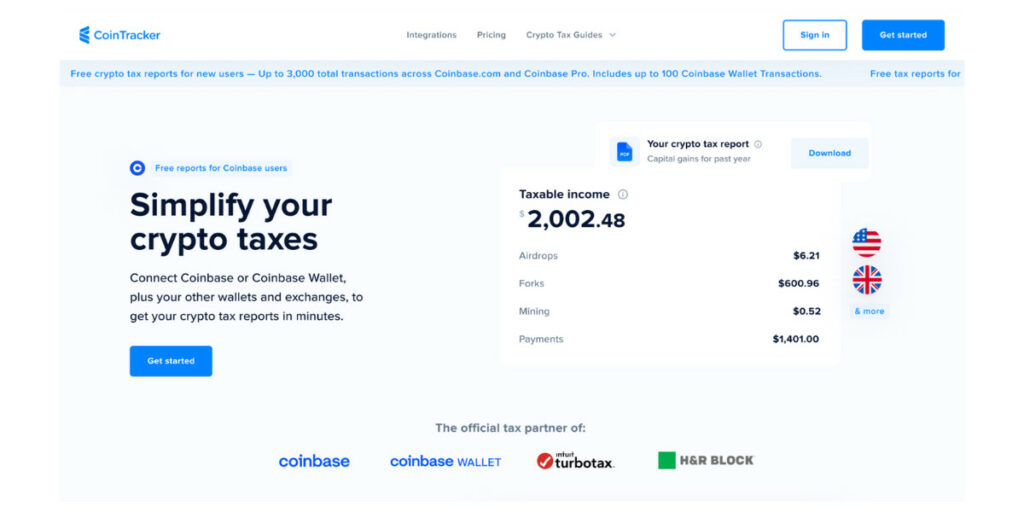

Crypto tax compliance can be a challenge for many investors. It gets even more complicated when a large portfolio and multiple platforms are involved. This is where software solutions like CoinTracker come in. Discover a software alternative to help you file crypto taxes, track your crypto portfolio, and manage decentralized finance (DeFi) investments in this CoinTracker review.

Overview

CoinTracker has several amazing features that make tracking and filing taxes for crypto assets as easy as possible. The table below is a summary of the main features and services that the platform offers.

| Crypto tax reports | Available for all plans |

| Crypto tax forms | Available for premium plans |

| Integrations | Over 500, including wallets and exchanges |

| Tax loss harvesting | Yes |

| DeFi support | Yes |

| NFT support | Yes |

| Mobile App | iOS and Android |

What Is CoinTracker?

CoinTracker is one of the market’s most trusted cryptocurrency tax software, but that is not all. As cryptocurrencies and other blockchain assets continue to grow in popularity, more and more people realize the need for a portfolio tracking and management tool. This is another important service that CoinTracker offers.

Typically, CoinTracker allows consumers to track their crypto asset portfolio. It does this by enabling the seamless integration of crypto wallets with other decentralized finance platforms like cryptocurrency exchanges and NFT marketplaces. Tracking these assets allows users to monitor market value, transaction details, and investment performance, and ultimately generates tax summary reports.

The generated crypto tax report helps you prepare tax forms you can submit to the IRS for compliance. Here’s a summary of the documents you can get on the platform.

- IRS form 1040 Schedule D: This is a tax summary of your capital gains and losses from crypto assets. You can file tax reports with the rest of your returns to justify the crypto-associated tax you’ve paid.

- Form 8949: CoinTracker generates this form for you to state the sales and dispositions of your digital assets. The document lists long-term and short-term gains and losses, enabling the IRS to understand your crypto financial standing clearly.

- CSV export file: This is a CSV format of the files you need to prove your crypto transactions. It is the format required when uploading your tax return forms on tax applications like the IRS-provided OLT

Pros

- Helps users file crypto taxes easily and accurately.

- Allows investors to track their digital asset investments across multiple DeFi platforms.

- Provides real-time tax loss harvesting.

- Helps manage NFTs

- Is highly secure

Cons

- Some impressive features, like tax-loss harvesting, are reserved for premium clients.

- It might be expensive depending on your transaction volume.

CoinTraker Review – Key Features

As a crypto tax and portfolio management software, CoinTracker has several amazing features to explore. Let’s break down each of these features and understand how they are useful for small-time crypto day trading activities and long-term investment portfolios.

Crypto Tax Filing

In many jurisdictions globally, cryptocurrencies are considered assets. This means they are subject to tax compliance regulations. Countries like the U.S., U.K., Canada, India, and Australia take these regulations very seriously. As such, CoinTracker offers its users a secure and accurate crypto tax filing platform to ensure they remain compliant.

Learn how crypto tax loss harvesting can help you maximize your tax savings while investing in digital assets.

Crypto tax filing on CoinTracker is a simple but detailed process. Here’s a summary of the steps for filing tax returns on the platform.

- Link your account: CoinTracker allows users to link all their crypto wallets and DeFi platform accounts in one place.

- Crypto Tax Calculator: The platform uses a simple crypto tax calculator to aggregate the worth of your digital assets. It categorizes taxable income from staking, mining, payments, airdrops, interests, and forks to provide a thorough breakdown of what you’re paying for. You can also see your total gains, transactions, and balance at the end of every tax year.

- Real-time tax loss harvesting: Another impressive aspect of tax filing is tax-loss harvesting, which helps you identify real-time opportunities to trade crypto to write off losses. It helps save a lot in crypto tax expenditure.

- Documented reporting: CoinTracker generates a detailed tax report on its findings. Depending on your plan, the Crypto tax filing feature can even provide pre-filled IRS-compliant forms for you to submit.

- Preview of tax impact: Ultimately, the software will preview the crypto taxes you will likely pay for future incoming and outgoing transactions. This helps you plan and create better investment strategies.

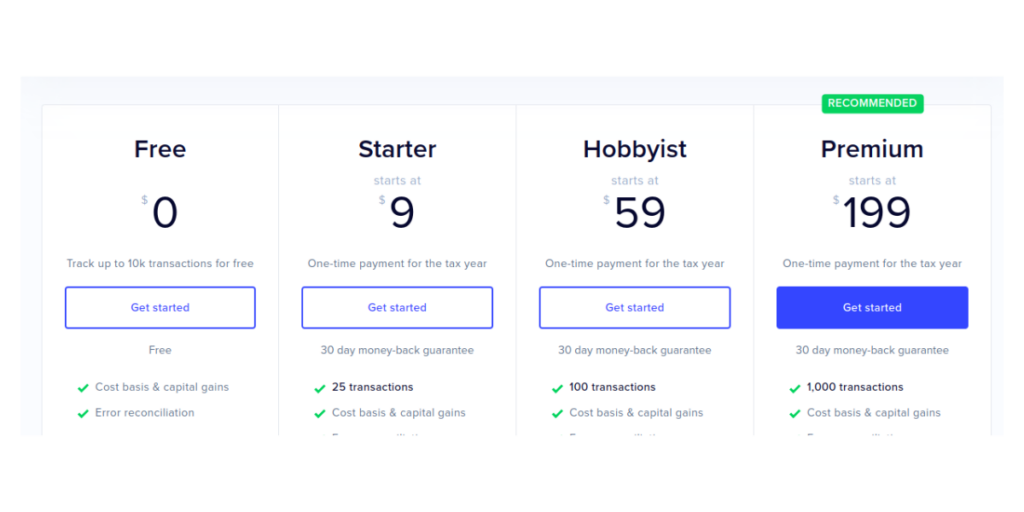

Because of its convenience, crypto tax filing on CoinTracker comes at a price. You can subscribe to four tiers to get the benefits of this feature. The table below summarizes all tiers and the benefits they offer.

| Details | Free | Starter | Hobbyist | Premium |

|---|---|---|---|---|

| Transactions | Track up to 10,000 transactions | Track up to 25,000 transactions | Track up to 100,000 transactions | Track up to 1,000,000 transactions |

| Download tax forms | No | Yes | Yes | Yes |

| Auto sync with unlimited exchanges and wallets | Yes | Yes | Yes | Yes |

| Cost basis methods | Yes | Yes | Yes | Yes |

| Error reconciliation | Yes | Yes | Yes | Yes |

| Transaction history CSV | Yes | Yes | Yes | Yes |

| Capital gains CSV | Yes | Yes | Yes | Yes |

| Referral to affiliate crypto tax advisor | Yes | Yes | Yes | Yes |

| Forum Support | Yes | Yes | Yes | Yes |

| Margin Trading | Yes | Yes | Yes | Yes |

Cointracker Review – Crypto Tracking

CoinTracker is also one of the best crypto portfolio tracker apps. Through its crypto portfolio tracking feature, the platform allows users to monitor multiple assets across their entire portfolio. According to the CoinTracker website, crypto tracking is available across at least 300 exchanges and 10,000 cryptocurrencies. Let’s explore how the feature works in brief detail.

- Connect all your wallets and exchange accounts: Crypto portfolio tracking allows you to link all your wallets and crypto trading platforms centrally. It has an automatic API import tool and also manual CSV uploads for different exchange accounts.

- Portfolio management: CoinTracker uses portfolio management software to help determine gains and losses across assets. The platform unifies your trade history file across every DeFi service and makes it easy to search and filter. Additionally, this technology supports fee tracking. It calculates the fees paid for different transactions and makes it easy to trace them on a cost basis.

- Live price data: Through the crypto portfolio tracker, you can know the real-time asset values across all investment platforms. This is helpful, especially when you need to make quick buy or sell decisions to avoid price dips or make huge profits.

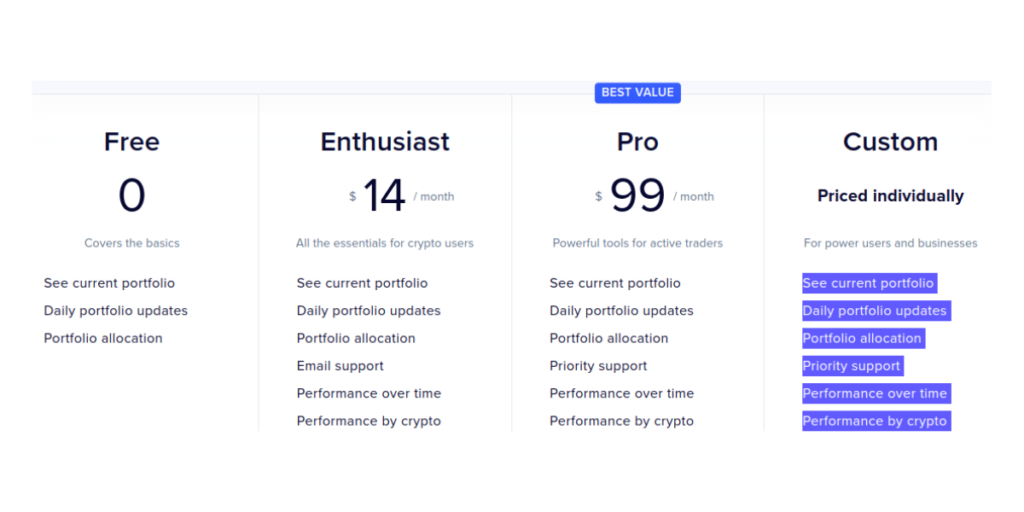

Like crypto tax filing, crypto tracking is a tiered service. CoinTracker offers a free version, enthusiast, pro, and custom pricing plans to access this service. The most recommended of these is the premium plan. Here’s a table with the features you will get from each plan.

| Details | Free | Enthusiast | Pro | Custom |

|---|---|---|---|---|

| See current portfolio | Yes | Yes | Yes | Yes |

| Daily portfolio updates | Yes | Yes | Yes | Yes |

| Portfolio allocation | Yes | Yes | Yes | Yes |

| Priority support | No | Yes | Yes | Yes |

| Performance over time | No | Yes | Yes | Yes |

| Performance by crypto | No | Yes | Yes | Yes |

Staking and Liquidity Pool Tracking

In addition to tracking your assets, you can also use CoinTracker to monitor multiple trading options. Specifically, you can leverage the platform’s DeFi Center for investment insights across your portfolio.

CoinTracker’s DeFi center is a hub that lets you view the particular liquidity pools you’ve invested in. It also shows you interest earned, outstanding loans, and relevant statistics to inform your investment decisions.

When it comes to staking, CoinTracker calculates Annual Percentage Yields (APY) and monitors staking durations. This ensures you are always on track with crypto and NFT staking rewards and have up-to-date information on your staked asset’s performance for better decision-making.

NFT Management

Non-fungible tokens are a major focal point in the modern-day crypto market, making them important assets to keep track of. CoinTracker helps you manage all your NFT transactions in a single space, giving you an easier time as far as monitoring is concerned.

Through the platform’s free-to-use NFT Center, users get multiple NFT support services that can guide them on how to flip NFTs and improve the overall value of their collection. Here are a few of the outstanding benefits of the NFT center.

- NFT tax calculator: Since NFTs are assets, they must comply with tax regulations. CoinTracker ensures compliance through an NFT tax calculator. This software helps to determine taxable gains and losses from various NFT investments easily. It also calculates cost bases and generates the necessary tax report.

- Easy asset sorting: The NFT center also makes it easy to sort out your assets by wallet or date acquired. This is especially effective for big-time NFT collectors who have a huge number of investments in their portfolios. Sorting allows you to look at individual assets quickly and even share these assets on platforms like Twitter.

- NFT info & capital gains: CoinTracker provides you with all the details of purchased NFTs. It shows you the date of purchase, how much you spent on the asset and its current market value. This helps you keep track of the gains or losses each asset makes. Additionally, the platform links you to top NFT marketplaces like OpenSea, making it easier to initiate trades while monitoring an NFT.

CoinTracker Review – Pricing

There are two major price points on CoinTracker, depending on the feature you want to unlock. Crypto tax filing and crypto tracking are paid features while staking, liquidity management, and NFT management are free. Let’s analyze the pricing plans for the paid features.

Crypto Tax Filing Price Plans

Users can opt for the free, starter, hobbyist, or premium plans to unlock the crypto tax filing feature. The price breakdown for each plan is as follows.

- Free: $0

- Starter: $9

- Hobbyist: $59

- Premium: $199

Crypto Tracking Price Plans

The crypto tracking feature also has four plans, free, enthusiast, pro, and custom. Below are the rates associated with each tier.

- Free: $0

- Enthusiast: $14

- Pro: $99

- Custom: Customized pricing

CoinTracker Review – Supported Wallets, Exchanges, and Blockchains

CoinTracker’s website states that the platform supports over 10,000 crypto assets across at least 500 digital asset wallets. Here are the top 10 wallets supported on the platform.

- Coinbase Wallet

- MetaMask

- Ledger

- Trezor

- Phantom

- Exodus

- Trust Wallet

- Atomic Wallet

- Casa

- eToro

Besides this, the platform allows integrations with multiple leading crypto exchanges. The list below summarizes the top 10 most popular altcoin exchanges on CoinTracker.

- eToro

- Binance

- Kraken

- Crypto.com

- KuCoin

- Gemini

- Uphold

- Bittrex

- FTX US

- FTX

Lastly, this tax-tracking platform is also famous for supporting numerous blockchains. Here’s a breakdown of the ten leading blockchains on CoinTracker

- Ethereum

- Bitcoin

- Binance Smart Chain

- Cardano

- Solana

- Cosmos

- Optimism

- Arbitrum One

- Ripple

- LiteCoin

CoinTracker Review – Mobile App

CoinTracker users enjoy the platform’s numerous benefits from the comfort of their mobile phones. The software has an iOS and Android application that enables users to manage their assets conveniently and track their crypto on the go.

CoinTracker Review – Security

Security is a top priority for the CoinTracker team. The platform implements security measures from all angles, whether physical or digital. CoinTrack runs background checks on all its employees to ensure they are trustworthy.

It is also a self-custodial platform, meaning they never get access to your private keys. Additionally, the platform supports two-factor authentication to guarantee account security, and it has a data privacy policy that ensures your crypto data will never be shared with third parties.

CoinTracker Review – Support

The CoinTracker platform has fairly decent online reviews. On TrustPilot, the platform scored 3.2 out of 5 stars. This score is slightly higher on Google Play and the App Store, where it scores at least 4.1 and 4.7, respectively. This is a good rating considering the sensitive nature of the tax services they offer.

Users can engage the Chatoshi AI bot to get support from the platform. This chatbot helps respond to questions and provides links to documentation that can better clarify queries. If Chatoshi isn’t enough, users can leverage the platform’s resource center for more clarification. However, for users with Pro, Custom, and Premium plans, there’s direct customer support within 24 to 48 hours, depending on the tier.

Cointracker Review – Final Thoughts

CoinTracker is an impressive crypto tax partner. It simplifies tax information collection across multiple platforms and currencies, generates reports, and even prefills IRS forms. Additionally, the platform effectively tracks tokens and other assets, like NFT, across DeFi applications. This makes it easier to plan and manage assets. The platform is worth a shot, especially for crypto investors who want a more organized and tax-compliant portfolio.

FAQs

Is CoinTracker good for taxes?

Yes. CoinTrack is a great platform for tracking assets and filing crypto tax returns. The site simplifies crypto information collection across multiple platforms and currencies, tax tracking, prefills IRS tax forms, and provides real-time tax reporting and loss harvesting.

Is CoinTracker safe?

CoinTracker is one of the safest crypto tax platforms. It is self-custodial, meaning it never accesses your private keys. Additionally, the platform supports two-factor authentication to guarantee account security, and it has a data privacy policy that ensures your crypto data will never be shared with third parties.

How much does Cointracker cost?

CoinTracker cost varies based on the feature you want and the tier you choose for that feature. The platform’s paid features are crypto tax filing and crypto tracking.

Crypto tax filing has four tiers free, starter, hobbyist, or premium.

The crypto tracking feature also has four plans, free, enthusiast, pro, and custom.

![Bybit Review [currentyear]: Exchange Features, Fee, Pros and Cons 23 Bybit Featured Image](https://coinwire.com/wp-content/uploads/2022/06/Bybit-review-1024x683.png)

![MoonPay Review ([currentyear]): Fees, Pros & Cons, and Sign-Up Guide. 24 Moonpay Review Featured Image](https://coinwire.com/wp-content/uploads/2023/09/moonpay-review-featured-image-1024x683.jpg)

![Tristan Tate Net Worth ([currentyear]): Biography, Businesses & Cars 25 Tristan Tate Net Worth Featured Image](https://coinwire.com/wp-content/uploads/2023/07/tristan-tate-net-worth-featured-image-1024x683.jpeg)

![Coinigy Review [currentyear]: Features, Pricing, Pros & Cons 26 Coinigy Review](https://coinwire.com/wp-content/uploads/2024/04/coinigy-review-1024x683.jpg)

![Bybit vs Kucoin [currentyear]: Exchange Leverage, Fees, Pros & Cons 27 Bybit Vs Kucoin](https://coinwire.com/wp-content/uploads/2024/01/bybit-vs-kucoin-1024x683.jpg)