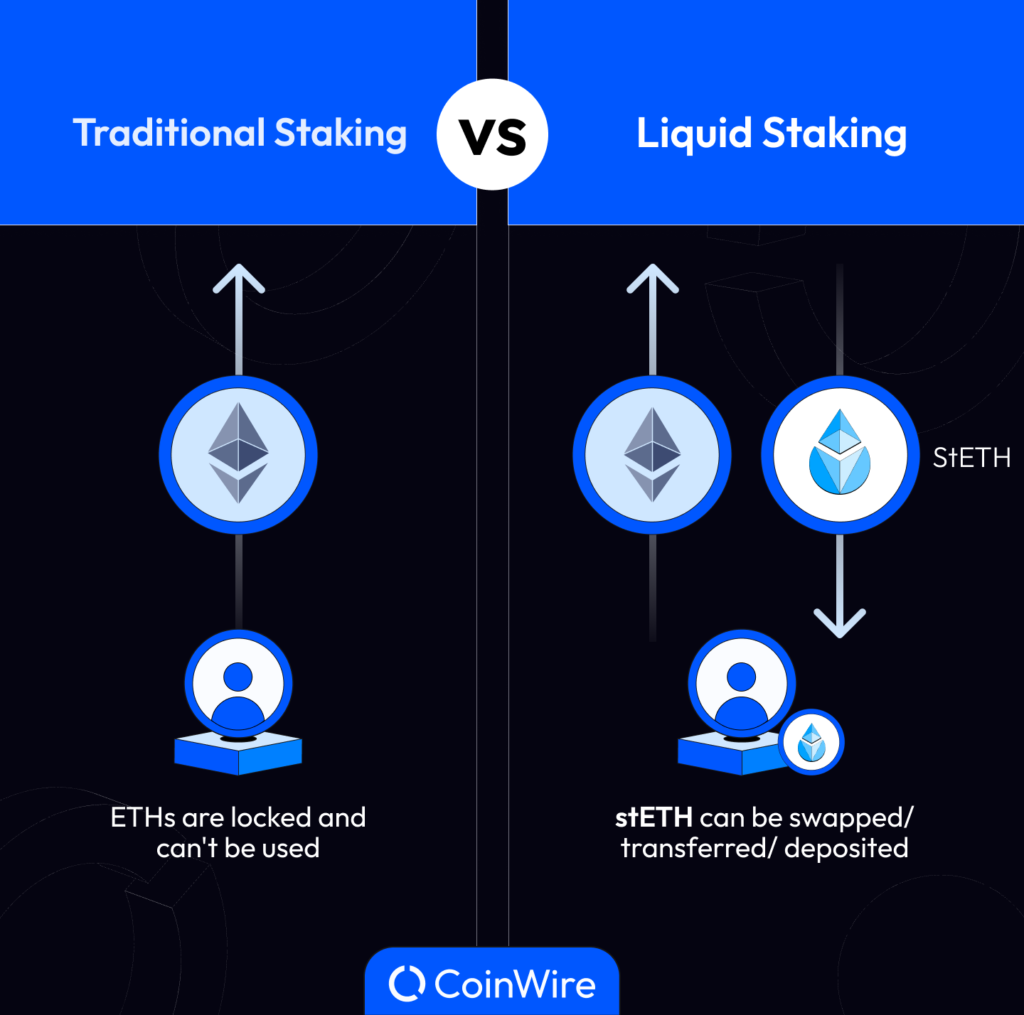

Liquid staking’s popularity is spreading fast among crypto investors. Unlike in traditional staking, where investors can’t access their locked staked funds, liquid staking provides room for investors to be able to access their staked funds to make other investments.

Because of this, it’s a great option for most investors who want to keep their money liquid while still earning passive income. So what is liquid staking? Let’s look at how this new type of staking works, how it differs from traditional staking, and how and where you can participate.

What Is Liquid Staking?

Liquid staking, also called “soft staking,” is another profit-generation strategy that allows you to securely stake your funds without sacrificing liquidity.

Like in traditional staking, liquid staking still involves stakers providing crypto assets to the blockchain before it assigns them to validators for minting purposes. But unlike traditional staking, liquid staking lets investors use their locked funds to make other investments in decentralized finance (DeFi).

For instance, they can trade the derivative assets obtained after staking and generate passive income. This means the staked funds in a liquid staking investment are unlocked.

How Does Liquid Staking Work?

To ensure stakers can still make use of their stake assets, liquid staking introduces the concept of “derived assets.” Derived assets are liquid assets attached to a stacked asset.

Typically, when an investor liquid stakes their coins, the blockchain generates smart contracts that mint a new token from each staked token in a ratio of 1:1.

Depending on the staking platform, the derived asset generated will have different names. For example, Ethereum-derived assets include staked-ETH (stETH) or Rocket-ETH (rETH). These newly derived assets are what investors use to diversify their staking currencies.

Platforms like Aave, Yearn, and Curve have investment opportunities for such assets. Investors can participate in yield farming on the platforms by contributing to derived-asset liquidity pools like USDC/stETH and DAI/stETH. Yield farming is another effective way to earn passive income in the crypto space.

This makes liquid staking an attractive option if you want to earn rewards on your crypto assets without sacrificing the ability to quickly access them when necessary.

Liquid Staking vs Traditional Staking

Liquid staking varies significantly from traditional staking. Traditional, or classic, staking is the most basic form of staking. It involves investors locking up their crypto coins for a selected duration and receiving rewards in exchange.

Liquid staking, on the other hand, involves submitting funds for rewards without having them locked up.

Let’s explore the table below to understand the difference between these two forms of staking:

| Feature | Traditional Staking | Liquid Staking |

|---|---|---|

| Lock-up Periods | Has Lock-up periods | Does not require lock-ups |

| Reinvesting Staked Tokens | Does not support reinvesting of staked tokens | Support reinvesting of staked tokens |

| Accessibility | More accessible on multiple Crypto exchanges and DeFi protocols | Accessible only on a few DeFi protocols |

| Yields | Depends on the token and staking duration | Depends on the token |

| Fees | Depends on the platform but mostly costs 2 to 5% of total yields | Depends on the platform but mostly costs 10 to 15% of total yields |

Where Can I Participate in Liquid Staking?

Recently, a number of different liquid staking protocols have emerged. These platforms enable investors to liquid-stake native tokens from various blockchains, including Ethereum, Polygon, Solana, Cosmos, Polkadot, and Kusama. Let’s discuss these liquid staking platforms in depth, analyzing what each offers its users.

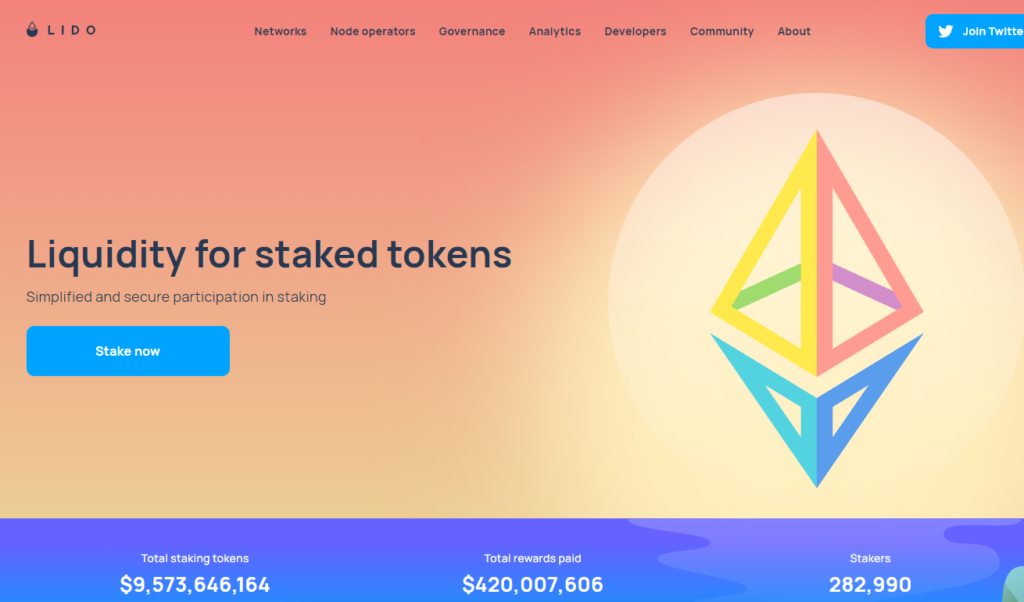

Lido

Lido is the most popular liquid staking platform on the market. It is a non-custodial platform with about 69% market share for liquid staking services. Lido’s system allows clients to liquid stake assets across multiple blockchains. Here’s a list of supported blockchains on Lido.

- Ethereum

- Polygon

- Solana

- Cosmos

- Polkadot

- Kasuma

How to liquid Stake on Lido

To liquid stake crypto on Lido, you only need to visit the platform’s website and click the Stake button. You then need to select your wallet, input the number of coins you want to stake, and agree to stake. Once the staked funds reflect, Lido automatically generates tokenized versions of the assets and sends them to your account. These derived assets have the name st+the name of the staked asset, for example, st-MATIC.

The staked tokens on Lido attract 4.8% to 15.5% rewards. However, a 10% platform fee is charged on the total reward, and the withdrawal period lasts three to four days.

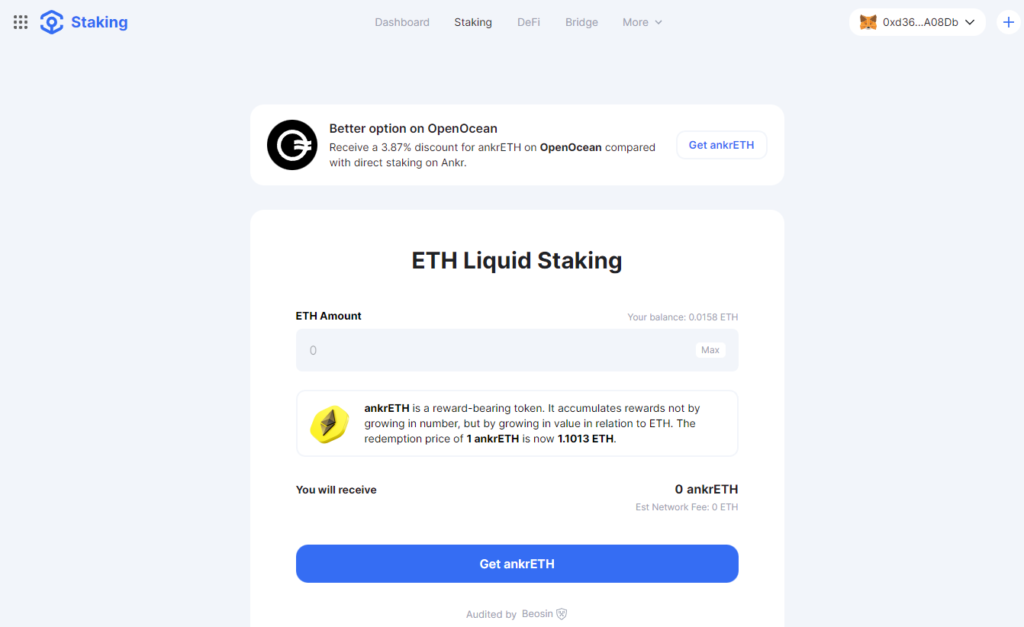

Ankr

Ankr is another popular decentralized protocol for liquid staking. This Web3 infrastructure launched on the Polygon network in 2022 and has been a trailblazer since. Like Lido, Ankr also supports liquid staking for multiple blockchains. Below is a list of the supported blockchains.

- Ethereum

- Polygon

- Binance

- Solana

- Phantom

- Cosmos

- Avalanche

- Polkadot

- Kasuma.

How to liquid Stake on Rocket ANKR

The Ankr staking process is easy. Investors click the “Stake Now” button on Ankr’s website, connect their wallets, select the amount to stake, and wait to receive the derived assets. Anrk’s derived assets are named ankr + the name of the staked asset, for example, ankrSOL.

Ankr users get 3.8% to 14.4% rewards for their liquid staking efforts. The rewards are subject to platform fees of from 100 to 3500 ANKR, or roughly $4 to $140. The average withdrawal waiting period is three to four days.

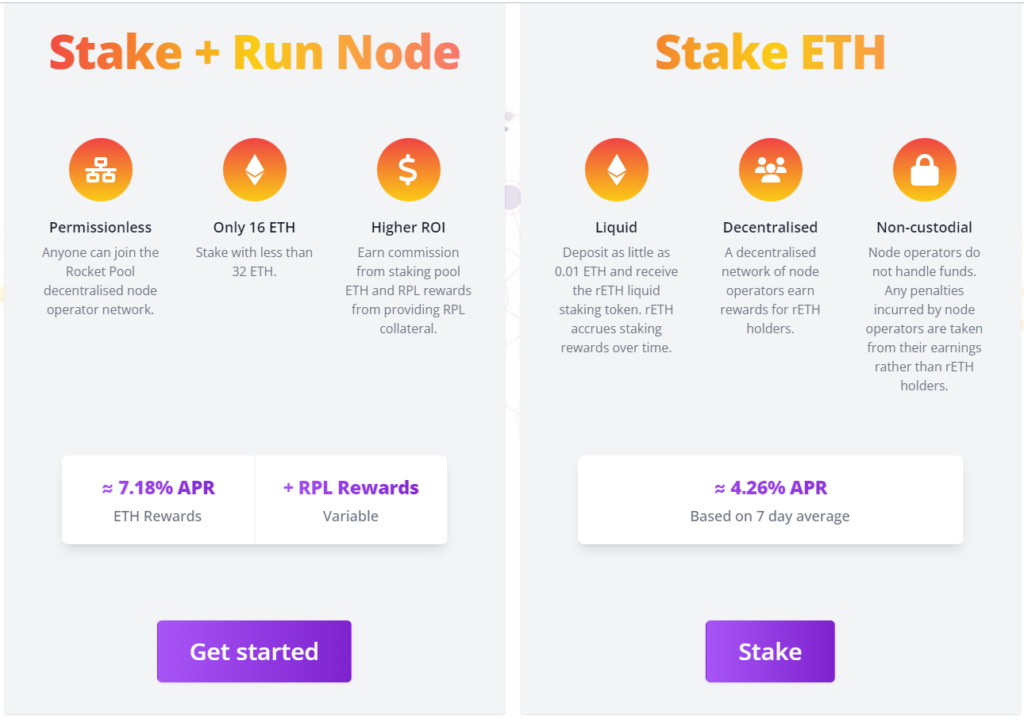

Rocket Pool

Rocket Pool is the go-to liquid staking platform for ETH staking. The platform launched in 2016, offering ETH investors an easier way to stake their tokens.

How to liquid Stake on Rocket Pool

Rocket Pool’s staking process is equally easy. Users need to visit the Rocket Pool website and scroll down the homepage until they get to the “Stake ETH” section. Under this section, they should click the stake button, connect their wallet, enter the amount they wish to stake, and wait for their converted assets. Rocket’s derivative assets are named rETH.

Staking ETH on Rocket generates an annual percentage rate (APR) of 4.5%. It takes investors a day to withdraw the rewards, which are subject to a 5% to 20% protocol fee.

Advantages and Disadvantages of Liquid Staking

Liquid staking has many advantages for investors. However, it may also cause several unpleasant outcomes.

Let’s explore some of the most outstanding benefits of liquid staking and explain the disadvantages that it may have.

Pros

- Increased composability: Composability refers to integrating one DeFi function with another. Courtesy of liquid staking, it is possible to merge two or more DeFi platforms. For instance, users can liquid stake assets on Lido, then use derived tokens as collateral for crypto loans on a platform like MakerDAO. Such assets are also reusable on yield farming sites like SushiSwap Onsen or Curve.

- Asset Preservation: Liquidity mining prevents the loss of staked assets through factors like slashing. Slashing happens when an exchange penalizes a validator for not following the correct verification steps when approving blocks. Since validators are assigned tokens from a given delegate, when they are slashed, delegators end up losing their assets. But, this is different in liquid staking because users can unstake their assets. Unstaking may induce a fee, but paying the fee is better than losing assets.

- Improved Blockchain Security and Stability: Liquidity is the backbone of the blockchain sector. If investors are unwilling to invest in a given chain, it will collapse. Classic staking presents an investment challenge because investors fear risking the loss of assets in case of slashing or price drops. However, this fear is eliminated with liquid staking, and more people feel comfortable staking assets, improving blockchain stability in the long run.

Cons

- The complexity of Asset Recovery: The biggest challenge with liquid staking is that it complicates the recovery of staked assets. When users re-invest their derived assets on secondary platforms, new smart contracts are introduced. Sometimes these contracts may clash with the contracts of the initial staking platform, making it difficult to recover the derived asset. Without the derived asset, investors retrieve their staked assets.

FAQs

Is Liquid Staking risky?

Liquid staking is an investment strategy like any other, which means it has several risks. The most common threat it poses is the difficulty of recovering staked assets when investors use derived assets on platforms whose smart contract regulations clash with the rules of the staking platform. Liquidity staking can also affect the liquidity of an asset in the crypto market, affecting its price and volatility.

What is Liquid Staking in Crypto?

Liquid staking is the process of submitting crypto assets to a platform to generate rewards without locking up the staked assets. The process creates derivative tokens from the staked asset in a ratio of 1:1. You can invest these derivative tokens on other DeFi platforms, allowing you to earn income from multiple streams using the same asset.

Who can perform Liquid Staking?

Anyone with a crypto asset can perform liquid staking. All you need to do is identify a liquid staking platform that supports your token, understand its terms and conditions, and follow its prescribed liquid staking process.

Read more: 5 Best Liquid Staking Derivate Tokens

![The Complete Guide to Add Bitcoin to MetaMask Wallet ([currentyear]) 14 Add Bitcoin To Metamask Featured Image](https://coinwire.com/wp-content/uploads/2023/05/add-bitcoin-to-metamask-1024x683.jpg)

![Binance Futures Quiz Answers (Updated in [currentmonth] [currentyear]) 15 Binance Futures Quiz Answers Featured Image](https://coinwire.com/wp-content/uploads/2022/12/binance-futures-quiz-answers-1024x683.png)

![Buy Bitcoin with Apple Pay No Verification in [currentyear] 16 Buy Bitcoin With Apple Pay No Verification](https://coinwire.com/wp-content/uploads/2024/01/buy-bitcoin-with-apple-pay-no-verification-1024x683.jpg)

![How to Convert BEP20 to ERC20 Tokens Guide in [currentyear] 17 How To Convert Bep20 To Erc20 Token](https://coinwire.com/wp-content/uploads/2023/09/bep20-to-erc20-1024x683.jpg)