Introduction

Since the year 2020, decentralized finance (DeFi) has experienced significant expansion, which has been spurred by the rise of Automated Market Makers (AMMs) in the spot market by Uniswap. On the other hand, there has not been a similar increase in AMMs for perpetuals, despite the fact that the trading volume on centralized exchanges for these contracts is substantially higher than that of spot markets.

Equation can be seen as a shining example of innovation in the ever-changing realm of decentralized finance, where it is transforming the landscape of everlasting contracts. Equation has accomplished impressive milestones in just two months, including achieving a trading volume of $16 billion and a leveraged liquidity of $5 billion. This was accomplished by utilizing a decentralized perpetual contract technology on Arbitrum. In this article, we delve deeply into the revolutionary features of Equation, including a comparison with competitors such as GMX and HMX, an examination of Equation’s one-of-a-kind position mining strategy, which allocates a significant forty percent of daily EQU emissions to position holders, and a discussion of the zero trading fees that Equation charges for Bitcoin and Ethereum.

Equation has the Total Trading Volume of more than $2.3 billion, Open Interest of nearly $90 million and the Leveraged Liquidity of over $500 million.

Unveiling Equation: A Paradigm Shift in Perpetual Contracts

Equation, a decentralized perpetual contract protocol, stands at the forefront of DeFi innovation. Its unique Balance Rate Market Maker (BRMM) approach differentiates it from conventional Automated Market Makers, providing an effective mechanism for price discovery and opportunities for market-making that are unmatched by any other.

Equation’s dedication to openness and security is steadfast, as evidenced by the fact that it has continuously secured a top-ten position on Defilama’s derivatives protocol rankings and has been subjected to stringent audits by ABDK, the same auditor from whom GMX is chosen.

Zero Trading Fees: A Game-Changer in DeFi

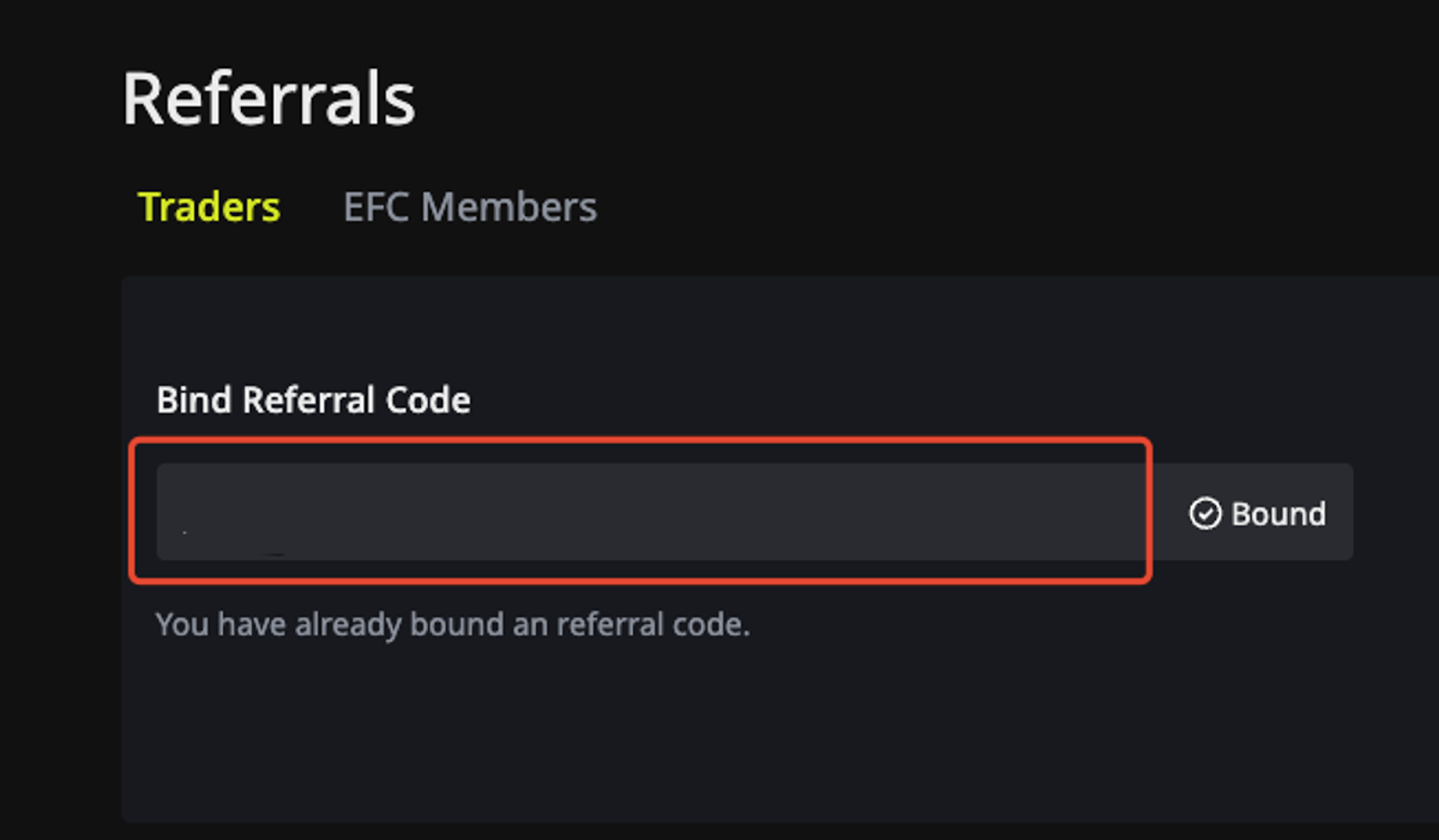

Equation has recently unveiled a revolutionary campaign, which does not charge any trading costs for Bitcoin and Ethereum pairs. This promotion has established a new norm for pricing structures in the decentralized finance market. It is possible for users who have a bound Equation referral code to take advantage of this deal, which will be active from December 16, 2023 until January 31, 2024.

Whereas HMX provides fees of 0.02% or 0.03%, GMX is now conducting a promotion that is equivalent to 0.015% of the fees. Therefore, Equation’s fee structure is not only competitive but also a disruptive force in the market. This is because even major centralized exchanges such as Binance and OKX levy substantially higher fees.

A maximum leverage of 200x, a maintenance margin rate of 0.25%, and no trading fees for Bitcoin and Ethereum pairs are some of the parameters that Equation offers customers. Equation is an appealing platform for both rookie and professional traders since it offers a zero-fee environment that enables small money to generate large gains with a leverage of 200 times.

Position Mining: Maximizing EQU Token Rewards

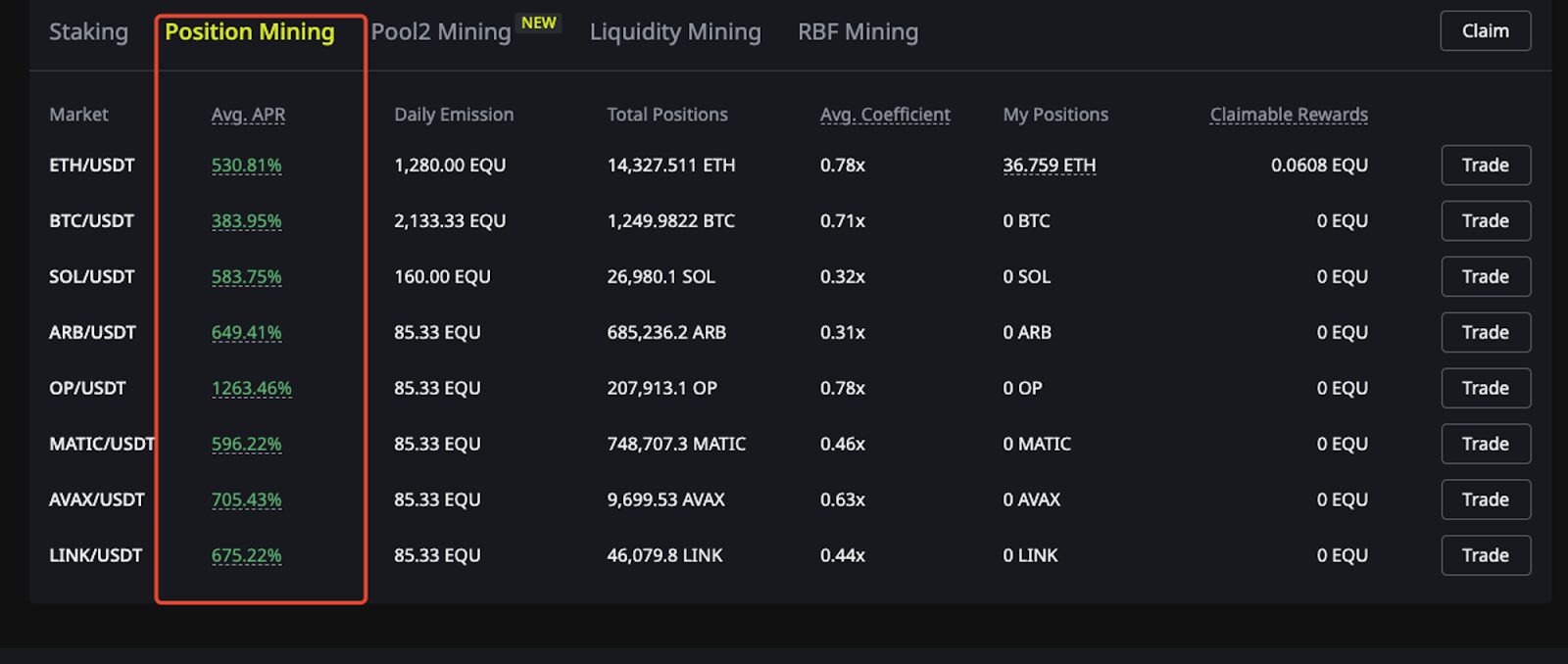

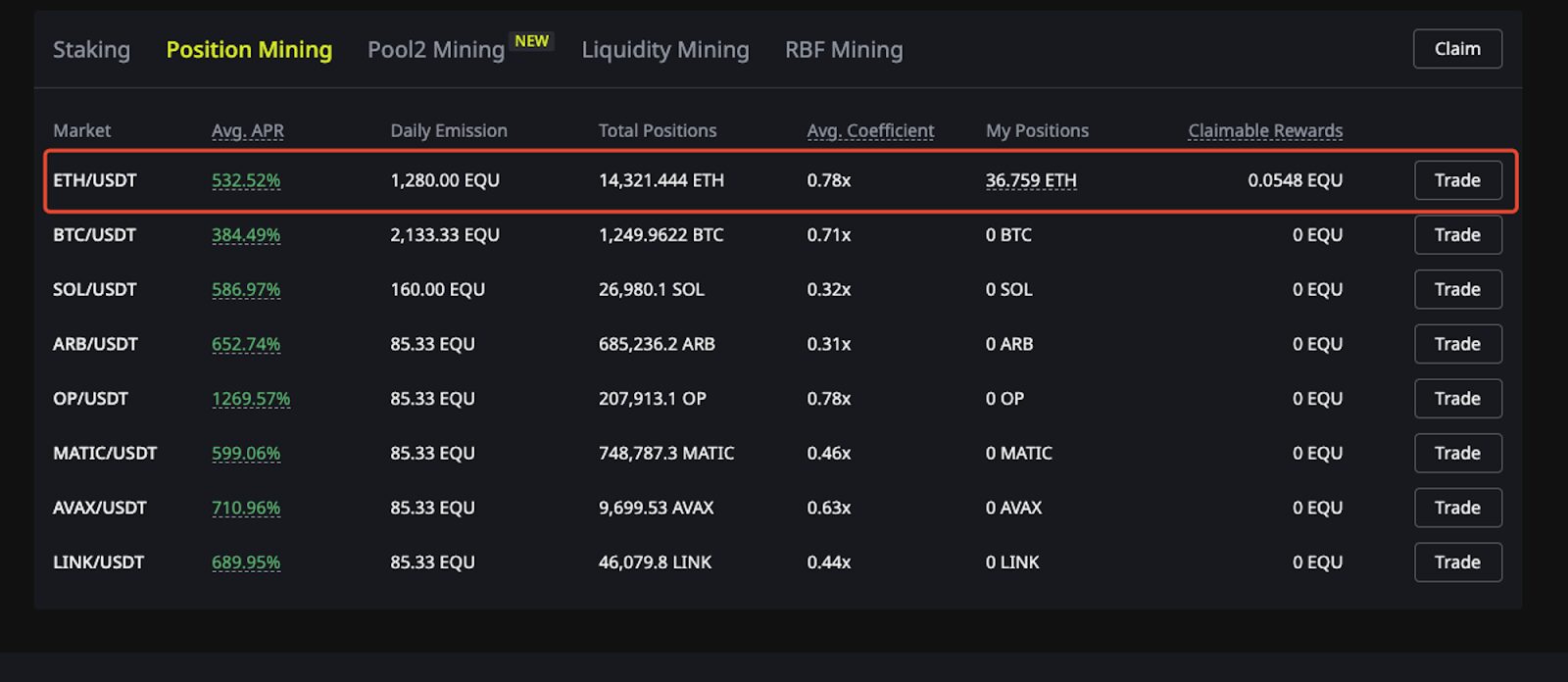

There is a unique and lucrative function on Equation called position mining. This feature enables traders to earn EQU tokens by holding positions, which is a unique and lucrative feature. By virtue of the fact that position holders receive a significant 40% of the daily EQU emissions, the EQU incentives are proportional to the position value and the frequency with which positions are opened.

A detailed tutorial is provided by Equation in order to assist users in navigating the complexities of position mining. Traders can access the Position Mining Tutorial here.

On Equation, position mining offers a compelling chance for traders to earn EQU tokens with absolutely no risk involved. The average Annual Percentage Rate (APR) on Equation is higher than 400%, while some pools have APRs that are higher than 1,000%.

Take a look at the EQU revenue that is being generated by the mining position. (The output of the EQU is influenced by the time-diminishing parameters of each position, and also by the output of my position/total position multiplied by the day output.)

EQU Emission Structure: Fueling the Ecosystem

EQU, the native token of Equation, is an essential component of the ecosystem that the protocol resides in. Position mining, liquidity mining, and referral mining are the three methods that are used to generate EQU, which has a maximum supply of ten million. Rewards are distributed to users according to the emission structure depending on a variety of behaviors, such as maintaining contract positions, providing liquidity, and contributing to Risk Buffer Funds (RBFs).

When users want to receive veEQU tokens, they have the option of either directly staking EQU or staking EQU-ETH LP NFTs from the Uniswap EQU-ETH pool. Those who possess these veEQU tokens are entitled to a quarter of the trading fees and governance powers associated with the system.

Equation’s Vision for Long-Term Development

Both Equation’s governance model and its most recent proposal, EQUIP-5, demonstrate the company’s dedication to the long-term development of its business. The governance model incorporates both regular and momentous decisions, with the input of the community playing an essential role in both types of decisions. The consent of both EFC-Architect holders and veEQU holders is necessary for major decisions, such as fee allocation ratios and daily emissions of EQU. This ensures that the decision-making process is both democratic and balanced.

In EQUIP-5, the need of long-term stability and growth is discussed, with an emphasis placed on the necessity of striking a balance between rapid monetization, high returns, and sustainability. The goal of Equation is to reward long-term investors and to create stability within the community. This will be accomplished by establishing a burn mechanism and raising the rate of non-lockup burning.

The Comprehensive Equation DAO Governance Model

Equation DAO is poised to become an essential part of the DeFi ecosystem, providing users with the opportunity to express their input over the development of the platform. Additionally, early governance elements have already been implemented, despite the fact that the full-scale introduction of Equation DAO Governance is not expected to take place until December 2023. Until the comprehensive governance system is fully operational, users who stake EQU are awarded an identical amount of veEQU on a 1:1 basis. This serves as the sole foundation for governance voting until the system is fully operational.

The introduction of a burn mechanism is the primary focus of the first Equation Improvement Proposal, which is referred to as EQUIP-1. This idea was conceived as a result of the fact that the current method provides users with the opportunity to either stake their EQU mining rewards or sell them on the market. However, the existing compensation scheme does not effectively align with the interests of long-term investors, despite the fact that those who choose to stake for longer periods of time indicate confidence in Equation’s initiative. A portion of the rewards that are not committed to longer-term staking will be burned as part of the planned burn process in order to remedy this issue. This will ultimately result in a reduction in the maximum supply of EQU. In addition to providing EQU holders with additional benefits, this strategic decision is intended to encourage long-term investment in the ecosystem and potentially increase the value of the assets that they now possess.

Overview: Equation’s Core Principles and Balance Rate Market Maker Model

Equation’s journey in the DeFi space is marked by a commitment to core principles and the introduction of the Balance Rate Market Maker model. The BRMM model, born out of the need for an efficient perpetual contract pricing mechanism, utilizes the Liquidity Pool Balance Rate (BR) to calculate short positions held by LPs relative to the total liquidity of LPs. This mechanism ensures a balanced state when BR is zero, providing an innovative approach to perpetual contract pricing.

The Pricing Mechanism is a crucial aspect of Equation’s BRMM model, with the Perpetual Contract Price Premium Rate (PR) being a function of the Liquidity Pool Balance Rate. The funding rate acts as a key component to maintain the perpetual contract price in balance with the spot price. LPs in the BRMM model play a crucial role as temporary counterparties to traders, with the funding rate anchoring the BR value, limiting the risk faced by LPs.

The Risk Buffer Fund further enhances Equation’s risk management by bearing all temporary losses incurred by LPs. The income of the RBF includes a portion of the trading fees from users, profits generated by LPs as temporary counterparties to traders, and capital from LPs’ liquidations.

Concluding the overview, Equation provides users with the opportunity to contribute liquidity to the RBF, offering a unique approach to risk buffering. Users contributing liquidity to the RBF enjoy the benefits of immunity from liquidation, with the liquidity locked for 90 days. This innovative approach aims to further enhance Equation’s risk management strategies and provide additional rewards to users.

The Equation Ecosystem: Tokenomics, Governance, and the Crucial EQUIP-5 Proposal

The Equation ecosystem thrives on a hybrid token model, combining Fungible Tokens (FT) and Non-Fungible Tokens (NFT). This innovative approach resolves conflicts of interest between community members, the founding team, and early investors. Community members contributing to Equation’s promotion receive lucrative and long-lasting income guarantees, ensuring a fair and inclusive distribution of rewards.

Equation’s DAO Governance Model, encompassing routine and major decisions, prioritizes community input. Routine decisions, such as adding trading pairs and adjusting non-core parameters, require approval from EFC-Architect holders. Major decisions, involving core parameters and daily emissions of EQU, necessitate approval from both EFC-Architect holders and veEQU holders in separate voting rounds, ensuring a comprehensive and democratic decision-making process.

The significance of EQUIP-5 for the long-term development of Equation is contextualized within the history of DeFi. Reflecting on the rise and fall of numerous projects, Equation recognizes the critical role of tokenomics in ensuring sustainable growth. The ‘Impossible Trinity’ is presented as a guiding principle, emphasizing the challenges of simultaneously achieving rapid monetization, high returns, and sustainability. The proposal to increase the rate of non-lockup burning is rooted in the belief that long-term stability and growth require a balanced approach, rewarding those who genuinely believe in Equation’s vision.

Conclusion: Equation’s Journey and Future Possibilities

To summarize, Equation’s journey in the decentralized finance arena is characterized by innovation, transparency, and a dedication to the development of the market over the long term. Equation’s position as a pioneer in the field of decentralized perpetual contracts has been strengthened by the introduction of zero trading fees, a robust position mining technique, and the provision of leverage of up to 200 times.

As Equation continues to develop and adjust to the ever-changing landscape of the DeFi industry, the company’s ambition for a financially robust and sustainable ecosystem promises to open up exciting opportunities for the wider cryptocurrency community. It is important for traders and investors who are looking for a platform that can smoothly blend cutting-edge technology with community-driven governance to keep a careful eye on the advancements that Equation will make in the future. While Equation continues to move forward, the company’s dedication to promoting stability, inclusion, and innovation lays the groundwork for a DeFi future in which all players have the opportunity to flourish.

Learn More

Website: https://equation.org/

Twitter: https://twitter.com/EquationDAO

Medium: https://medium.com/@EquationDAO

Discord: https://discord.gg/equationdao

Telegram: https://t.me/EquationDao

CoinMarketCap: https://coinmarketcap.com/currencies/equation/

CoinGecko: https://www.coingecko.com/en/coins/equation

DefiLIama: https://defillama.com/protocol/equation

Whiepaper: https://docs.equation.org/whitepaper/overview

Github: https://github.com/EquationDAO

Audit: https://github.com/EquationDAO/equation-contracts/tree/main/contracts/audits

Disclaimer

Opinions stated on CoinWire.com do not constitute investment advice. Before making any high-risk investments in cryptocurrency, or digital assets, investors should conduct extensive research. Please be aware that any transfers and transactions are entirely at your own risk, and any losses you may experience are entirely your own. CoinWire.com does not encourage the purchase or sale of any cryptocurrencies or digital assets, and it is not an investment advisor. Please be aware that CoinWire.com engages in affiliate marketing.